Please refer to the Class 12 Accountancy Sample Paper below. These CBSE Sample Papers for Class 12 Accountancy have been prepared based on the latest guidelines and examination patterns issued for the current academic year. We have provided Term 1 and Term 2 sample papers with solutions. You can click on the links below and access the free latest CBSE Sample Papers for Accountancy for Standard 12. All guess papers for Accountancy Class 12 have been prepared by expert teachers. You will be able to understand the type of questions which are expected to come in the examinations and get better marks.

CBSE Sample Papers for Class 12 Accountancy

Class 12 Accountancy Sample Paper Term 2 With Solutions Set A

Part – A

2. Record the necessary journal entries :

(a) Creditors worth Rs 85,000 accepted, 40,000 in cash and investment woth Rs 43,000 in full settlement of their claim.

(b) Creditors worth Rs 16,000 accepted machinery value at Rs 18,000 in settlement of their claim.

Ans.

3. Suresh, Ramesh and Tushar were partners of a firm sharing profits in the ratio of 6:5:4. Ramesh retired and his capital after making adjustments on account of reserves, revaluation of assets and reassessment of liabilities stood at ₹ 2,50,400. Suresh and Tushar agreed to pay him ₹ 2,90,000 in full settlement of his claim. Pass necessary journal entry for the treatment of goodwill. Show workings clearly

Ans.

4. Calculate the amount of sports material to be transferred to Income and Expenditure account of SHIVANIS ports Club, Ludhiana, for the year ended 31st March, 2018:-

Particulars Amount (₹)

i. Sports Material sold during the year (Book Value ₹ 50,000) = 56,000

ii. Amount paid to creditors for sports material = 91,000

iii. Cash purchase of sports material = 40,000

iv. Sports material as on 31.3.17 = 50,000

v. Sports Material as on 31.3.18 = 55,000

vi. Creditors for sports material as on 31.3.17 = 37,000

vii. Creditors for sports material as on 31.3.18 = 45,000

Ans. Calculate the amount of sports material to be transferred to Income and Expenditure account of SHIVANIS ports Club, Ludhiana, for the year ended 31st March, 2018:-

Particulars Amount (₹)

Payment to creditors of sports material 91,000

Add: Closing creditors of sports material 45,000

Less: Opening creditors of sports material (37,000)

Add: Cash purchases of sports material 40,000

Total purchases 1,39,000

Less: Sports material sold during the year (Book Value) (50,000)

Add: Opening stock of sports material 50,000

Less: Closing stock of sports material (55,000)

Amount to be shown to Income and Expenditure Account 84,000

OR

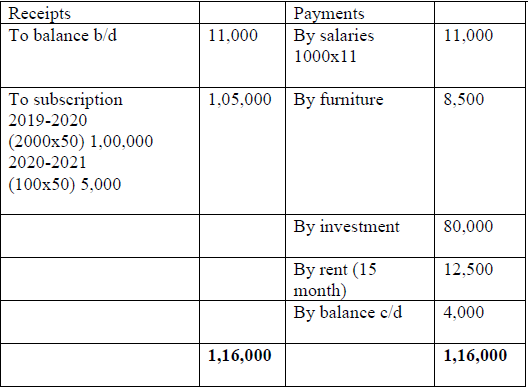

Prepare Receipt and Payments Account of sports club, Jaipur for the year ending 31st March , 2020 from the following information:

Cash balance on 1-4-2019 Rs.11,000; subscription fee of 2,000 members @ Rs. 50 each received, 100 members paid subscription for next year.

Salary paid @ Rs. 1,000 p.m. up to February 2020 salary for march, 2020 is outstanding. Furniture purchased Rs. 8,500, investments Rs. 80,000. Rent @Rs. 10,000 p.a. has been paid up to June, 2020.

Ans. SPORTS CLUB

RECEIPTS AND PAYMENTS ACCOUNT

For the year ended 31st March, 2020

p.4

5. A, B and C are partners in a firm whose books are closed on March 31st each year. A died-on 30th June 2018 and according to the agreement the share of profits of a deceased partner up to the date of the death is to be calculated on the basis of the average profits for the last five years. The net profits for the last 5 years have been: 2014 Rs. 14,000: 2015 Rs. 18,000: 2016 Rs. 16,000; 2017 Rs. 10,000 (loss) and 2018 Rs. 16,000. Calculate A’s share of the profits up to

the date of death and pass necessary journal entry assuming:

(a) there is no change in the profit-sharing ratio of remaining partners:

(b) There is change in the profit-sharing ratio of remaining partners, new ratio being 3: 2.

Ans. journal

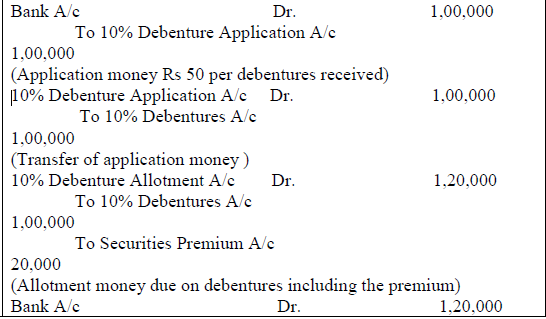

6. XYZ Industries Ltd., issued 2,000, 10% debentures of Rs 100 each, at a premium of Rs 10 per debenture payable as follows:

On application Rs 50

On allotment Rs 60

The debentures were fully subscribed and all money was duly received.

Record the journal entries in the books of a company.

Ans.

Or

Blue Prints Ltd., purchased building worth Rs 1,50,000, machinery worth Rs 1,40,000 and furniture worth Rs 10,000 from XYZ Co., and took over its liabilities of Rs 20,000 for a purchase consideration of Rs 3,15,000. Blue Prints Ltd., paid the purchase consideration by issuing 12% debentures of Rs 100 each at a premium of 5%. Record necessary journal entries.

Ans.

7. P, Q and R are partners sharing profits and losses in the ratio of 3:2:1 respectively. The balance sheet of the firm as on 1st April, 2021 was as under:

Q retires on the above date and it was agreed that:

(i)The goodwill of the firm is valued at Rs.24,000

(ii)Furniture, Plant and Machinery are depreciated by 10% and 6% respectively (iii)Bills receivables of a customer Rs.5,000 discounted from bank was decided to create provision for doubtful debts on debtors @ 5%

(iv)Stock is appreciated by 10% and building is valued at Rs.53,000

(v)Revaluation expenses Rs.750 were paid by the firm

(vi)The amount due to Q is to be transferred to his loan account

Pass journal entries, Prepare Revaluation Account, Capital Accounts and Opening Balance Sheet of the new firm.

Ans.

OR

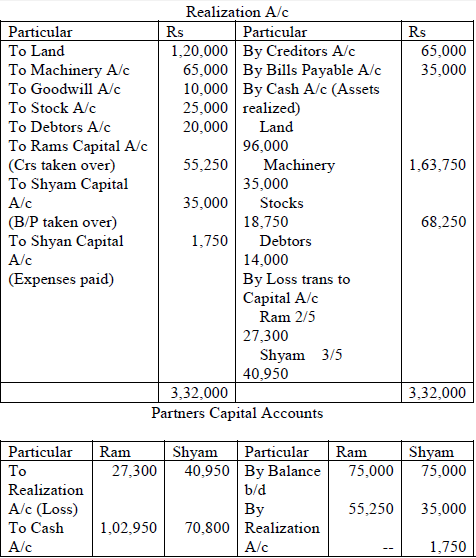

Ram and Shyam were partner in a firm sharing profit in the ratio of 2:3 respectively. They became old and no one was there to look after their business. Therefore, they decided to dissolve the business and donate the amount available to an N.G.O who are providing the service for growing trees in urban areas to control pollution. On 31st January, 2021, their Balance Sheet was as follows:

Ram paid the creditors at a discount of 15 % and Shyam paid bills payable in full. Assets realized : Land at 20 % less, Machinery Rs 35,000; Stock 25 % less;Debtors Rs14,000. Expenses of realization paid by Shyam were Rs 1,750. Prepare Realization Account, and Capital Account of partners to close the books of the firm.

Ans.

8. Animesh Ltd. issued 1,000, 12 % Debenture of 100 each in the following manner:

1. For cash at par at Rs. 50,000 nominal value.

2. For creditors of Rs. 45,000 against purchase of machinery at nominal value of Rs. 35,000.

3. To S.B.I. bank against a loan of Rs. 10,000 as collateral security at nominal value of Rs. 15,000.

Pass Journal entries.

Ans.

9. Following is the Receipts and Payments Account of Modern Club, New Delhi for the year ending 31st December ,2021.

Subscriptions outstanding at the end of 2016 were Rs.4,000 and at the end of 2021 were Rs.6,000. Salaries outstanding on 31st December 2020 and 31st December 2021 were Rs.2,000 and Rs.2,500 respectively.

On 31st December 2020 the club had investments worth Rs.12,000; Furniture 10,000 and Sports Equipment valued at Rs.20,000.

Prepare Income and Expenditure A/c for the year ended 31st Dec 2021

Ans. Surplus = Rs. 11,780

Capital Fund = Rs.46,300;

Total of Opening Balance Sheet = 48,300

Part – B

10. State the category of the following items for a financial as well as non-financial company

(i) Dividend received

(iii) Interest paid

(ii) Dividend paid

(iv) Interest received

Ans. Payment of interest and dividend is classified as Financing Activity.

Receipt of interest and dividend is classified as Investing Activity.

11. From the following information, prepare a Comparative Statement of Profit and Loss:

Ans. Comparative Statement of Profit and Loss

For the year ended on 31st March, 2020 and 2021

OR

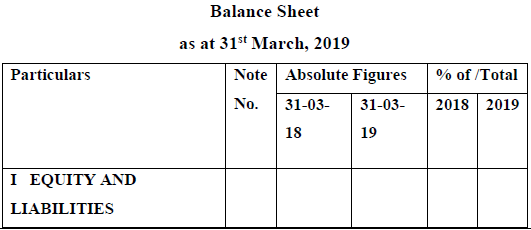

From the following Balance Sheet of R Ltd., Prepare a Common Size Statement.

Ans.

12. From the following summarized Balance Sheet of a company, prepare cash flow statement as on 31st March, 2021:

Additional Information:

Tax paid during the year amounted to Rs. 16,000.

Machine with a net book value of Rs.10,000(Accumulated Depreciation Rs.40,000) was sold for Rs.2,000 prepare a Cash Flow Statement.

Ans.