Please refer to Class 12 Accountancy Sample Paper Term 1 With Solutions Set B provided below. The Sample Papers for Class 12 Accountancy have been prepared based on the latest pattern issued by CBSE. Students should practice these guess papers for class 12 Accountancy to gain more practice and get better marks in examinations. The Term 1 Sample Papers for Accountancy Standard 12 will help you to understand the type of questions which can be asked in upcoming examinations.

Term 1 Sample Paper for Class 12 Accountancy With Solutions Set B

Part – I

Section – A

1. When a new partner brings his share of goodwill in cash, the amount is debited to

(a) Goodwill A/c

(b) Capital A/c of the new partner

(c) Cash A/c

(d) Capital A/cs of the old partners

Answer

C

2. Nominal share capital is ……… .

(a) that part of authorised capital which is issued by the company

(b) the amount of capital which is actually applied by prospective shareholders

(c) the amount of capital which is paid by the shareholders

(d) the maximum amount of share capital that a company is authorised to issue

Answer

D

3. M and N are partners in a firm and share profits and losses in the ratio of 3 : 2. Extract of their balance sheet on 31st March, 2020 is as follows

At the time of admission of O as a partner, if provision for doubtful debts is to be maintained at 10% of receivables as on 31st March, 2020, then what amount of provision for doubtful debts will be shown in reconstituted balance sheet?

(a) ₹ 2,000

(b) ₹ 6,000

(c) ₹ 800

(d) ₹ 12,000

Answer

A

4. A partner introduced additional capital of ₹ 6,000 and advanced a loan of ₹ 8,000 to the firm at the beginning of the year. Partner will receive year’s interest

(a) ₹ 840

(b) ₹ 480

(c) Nil

(d) ₹ 360

Answer

B

5. Which of the following goodwill is accounted for, as per Accounting Standard 26?

(i) Purchased goodwill only

(ii) Self-generated goodwill

(iii) Goodwill brought in by a partner

(a) Only (i)

(b) Only (ii)

(c) (i) and (ii)

(d) (i) and (iii)

Answer

A

6. Which of the following statements apply only to preference shareholders?

(i) Shareholders risk the loss of investment

(ii) Shareholders bear the risk of no dividends in the event of losses

(iii) Shareholders usually have the right to vote

(iv) Dividends are usually given at a set amount in every financial year

(a) (i) and (ii)

(b) (i) and (iv)

(c) (iii) and (iv)

(d) Only (iv)

Answer

D

7. D and E are partners in a partnership firm without any agreement. D devotes more time for the firm as compare to E. D will get the following commission in addition to profit in the firm’s profit.

(a) 6% of profit

(b) 4% of profit

(c) 5% of profit

(d) None of these

Answer

D

8. If the existing profit sharing ratio among P, Q and R of 3 : 2 : 1 is changed to 1 : 2 : 3, then the partner (s) whose share will be unaffected is/are

(a) P

(b) Q

(c) R

(d) All of these

Answer

B

9. After some specified time, which shareholders are returned their capital?

(i) Redeemable preference shares

(ii) Irredeemable preference shares

(iii) Cumulative preference shares

(iv) Participating preference shares

(a) Only (i)

(b) (ii) and (iii)

(c) (i) and (iii)

(d) (iii) and (iv)

Answer

A

10. Red and Blue were partners in a firm with capitals of ₹ 16,00,000 and ₹ 4,00,000, respectively. Green was admitted as a new partner for 1/4 th share in the profits of the firm. Green brought ₹ 2,40,000 for her share of goodwill premium and ₹ 4,80,000 for her capital. The amount of goodwill premium credited to Red will be

(a) ₹ 80,000

(b) ₹ 60,000

(c) ₹ 1,44,000

(d) ₹ 1,20,000

Answer

D

11. Continency reserve appearing in the balance sheet at the time of admission of a partner is ……… to old partners’ capital accounts in old ratio.

(a) debited

(b) credited

(c) Either (a) or (b)

(d) None of these

Answer

B

12. A company forfeited 4,000 shares of ₹ 10 each issued at 20% premium to be paid at the time of allotment on which ₹ 8 is called-up. Company not received ₹ 4 on allotment including premium and ₹ 2 on first call. What will be the amount debited to share capital account?

(a) ₹ 40,000

(b) ₹ 32,000

(c) ₹ 48,000

(d) ₹ 36,000

Answer

B

13. Identify the correct sequence of steps of treatment of goodwill at the time of change in profit sharing ratio.

(i) Calculate compensation payable by gaining partner(s) to sacrificing partner(s).

(ii) Pass the adjustment entry.

(iii) Calculate the share gained and share sacrified.

(a) (i), (iii), (ii)

(b) (i), (ii), (iii)

(c) (iii), (i), (ii)

(d) (iii), (ii), (i)

Answer

C

14. When shares are issued at premium, share premium is considered as ……… .

(a) profit

(b) income

(c) revenue receipt

(d) capital profit

Answer

D

15. P and Q were partners in a firm sharing profit and losses in the ratio of 3 : 1. They admitted R as a new partner. P sacrificed 1/4th of his share and Q sacrificed 1/4th of her share in favour of R. R’s share in the profits of the firm will be

(a) 5/8

(b) 1/8

(c) 1/4

(d) 7/16

Answer

C

16. DLF Ltd. forfeited 40,000 equity shares of ₹ 100 each for non-payment of first and final call of ₹ 40 per share. The maximum amount of discount at which these shares can be reissued will be

(a) ₹ 16,00,000

(b) ₹ 24,00,000

(c) ₹ 40,00,000

(d) ₹ 40,000

Answer

B

17. Star and Sun were partners in a firm sharing profits and losses in the ratio of 3: 2. Their capitals were ₹ 2,40,000 and ₹ 4,80,000, respectively. They were entitled to interest on capitals @ 10% p.a. The firm earned a profit of ₹ 36,000 during the year. The interest on Star’s capital will be

(a) ₹ 24,000

(b) ₹ 21,600

(c) ₹ 14,400

(d) ₹ 12,000

Answer

D

18. PQR Ltd. purchased the sundry assets of M/s XYZ Ltd. for ₹ 57,20,000 payable in fully paid shares of ₹ 100 each. State the number of shares issued to vendor when issued at premium of 10%.

(a) 56,000

(b) 63,556

(c) 57,200

(d) 52,000

Answer

D

Section – B

19. The capital invested is ₹ 2,00,000. Calculate goodwill on 3.5 years’ purchase of super profits if a fair return on capital involved is 20% and average actual profits are ₹ 44,000.

(a) ₹ 4,000

(b) ₹ 12,000

(c) ₹ 14,000

(d) None of these

Answer

C

20. When full nominal (face) value of a share is called by the company, but as some shareholders did not pay the money on due date, their shares are being forfeited by the company. How the share capital is shown in the balance sheet (notes to accounts) of a company?

(a) Subscribed and fully paid up

(b) Subscribed but not fully paid up

(c) Subscribed and called-up

(d) Subscribed but not called-up

Answer

A

21. Which of the following is true?

(i) An incoming partner acquires his share from all the old partners in their profits sharing ratio.

(ii) An incoming partner acquires his share from all the old partners in some agreed ratio.

(iii) An incoming partner acquires his share from one or more of the old partners in some agreed ratio.

(a) Only (i)

(b) Only (ii)

(c) Only (iii)

(d) None of these

Answer

C

22. Assertion (A) New profit sharing ratio is calculated even for old partners, at the time of admission of a partner.

Reason (R) A new partner acquires his share in profits from old partners which reduced old partners’s share in profits.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

23. The directors of Goyal Ltd. forfeited 40,000 equity shares of ₹ 10 each, ₹ 8 per share called-up for non-payment of first call of ₹ 2 per share. Final call of ₹ 2 per share has not been yet called. Half of the forfeited shares were reissued as fully paid up for ₹ 15 per share. The amount transferred to capital reserve will be

(a) ₹ 4,00,000

(b) ₹ 2,40,000

(c) ₹ 1,20,000

(d) ₹ 80,000

Answer

C

24. A charitable dispensary is run by 8 members. A new member wants to join them. The new member is of the opinion that partnership deep must be written while other members refused to do that. They said this is not a partnership. Give reason(s) in favour of other members.

(i) There is no business.

(ii) There is no sharing of profits.

(iii) There is no motive of profit making

(a) (i) and (ii)

(b) (i) and (iii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

Answer

D

25. Assertion (A) On forfeiture of shares, amount received for securities premium will not be debited to securities premium reserve account.

Reason (R) Amount received for securities premium will be debited while writing-off certain types of capital loss or expenditure.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

26. When partners’ capital accounts are floating which one of the following items will be written on the credit side of the partners’ capital accounts?

(i) Interest on drawings

(ii) Loan advanced by partner to the firm

(iii) Partner’s share in the firm’s loss

(iv) Salary to the active partners

(a) (i) and (ii)

(b) (i) and (iv)

(c) (iii) and (iv)

(d) Only (iv)

Answer

D

27. Aggarwal Ltd. issued 5,00,000 shares of ₹ 10 each at a premium of ₹ 2 payable as application – ₹ 3; allotment – ₹ 4 (including premium)

First call – ₹ 3; Final call – ₹ 2.

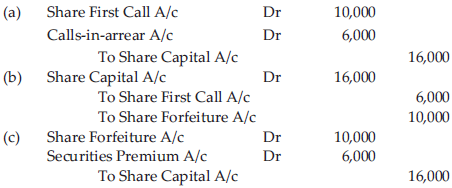

P who holds 2,000 shares failed to pay the first call money. The company has forfeited 2,000 shares after the first call. Entry of forfeiture will be

Answer

B

28. Which of the following factors help in generation of self-generated goodwill?

(i) Hardwork of organisation

(ii) Better quality products

(iii) Better customer services

(iv) All of the above

(a) Only (i)

(b) (ii) and (iii)

(c) (i) and (ii)

(d) (i), (ii) and (iii)

Answer

D

29. P, Q, R, S are in a partnership sharing profits and losses in ratio of 1 : 2 : 3 : 4. T joins for 25% share. The new profit sharing ratio among P, Q, R, S will be 4 : 3 : 2 : 1. What is new profit sharing ratio among P, Q, R, S, T?

(a) 4 : 3 : 2 : 1 : 4

(b) 8 : 6 : 4 : 2 : 8

(c) 12 : 9 : 6 : 3 : 10

(d) Can t be determined

Answer

C

30. If company wants to calculate amount forfeited on reissued shares, then which amongst given formula will be used?

(a) Total Amount Forfeited / Number of Shares Forfeited

(b) Total Amount Forfeited / Number of Shares

(c) Number of Shares Forfeited / Total Amount Forfeited X Shares Reissued

(d) Total Amount Forteited / Number of Shares Forfeited X Number of Shares Reissued

Answer

D

31. Assertion (A) At the time of admission of a partner, profit or loss on revaluation is not transferred to incoming partner’s capital account.

Reason (R) Profits or loss on revaluation belongs to pre admission period and thus belongs to old partners.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

32. U, V and N are partners sharing profits in the ratio of 3 : 3 : 2. As per the partnership agreement, W is to get a minimum amount of ₹ 1,60,000 as his share of profits every year and any deficiency on this account is to be personally borne by U. The net profit for the year ended 31st March, 2020 amounted to ₹ 6,24,000. In this case, ……… was the amount of deficiency borne by U.

(a) ₹ 2,000

(b) ₹ 8,000

(c) ₹ 16,000

(d) ₹ 4,000

Answer

D

33. Bansal Ltd. issued 30,000 equity shares of ₹ 20 each at a premium of ₹ 5 payable, ₹ 5 on application , ₹ 10 on allotment (including premium and the balance on first and final call.

The company received applications for 45,000 shares and allotment was made pro rata. Zen to whom 2,400 shares were allotted, failed to pay the amount due on allotment. All his shares were forfeited after the call was made. The forfeited shares were reissued to Dheeraj at par. Assuming that no other bank transactions took place, the bank balance of the company after the above transactions is

(a) ₹ 13,70,000

(b) ₹ 7,21,000

(c) ₹ 7,56,000

(d) ₹ 12,68,000

Answer

C

34. ‘X’ and ‘Y’ are partners in a firm, ‘X’withdraw ₹ 1,600 per month at the beginning of every month for 6 months ending on 31st December, 2017, ‘Y’withdraw ₹ 1,600 per month at the end of every month for 6 months ending on 31st December, 2017.

Calculate interest on drawing @ 15% per annum on 31st December, 2017.

(a) X = ₹ 640, Y = ₹ 560

(b) X = ₹ 360, Y = ₹ 440

(c) X = ₹ 1,440, Y = ₹ 1,440

(d) X = ₹ 420, Y = ₹ 300

Answer

D

35. DLF Ltd. purchased an asset of ₹ 70,000 from DLF. Ltd. on 1st April, 2020. ₹ 20,000 were paid immediately and balance by issue of ₹ 52,500 shares journal entry for payment made will be

DLF Ltd. A/c Dr X

Discount on Issue of Shares A/c Dr Y

To Share Capital A/c Z

To Bank A/c W

Here X, Y, Z, W are

(a) ₹ 70,000, ₹ 2,500, ₹ 52,500, ₹ 20,000 respectively

(b) ₹ 2,500, ₹ 70,000, ₹ 52,500, ₹ 20,000 respectively

(c) ₹ 70,000, ₹ 2,500, ₹ 20,000, ₹ 52,500 respectively

(d) ₹ 20,000, ₹ 52,500, ₹ 70,000, ₹ 2,500 respectively

Answer

A

36. E, F, G are partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. They decided to share future profits and losses in the ratio of 3 : 2 : 1. Each partner’s gain or sacrifice due to change in the ratio will be

(a) E – Sacrifice 1/30, F – Gain 1/30, G – Nil

(b) E – Gain 1/30, F-Nil, G – Sacrifice 1/30

(c) E – Nil, F – Sacrifice 1/30, G-Gain 1/30

(d) E – Nil, F – Gain 1/30, G – Sacrifice 1/30

Answer

D

Section – C

On 1st April, 2019, Action Ltd. made an issue of 6,00,000 equity shares of ₹ 10 each at a premium of ₹ 4 per share, payable as follows

₹ 6 on application (including ₹ 1 premium)

₹ 2 on allotment (including ₹ 1 premium)

₹ 3 on first call (including ₹ 1 premium)

₹ 3 on second and final call (including ₹ 1 premium)

Applications were received for 9,00,000 shares, of which applications for 1,80,000 shares were rejected and their money was refunded. Rest of the applicants were issued shares on pro rata basis and their excess money was adjusted towards allotment.

Zen, to whom 12,000 shares were allotted, failed to pay the allotment money and his shares were forfeited after allotment. Ben who applied for 21,600 shares failed to pay the two calls and on his such failure, his shares were forfeited.

24,000 forfeited shares were reissued as fully paid on receipt of ₹ 9 per share, the whole of Ben’s shares being included.

37. What is the amount refunded to shareholders?

(a) ₹ 9,00,000

(b) ₹ 10,80,000

(c) ₹ 8,00,000

(d) ₹ 10,00,000

Answer

B

38. Amount of forfeiture transferred to balanced sheet is ……… .

(a) ₹ 1,08,000

(b) ₹ 1,20,000

(c) ₹ 36,000

(d) ₹ 24,000

Answer

C

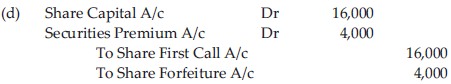

Tom, Tim and Ben were partners in a firm sharing profits and losses equally. The firm was engaged in the storage and distribution of canned juice and its godowns were located at three different places in the city. Each godown was being managed individual by Tom, Tim and Ben. Because of increase in business activates at the godown managed by Tim, he had to devote more time Tim demanded that his share in the profits of the firm be increased to which Tom and Ben agreed. The new profit sharing ratio was agreed to be 1 : 2 : 1.

For this purpose, the goodwill of the firm was valued at two years’ purchased of the average profits of last five years.

The profit of the last five years were as follows

39. Goodwill of the firm

(a) ₹ 7,20,000

(b) ₹ 14,40,000

(c) ₹ 3,60,000

(d) ₹ 14,00,000

Answer

B

40. Sacrifice/Gain of Tom, Tim and Ben will be

Answer

A

41. What will be the journal entry for treatment of goodwill on change in profit sharing?

Answer

C

Part – II

Section – A

42. Which one of the following is commitment?

(i) Proposed dividend

(ii) Interim divided

(iii) Unpaid/unclaimed dividend

(iv) Dividend arrears on cumulative preference shares

(a) (i) and (ii)

(b) (ii) and (iii)

(c) (i) and (iv)

(d) Only (i)

Answer

D

43. Which of the following is not a operating expenses?

(i) Office expenses

(ii) Selling expenses

(iii) Bad debts

(iv) Loss by fire

(a) (i) and (ii)

(b) (ii) and (iii)

(c) (i) and (iv)

(d) Only (iv)

Answer

D

44. Match the column.

Codes

A B C

(a) (iii) (i) (ii)

(b) (i) (ii) (iii)

(c) (ii) (i) (iii)

(d) (iii) (ii) (i)

Answer

A

45. Assertion (A) Current ratio is calculated to assess the short-term financial position of the business.

Reason (R) Current ratio explains the relationship between current assets and current liabilities.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

46. Which of the following is not correct in regards to significance of financial statement analysis?

(i) To judge the financial stability of an enterprise.

(ii) To measure the operating efficiency and profitability of enterprise.

(iii) To present the complex financial data in simplified and under standable form.

(iv) It does not consider price level changes.

(a) (i) and (ii)

(b) (i) and (iv)

(c) (ii) and (iv)

(d) Only (iv)

Answer

D

47. If the inventory turnover ratio is divided into 365, it becomes a measure of ……… .

(a) sales efficiency

(b) average age of inventory

(c) sales turnover

(d) average collection period

Answer

B

48. The formula for calculating the debt-equity ratio is

(a) Short – term Debts / Shareholder’s Funds

(b) Shareholder’s Funds / Fixed Assests

(c) Short – term Debts + Long – term – Debts / Shareholder’s Fund

(d) None of the above

Answer

D

Section – B

49. Which of the following is the importance of financial analysis for labour unions?

(i) To assess whether an enterprise can increase their pay.

(ii) To check whether an enterprise can increase productivity or raise the prices of products/services to absorb a wage increase.

(iii) To determine tax liabilities.

(a) (i) and (iii)

(b) Only (i)

(c) (i) and (ii)

(d) (ii) and (iii)

Answer

C

50. Assertion (A) Purchase of goods on credit will reduce the current ratio.

Reason (R) When goods are purchased on credit, current assets and current liabilities are increased with the same amount.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

51. Inventory Turnover Ratio = 5 times

Revenue from Operations = ₹ 4,00,000

Gross Profit Ratio = 25%

Closing inventory was ₹ 10,000 more than the opening inventory. Average inventory will be

(a) ₹ 60,000

(b) ₹ 3,00,000

(c) ₹ 1,00,000

(d) ₹ 25,000

Answer

A

52. Which of the following parties are interested in financial statement analysis?

(i) Top management

(ii) Labour union

(iii) Lenders

(iv) Investors

(a) Only (i)

(b) (i) and (iii)

(c) (i), (ii), (iii)

(d) (i), (ii), (iii), (iv)

Answer

D

53. Which of the following is not a sub-head under the current assets?

(i) Cash and cash equivalents

(ii) Trademarks

(iii) Short-term loans and advances

(iv) Inventories

(a) (i) and (ii)

(b) Only (ii)

(c) (ii) and (iii)

(d) (ii) and (iv)

Answer

B

54. Assertion (A) Provision for doubtful debt is shown under the head ‘Short-term provision’.

Reason (R) Short-term provisions are provisions against which liability is likely to arise within 12 months from the date of balance sheet.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

55. Calculate debt-equity ratio from the following.

(a) 2 : 1

(b) 1 : 1

(c) 1 : 2

(d) None of these

Answer

A