Please refer to the Chapter 10 Financial Statements – II Important Questions with answers provided below. We have provided Important Questions for Class 11 Accountancy for all chapters as per CBSE, NCERT and KVS examination guidelines. These case based questions are expected to come in your exams this year. Please practise these Important based Class 11 Accountancy Questions and answers to get more marks in examinations.

Important Questions Chapter 10 Financial Statements – II

Short Answer Type Questions :

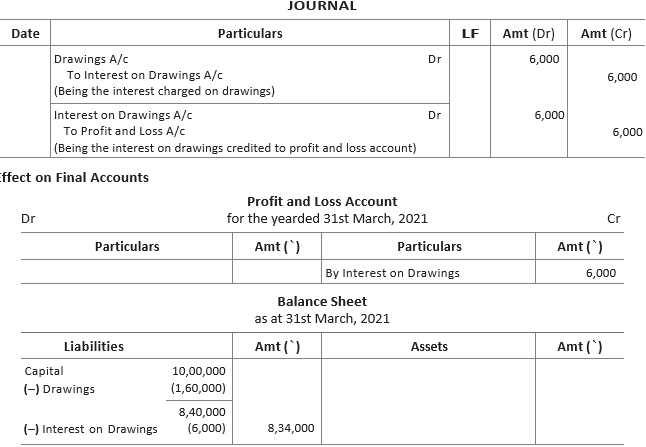

Question. Consider the following extract of trial balance from books of Prateek Limited.

Adjustment Charge ₹ 6,000 as interest on drawings.

Pass an adjusting entry and show effect on financial statements.

Ans. Adjustment Entries

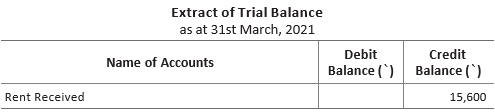

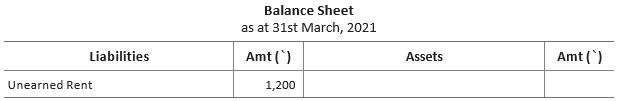

Question. Consider the following extract of trial balance taken from Prakhar’s Books

Additional Information

Rent received but not earned ₹ 1,200.

Pass an adjusting entry and show how will this appear in final accounts.

Ans. Adjustment Entry

Question. What is meant by closing stock? Show its treatment in final accounts.

Ans. Closing stock implies the value of unsold goods at the end of an accounting period. Closing stock is valued at cost or net realisable value, whichever is lower.

If closing stock is given in adjustment, it will be shown on the credit side of trading account and will also be shown on the assets side of balance sheet under current assets. If closing stock is given in trial balance, it will only be shown on the assets side of balance sheet under current assets.

Question. The net profit of a firm amounts to ₹ 31,500 before charging commission. The manager of the firm is entitled to a commission of 5% on the net profits. Calculate the commission payable to the manager in each of the following alternative cases and also show its effect on final accounts.

(i) If the manager is allowed commission on the net profit before charging such commission.

(ii) If the manager is allowed commission on the net profit after charging such commission.

Also, show its treatment in final accounts ending on 31st March, 2021.

Ans.

Question. Consider the following extract of trial balance taken from books of Mehta Limited.

Additional Information

During the year, the proprietor, Mr Mehta withdrew goods worth ₹ 5,000.

Pass an adjusting entry and show effect on financial statements.

Ans. Adjusting Entry

Question. What is meant by provision for doubtful debts? Why is it necessary to create a provision for doubtful debts at the time of preparation of final accounts?

Ans. The provision for doubtful debts is estimated amount of bad debts that will arise from amount receivable from debtors. In order to bring an element of certainty in amount of debtors, a provision for doubtful debts is created to cover the loss of possible bad debts as per the principle of prudence or conservatism.

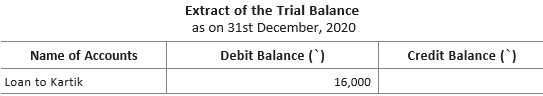

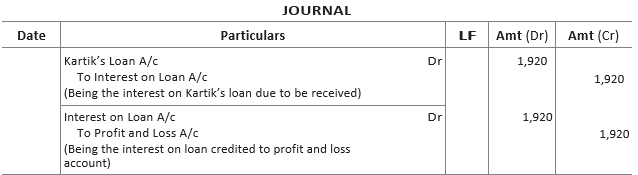

Question. Consider the following extract of trial balance of ABC Limited

Adjustment Interest on Kartik’s loan is due to be received @ 12% per annum for the whole year.

Pass an adjusting entry and show effect on financial statements.

Ans. Adjustment Entries

Working Note

Interest of Loan = 16,000 ×12/100 = ₹ 1,920

Effect on Final Accounts

Question. Consider the following extract of trial balance taken from books of Harshit Enterprises.

Additional Information

(i) Write-off further bad debts ₹ 6,000.

(ii) Provision for doubtful debts to be maintained at 5% on sundry debtors.

(iii) Create a provision for discount on sundry debtors at 3%.

Show effect on profit and loss account and balance sheet.

Ans. Effect on Final Acccounts

Question. Following trial balance is prepared on 31st March, 2019 from a trader’s book

Taking into consideration the adjustments given below. Pass the journal entries for the same.

(i) Closing stock ₹ 1,00,000

(ii) Outstanding rent ₹ 4,200 and outstanding wages ₹ 9,000

(iii) Prepaid insurance ₹ 7,900 and accrued commission ₹ 1,200

(iv) Charge depreciation on furniture @ 10% p.a.

Ans.

Working Note

Depreciation of Machinery = 2,00,000 ×10/100 = ₹ 20,000

Question. What are the adjusting entries? Why are they necessary for preparing final accounts?

Or

Why is it necessary to record the adjusting entries in the preparation of final accounts?

Ans. It is the entry passed to record expenses and incomes that relate to the accounting period but are yet to be paid or received.

The need of making various adjustments are stated below

(i) To ascertain the true profit or loss of the business.

(ii) To determine the true financial position of the business.

(iii) To make a record of the transactions earlier omitted in the books.

(iv) To rectify the errors committed in the books.

(v) To complete the incomplete transactions.

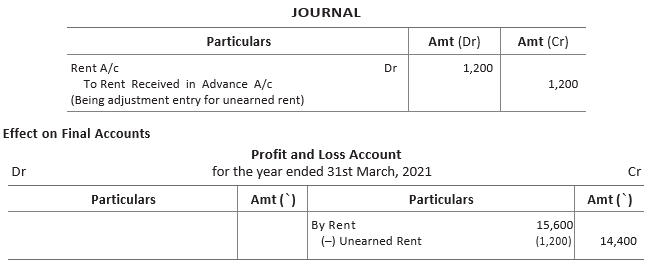

Question. Consider the following extract of trial balance

Additional Information

Commission earned but not received ₹ 1,800.

Pass an adjusting entry and show how will this appear in final accounts.

Ans. Adjustment Entry

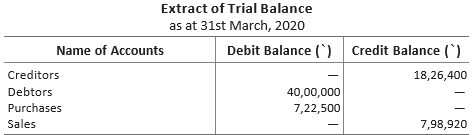

Question. Consider the following extract of trial balance taken from books of Manisha Enterprises.

Additional Information

(i) Credit sales of ₹ 9,000 were not recorded in books of accounts.

(ii) Received ₹ 98,000 worth of goods on 29th March, 2020 but the invoice of purchases was not recorded.

Ans.

Question. State the meaning of

(i) Outstanding expenses

(ii) Prepaid expenses

(iii) Income received in advance

Ans. (i) Outstanding Expenses Those expenses whose benefit have been derived during the current year but payment is not made at the end of the year are known as outstanding expenses.

(ii) Prepaid Expenses Those expenses which have been paid in current year but the benefit of which will be available in the next accounting year are known as prepaid expenses.

(iii) Income Received in Advance The income or portion of income which is received during the current accounting year but has not been earned is called unearned income.

Question. Consider the following trial balance of Rohan Limited.

Additional Information

During the year the proprietor, Mr Rohan distributed goods worth ₹ 10,000 as free samples.

Pass an adjusting entry and show effect on financial statements.

Ans. Adjusting Entry

Long Answer Type Questions :

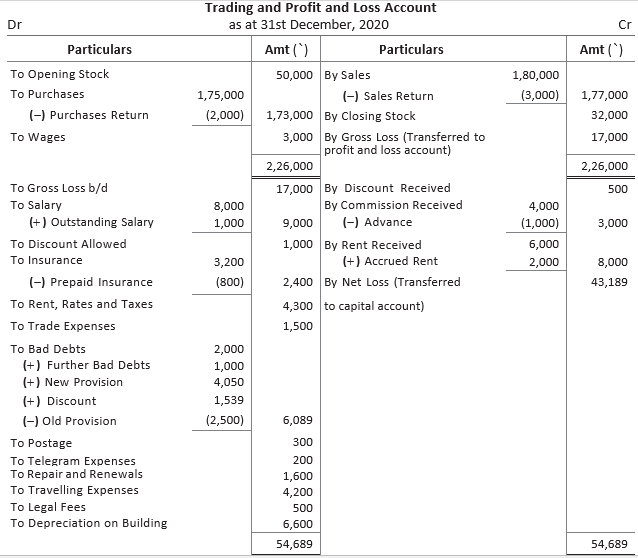

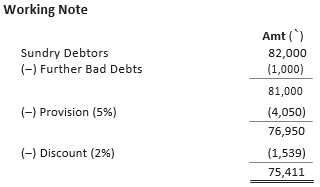

Question. Prepare a trading and profit and loss account for the year ending 31st December, 2020 from the balances extracted from M/s Rahul and Sons. Also prepare a balance sheet at the end of the year.

Adjustments

(i) Commission received in advance ₹ 1,000.

(ii) Rent received ₹ 2,000.

(iii) Salary outstanding ₹ 1,000 and insurance prepaid ₹ 800.

(iv) Further bad debts ₹ 1,000 and provision for bad debts@5% on debtors and discount on debtors@2%.

(v) Closing stock ₹ 32,000.

(vi) Depreciation on building @ 6% p.a.

Ans.

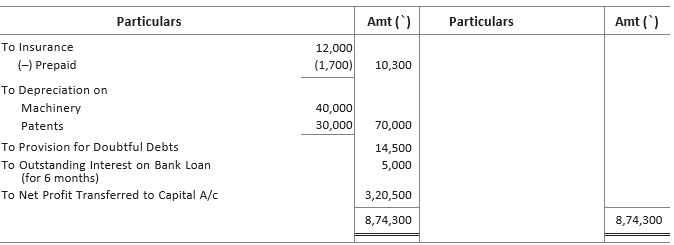

Question. The following is the trial balance of Mr Chidambram on 31st March, 2020.

Taking into account the following adjustments, prepare trading and profit and loss account and the balance sheet.

(i) Stock in hand on 31st March, 2020 is ₹ 1,36,000.

(ii) Machinery is to be depreciated at the rate of 10% p.a. and patent at the rate of 20% p.a.

(iii) Salaries for the month of March, 2020 amounting to ₹ 30,000 were unpaid.

(iv) Insurance includes a premium of ₹ 1,700 for 2020-21.

(v) Wages include a sum of ₹ 40,000 spent on the erection of a cycle shed for employees and customers.

(vi) A provision for doubtful debts is to be created to the extent of 5% on sundry debtors.

(vii) Bank loan was taken on 1st October, 2019.

Ans.

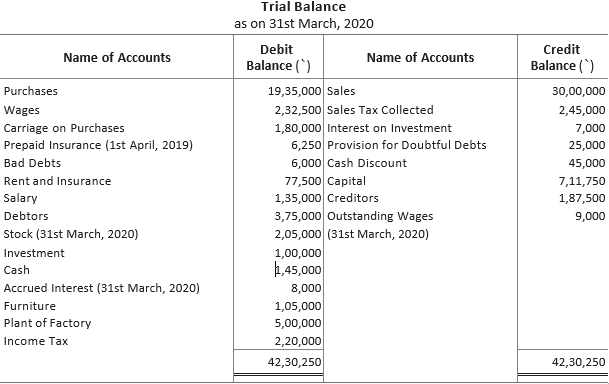

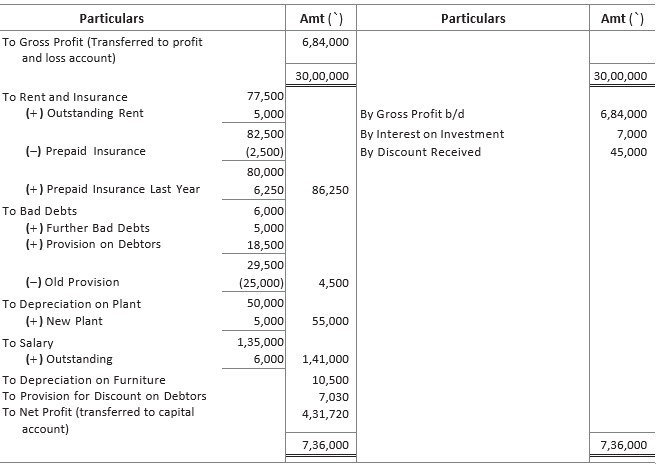

Question. From the books of M/s Aggarwal, the following trial balance has been prepared on 31st March, 2020

Prepare the trading and profit and loss account for the year ended 31st March, 2020 and the balance sheet as at that date, taking into consideration the adjustments given below

(i) On 1st October, 2019, plant worth ₹ 1,00,000 was purchased on credit but no entry has been passed.

(ii) Outstanding expenses rent ₹ 5,000 and salary ₹ 6,000.

(iii) Prepaid expenses insurance ₹ 2,500 and wages ₹ 4,000.

(iv) Goods worth ₹ 27,500 were taken for personal use by the owner but no entry has been made.

(v) Write-off depreciation on plant and furniture @ 10% p.a.

(vi) Write-off ₹ 5,000 from debtors as bad debts and create provision for doubtful debts @ 5% and 2% provision for discount on debtors.

Ans.

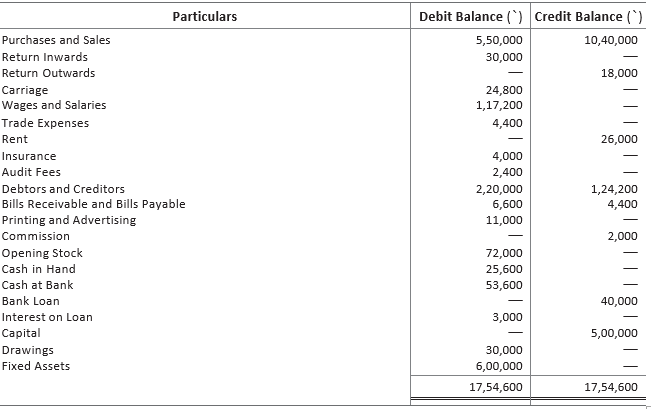

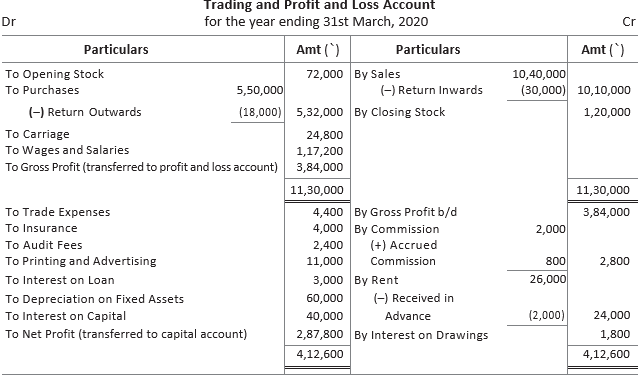

Question. From the following trial balance of Sh. Prakash, prepare trading and profit and loss account for the year ended 31st March, 2020 and balance sheet as at that date.

Additional Information

(i) Stock at the end₹1,20,000. (ii) Depreciation to be charged on fixed assets @10%.

(iii) Commission earned but not received amounting to ₹ 800.

(iv) Rent received in advance ₹ 2,000.

(v) 8% interest to be allowed on capital and ₹ 1,800 to be charged as interest on drawings.

Ans.

Question. From the following ledger balances of Mr Navjot Singh, prepare the trading and profit and loss account for the year ended 31st March, 2020 and the balance sheet as at that date after making the necessary adjustments.

Additional Information

(i) Stock on 31st March, 2020 was ₹ 28,000.

(ii) Write-off ₹ 1,200 as bad debts.

(iii) Provision for doubtful debts is to be maintained @ 5%.

(iv) Provision for depreciation on furniture and fixtures at 5% p.a. and on plant and machinery at 20% p.a.

(v) Insurance prepaid was ₹ 200.

(vi) A fire occurred in the godown and stock of the value of ₹ 10,000 was destroyed. It was insured and the insurance company admitted full claim.

Ans.

Note – Sometimes, the balance in the provision for doubtful debts account is more than sufficient to meet the bad debts and the new provision required. Thus, remaining amount is then credited to the profit and loss account.

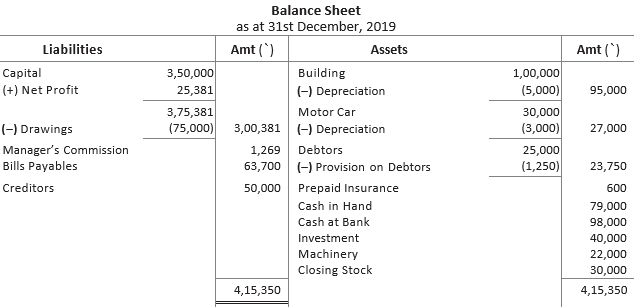

Question. Following balances have been extracted from the trial balance of M/s Keshav Electronics Ltd. You are required to prepare the trading and profit and loss account and balance sheet as on 31st December, 2019.

The following additional information is available

(i) Stock on 31st December, 2019 was ₹ 30,000.

(ii) Depreciation is to be charged on building @ 5% and motor van @ 10%.

(iii) Provision for doubtful debts is to be maintained @ 5% on sundry debtors.

(iv) Unexpired insurance was ₹ 600.

(v) The manager is entitled to commission @ 5% on net profit after charging such commission.

Ans.