Students can read the important questions given below for Money and Credit Class 10 Social Science. All Money and Credit Class 10 Notes and questions with solutions have been prepared based on the latest syllabus and examination guidelines issued by CBSE, NCERT and KVS. You should read all notes provided by us and Class 10 Social Science Important Questions provided for all chapters to get better marks in examinations. Social Science Question Bank Class 10 is available on our website for free download in PDF.

Important Questions of Money and Credit Class 10

Very Short Answer Type Questions

Question. Why do banks or lenders demand collateral against loans?

Answer : Bank or lenders demand collateral against loans as it is used as a guarantee to a lender until the loan is repaid

Question. Explain the importance of ‘Collateral’.

Answer : Importance of ‘Collateral’:

It is used as a guarantee to a lender until the loan is repaid.

Question. Explain the importance of formal sector loans in India.

Answer : Importance of formal sector loans in India: Low interest rate.

Question. Give one example each of modern currency and old currency.

Answer : Modern currency – Paper notes/coins, old currency – metallic coins like gold, silver & copper coins.

Question. Give any one example of the methods to make payment without using cash.

Answer : Online transfer, by cheque (Any one)

Question. Give one example of money which is not in the form of currency (cash).

Answer : By cheque

OR

Debit/Credit Card.

Question. Give any two examples of informal sector of credit.

(i) Credit from ‘moneylenders’.

(ii) Credit from ‘family members’.

Question. What is Barter System?

Answer : It is a system of exchange in which goods are directly exchanged without the use of money.

Question. What are the two forms of modern currency?

Answer : Paper notes and coins.

Question. Why one cannot refuse a payment made in rupess in India?

Answer : Because it is authorized by the Government of India.

Question. Who supervises the functioning of formal sources of loan?

Answer : Reserve Bank of India (RBI).

Question. Why are most of the poor households deprived from the formal sector of loans?

Answer : Because they cannot fulfil the formalities of the formal sector of loAnswer :

Question. Why do farmers require credit?

Answer : To purchase the raw materials and inputs for agriculture.

Question. Why do banks maintain cash reserve?

Answer : To arrange for daily withdrawals by depositors.

Question. What is credit?

Ans. Credit (loan) refers to an agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment.

Question. What are formal sources of credit?

Ans. Banks and Cooperative societies which charge less interest on loan are called formal sources of credit.

Question. Explain the inherent problem of the ‘barter system’.

Ans. The inherent problem of the barter system is that it is not necessary that when one person is willing to exchange his/her goods, the person he/she wants to exchange with is also willing to do the same.

Question. Why are demand deposits considered as money?

Ans. Demand deposits are considered as money because they can be withdrawn from the bank as and when needed. Also, they are accepted widely as a means of payment by way of a cheque instead of cash.

Question. Krishna is working in a neighboring field on very less wage. Expenses on sudden illnesses or functions in the family are also met through loans. The landowner charges an interest rate of 5% per month. At present, she owes the landowner ₹ 5,000. Analyse his credit arrangements given above.

Ans. Krishna takes loan from an informal source (her landowner) who provides loan without collaterals or documents and charges a very high rates of interest for profit. The 5% per month interest has lead him into a debt trap.

Question. What do terms of credit include?

Ans. The terms of credit include interest rate, collateral, documentation requirement, mode of payment.

Question. Why do banks ask for collateral while giving loans?

Ans. Banks use collateral as a guarantee until the loan is repaid.

Question. How do the Demand Deposits offer facilities

Ans. Demand Deposits offer facilities as: It offers essential characteristics of money/Safe transfer of money.

Question. Observe the picture carefully

Describe this image in your own words.

Question. This image showcases a meeting of a women self-help group.

Question. Which bank issues ‘currency notes’ in India on behalf of the central government ?

Ans. The Reserve Bank of India issues currency notes in India on behalf of federal government.

Question. How is money beneficial in transactions?

Ans. Money has made transactions easy as it solves the problem of double coincidence of wants by acting as a medium of exchange.

Question. Give one example each of modern currency and older currency.

Ans. Examples of modern currency are paper bills/notes, coins, credit cards etc., whereas examples of older currency are coins made of precious metals like gold or silver and also terracotta coins, etc.

Question. How do the deposits with banks become their source of income?

Ans. Banks use a major portion of its deposits to extend loans to people, for which they charge high interests and this is how the deposits with banks become their source of income.

Question. Why is money called a medium of exchange?

Ans. Money is accepted as a ‘medium of exchange’ because it acts as an intermediary in the process of exchange. A person holding money can easily exchange it for any commodity or service.

Question. How is double coincidence of wants not appreciable in the contemporary scenario?

Ans. Double coincidence of wants not appreciable:

What a person desires to sell is exactly not what the other wishes to buy.

Question. Give one reason that prevents a rural poor from getting a formal loan.

Ans. Lack of collateral

Question. What is a cheque?

Ans. A cheques is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been issued.

Question. What can be the alternative mode of payment in place of cash money?

Ans. Cheques and demand deposits’ are two alternative modes of payment that can be used in place of cash money.

Question. Explain the meaning of ‘Currency’.

Ans. Currency is the form of money: paper notes and coins.

Short Answer Type Questions

Question. Describe the significance of the Reserve Bank of India.

Answer : It is the Reserve Bank of India, which controls the functioning and supervises the activities of the formal sectors in India. It also acts as the guardian of all the monetary policies in our country. It monitors the balance kept by banks for day-today transactions. Periodically, banks have to give details about lenders, borrowers and interest rate to RBI. Thus, RBI plays a significant role in our country.

Question. How can money be easily exchange itself for goods or services? Give example to explain.

Answer : Money acts as a medium to exchange itself for goods and services: A person holding money can easily exchange it for any commodity or service that he or she wants. Everyone prefers to receive payments in money and exchanges the money for things he wants. For example: A shoemaker wants to sell shoes in the market and buy wheat. The shoemaker will first exchange shoes for money and then exchange the money for wheat. If the shoemaker had to directly exchange shoes for wheat without the use of money, he would have to look for wheat growing farmer who not only wants to sell wheat but also wants to buy the shoe in exchange. Both parties have to agree to sell and buy each other’s commodities. This process is very difficult, time consuming and unhealthy.

Question. How is money transferred from one bank account to another bank account? Explain with an example.

Answer : Money transfer from one bank account to another bank account: If a person has to make a payment to his or her friend and writes a cheque for a specific amount, this means that the person instructs his bank to pay this amount to his friend. His friend takes this cheque and deposits it in his account in the bank. This said amount is transferred from one bank account to another bank account.

Question. Why is modern currency accepted as a medium of exchange without any use of its own? Find out the reason.

Answer : Modern currency is accepted as a medium of exchange without any use of its own because:

(i) Modern currency is authorised by the government of a country.

(ii) In India, the Reserve Bank of India issues all currency notes on behalf of the central government.

(iii) No other individual or organisation is allowed to issue currency.

(iv) The law legalises the use of rupee as a medium of payment that cannot be refused in settling transactions in India.

(v) No individual in India can legally refuse a payment made in rupees.

Question. Imagine yourself to be XYZ, a member of a women Self Help Group. Analyse the ways through which your group provides loan to the members.

Answer : (i) Self Help Groups pool their savings.

(ii) A typical SHG has 15–20 members, usually belonging to one neighbourhood, who meet and save regularly.

(iii) Saving per member varies from Rs. 25 to Rs. 100 or more, depending on the ability of the people to save.

(iv) Members can take small loans from the group itself to meet their needs.

(v) The group charges interest on these loans but this is still less than what the moneylender charges.

(vi) After a year or two, if the group is regular in savings, it becomes eligible for availing loan from the bank.

Question. Explain the role of Self Help Groups in the rural economy.

Answer : The role of Self-Help Groups:

(i) Self-Help Groups are small groups (especially from rural areas) who pool their resources and individual savings together to help the others in need of funds.

(ii) Facilitates the members to employ themselves in numerous self-employment opportunities.

(iii) Help in raising the living standards of the concerned members.

(iv) Reduces the dependence on the informal credit sources.

(v) Thus, with the help of SHGs, the rural poor become economically independent and their dependence on the local moneylenders who charge a high rate of interest is also reduced.

Question. Why do we need to expand formal source of credit in India?

OR

Explain any three reasons for the banks and cooperative societies to increase their lending facilities in rural areas.

Answer : Expand formal sources of credit in India

(i) To save people from the exploitation of Informal sector,

(ii) Formal charge a low interest on loans,

(iii) To save from debt trap,

(iv) It provides cheap and affordable credit,

(v) RBI also supervises the formal sector credit through various rules and regulations which ensures that banks give loans to small cultivators, small borrowers, etc. and not just to profit making business and traders OR Answer : Banks and Cooperatives can help people in obtaining cheap and affordable loAnswer : This will help people to grow crops, do business set up small scale industries or trade goods and also help indirectly in the country’s development.

(i) They should do so, so that relatively poor people do not have to depend on informed sources of credit.

(ii) Formal sector loans need to expand. It is also necessary that everyone receives these loAnswer :

(iii) At present it is the richer households who receive formal credit whereas the poor have to depend on informal sources. It is important that the formal credit is distributed more equally so that poor can be benefitted from the cheaper loAnswer :

Question. Why do banks and co-operative societies need to lend more? Explain.

Answer : Banks and cooperative societies need to lend more:

(i) This would lead to higher incomes.

(ii) People could borrow cheaply for a variety of needs.

(iii) They could grow crops and set up small-scale industries, etc.

(iv) Cheap and affordable credit is crucial for the country’s development.

(v) To save and reduce the dependence on informal sources of credit.

(vi) It is important that the formal credit is distributed more equally so that the poor can benefit from the cheaper loAnswer :

Question. Describe the importance of formal sources of credit in the economic development.

Answer : Importance of formal sources of credit in the Economic Development:

(i) Formal sources provide cheap credit.

(ii) Credit at affordable rate is available through formal sources.

(iii) Terms and conditions of credit through formal sources are regulated by government.

(iv) Credit from formal source are favourable.

(v) Any other relevant point.

Question. Describe the bad effects of informal sources of credit on borrowers.

Answer : Bad effects of informal sources of credit on borrowers:

(i) Higher interest rate.

(ii) Higher cost of borrowing means a larger part of the earnings of the borrowers is used to repay the loan.

(iii) In certain cases, the high interest rate for borrowing can mean that the amount to be repaid is greater than the income of the borrower.

(iv) This could lead to increasing debt and debt trap.

(v) Any other relevant point.

Question. Why is it necessary to increase of a large number of banks mainly in rural areas? Explain.

Answer : Increase large number of banks:

(i) To reduce the dependence on informal sector of credit.

(ii) To provide cheaper loAnswer :

(iii) To provide accessibility towards loans for the poor.

(iv) Any other relevant point to be explained.

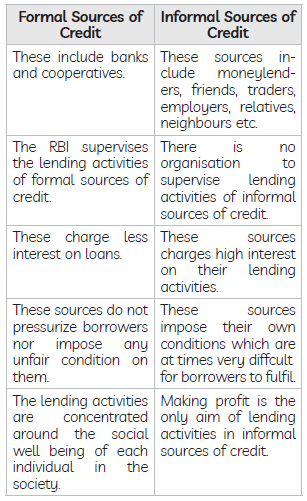

Question. Why are service conditions of formal sector loans better than informal sector? Explain.

Answer : Formal sector are better than informal sector:

(i) Low interest rate.

(ii) Transparency.

(iii) Supervision by the Reserve Bank of India on the functioning of the formal sector.

(iv) No use of unfair means for getting the money back.

Question. Why is cheap and affordable credit important for the country’s development? Explain any three reasons.

Answer : Importance of cheap and affordable credit for the country’s development:

(i) Cheap and affordable credits would lead to higher income.

(ii) Many people could borrow for a variety of needs.

(iii) It encourages people to invest in agriculture, do business and set up small scale industries, etc.

(iv) It enables more investment which will lead to acceleration of economic activities.

(v) Affordable credit would also end the cycle of debt-trap.

(vi) Any other relevant point. (Any three points)

Question. Why are formal sources of credit preferred over the informal source of credit? Give three reasons.

Answer : Formal sources of credit preferred over informal sources of credit because:

(i) Formal sources have low cost of borrowing.

(ii) Higher Income through cheap borrowing.

(iii) No exploitation and debt trap.

Question. “The credit activities of the informal sector should be discouraged.” Support the statement with arguments.

Answer : Credit activities of the informal sector should be discouraged:

(i) Most loans from informal lenders carry a very high interest rate and do little to increase the income of the borrowers.

(ii) The poor households have to pay a large amount for borrowing.

(iii) 85% of the loans taken by poor households in the urban areas are from informal sources.

(iv) Cheap and affordable credit is crucial for the country’s development.

(v) Any other relevant point. (Any three points to be explained)

Question. Explain any three loan activities of banks in India.

Answer : Loan activities of Banks in India:

(i) Banks use the major portion of the deposits to extend loAnswer :

(ii) Banks make use of the deposits to meet the loan requirements of the people.

(iii) Banks mediate between those who have surplus funds (the depositors) and those who are in need of these funds (the borrowers).

(iv) Banks charge a higher interest rate on loans than what it offers on deposits.

(v) Any other relevant point. (Any three points to be explained)

Question. “Deposits with the banks are beneficial to the depositors as well as to the nation”. Examine the statement.

Answer : Refer to Answer : of Long 9.

Question. Mention three points of difference between formal sector and informal sector loAnswer :

Answer : Refer to Answer : of Long 14.

Question. Dhananjay is a government employee and belongs to a rich household, whereas Raju is a construction worker and comes from a poor rural household. Both are in need and wish to take loan. Create a list of arguments explaining who between the two would successfully be able to arrange money from a formal source. Why?

Answer : Dhananjay will be able to get a loan from a formal source.

Arguments:

Banks are not present everywhere in rural India.

Even when they are present, getting a loan from a bank is much more difficult than taking a loan from informal sources.

Bank loans require proper documents and collateral.

Absence of collateral is one of the major reasons which prevents the poor from getting bank loAnswer : Informal lenders such as moneylenders, on the other hand, know the borrowers personally and hence, are often willing to give a loan without collateral.

Question. “Poor households still depend on informal sources of credit”. Support the statement with examples.

Answer : Poor households still depend on informal sources of credit because:

(i) Banks are not present everywhere in the rural areas.

(ii) Even when they are present, getting a loan from the bank is much more difficult than taking a loan from informal sources.

(iii) Mega banks or public sector banks require proper documents and collateral.

(iv) Absence of collateral is one of the major reasons which prevents the poor from getting bank loAnswer :

(v) Informal lenders such as moneylenders know the borrowers personally and they are willing to give a loan without collateral.

Question. What is meant by term of credit? What does it include?

Answer : Terms of credit are the requirements need to be satisfied for any credit arrangements. It includes interest rate, collateral, documentation and mode of repayment. However, the terms of credit vary depending upon the nature of lender, borrower and loan.

Question. Why do lenders ask for collateral while lending? Explain.

Ans. A collateral is any physical or monetary asset like a building, vehicle, jewellery or cash deposits which a lender uses as a guarantee against the money he/she has lent to the borrower.

In case, a borrower fails to repay his/her loan, collateral can be used in turn to generate the amount the borrower owes.

Thus collateral becomes a legal guarantee that the borrower will repay the cash by all means. It encourages the lender to lend money without worrying about repayment.

Question. “The credit activities of the informal sector should be discouraged.” Support the statement with arguments.

Ans. (1) There is no organisation which supervises the credit activities of lenders in the informal sector. The informal sector can lend at whatever interest rate they want and there is no one to stop them from using unfair means to get their money back.

(2) Most of the informal moneylenders charge a very high rate of interest on loans in comparison to the formal lenders, which in turn increases the principal ammount which is to be paid back.

(3) Sometimes the amount to be repaid is greater than the income of the borrower. It also significantly reduces the income of the borrower, as much of the earnings go into repayment of the loan.

Question. Explain the role of credit for economic development.

OR

‘‘Credit can play a positive role.’’ Support the statement with arguments.

Ans. Credit plays a crucial role in a country’s development in the following ways –

(1) Credit or loans sanctioned by banks help industrialists as capital investments to revive their failing industry or start up a completely new venture without worrying about the lack of cash. This in turn leads to increase in employment opportunities and economic development of a country.

(2) For farmers, loans help them buy new seeds before the sowing season and becomes their only source of capital in times of urgent need. This helps them grow more and earn more.

(3) Credit also helps to boost various other sectors. It helps to buy houses, vehicles and generate demands which in turn helps to boost economy. The borrower is able to repay this loan in installments.

Question. How do demand deposits have the essential features of money? Explain.

Ans. The most essential feature of money is that it becomes a medium of exchange to buy things. Demand deposits, like cheque, also fulfill this role.

A cheque is a paper instructing the bank to pay a specific amount from the person’s account to the other person or to the account holder.

Thus this facility involving cheques makes the settlement of payments possible without using cash. Since they are widely used alongside money as a medium of exchange, demand deposits have this feature, which is similar to money.

Question. Explain the three important terms of credit.

Ans. The important terms of credit are as follows:

(1) Collateral: Collateral refers to an asset like a building or vehicle owned by the borrower, which acts as a guarantee against which the loan is given to the borrower.

(2) Documentation: Before lending money, the lender checks all the documents, like income and employment records, etc.

(3) Interest rate: While borrowing or lending money, both the parties decide the rate of interest on which the amount is being lent. The borrower pays the principal amount added to the interest amount while repaying the loan. Document is specified for the same.

(4) Mode of payment: It refers to the mode of payment in which the borrower will return the money to the lender. The duration of time for which the amount is being given also comes under this term.

Question. ‘‘Credit can play a negative role.’’ Support the statement with arguments.

Ans. The following points elucidate how credit can play a negative role:

(1) The cost of informal loans is much higher and often leads to a debt-trap. In addition budding entrepreneurs who might wish to start a new enterprise by borrowing may not do so because of the high cost of borrowing.

(2) Most loans from informal lenders carry a very high interest rate and do little to increase the income of the borrowers.

(3) Credit does no good to the borrower if he/she doesn’t utilise that money in a profitable manner. Sometimes, farmers borrow money to buy raw material to grow crops but due to some factors, the crop turns out to be a failure. The farmer is not able to repay the amount and thus falls into a debt-trap.

Question. “Banks are eficient medium of exchange.” Support the statement with arguments.

Ans. Banks are effcient m ediusm o f exchang because:

(1) Demand deposits share the essential features of money.

(2) The facility of cheque against demand deposit makes it possible to directly settle payment without use of cash.

(3) Demand deposits are accepted widely as a means of payment.

Question. Why is it necessary to increase a large number of banks in rural areas? Explain.

Ans. It is necessary to increase a large number of banks in rural areas. The cost of informal loans is much higher and often leads to a debt trap. People who might wish to start a new enterprise by borrowing may not do so because of the high cost of borrowing in such a case.

Most loans from informal lenders carry a very high interest rate and do little to increase the income of the borrowers Banks can change this..

It is necessary that banks and cooperatives increase their lending particularly in the rural areas, so that the dependence of the poor on informal sources of credit reduces.

It is important that formal credit sources like banks are distributed more equally in rural and urban areas so that the poor can benefit from the cheaper loans.

Question. Why do we need to expand formal sources of credit in India? Explain.

Ans. Expand formal sources

(1) To save people from the exploitation of Informal sector

(2) Formal charge a low interest on loans.

(3) To save from debt trap.

(4) It provides cheap and affordable credit.

(5) RBI also supervises the formal sector credit through various rules and regulations which ensures that banks give loans to small cultivators, small borrowers, etc. and not just to profit making business and traders.

Question. Modern forms of money include currency: paper notes and coins. unlike the things that were used as money earlier modern currency is not made of precious metals such as gold silver and copper and unlike green and cattle they are neither of everyday use the modern currency is without any use of its own. Why is modern currency accepted as a medium of exchange without any use of its own?

Ans. Modern currency is accepted as a medium of exchange without any use of its own because:

(1) Modern currency is authorised by the government of the country because the Reserve Bank of India issues all currency notes on behalf of Central Government.

(2) No other individual or organisation apart from RBI is allowed to issue currency.

(3) Indian law legalises the use of rupee as amedium of payment that cannot be refused in settling transactions in India.

Question. Examine any three situations in which credit helps in the development of agriculturists.

Ans. Credit helps in the development of agriculturists:

(1) The credit helps him to meet the ongoing expenses of production.

(2) It helps in purchasing raw material and equipment.

(3) It helps in irrigation.

(4) It helps in completing production on time.

(5) It helps in storage of production.

(6) It helps in increasing his earnings.

Question. Examine any three situations in which credit pushes the borrower into a debttrap.

Ans. Credit and debt-trap:

(1) Loans from informal sector could lead to debt trap.

(2) Lack of planning results in debt.

(3) Diffculty in repaying loans due to certain circumstances.

(4) Higher interest rate.

Question. The other form in which people hold money is as deposits with banks. At a point of time, people need only some currency for their day-to-day needs. For instance, workers who receive their salaries at the end of each month have extra cash at the beginning of the month. They deposit this extra cash with the banks by opening a bank account in their name. Why do people deposit their money in bank?

Ans. People deposit money in bank because:

(1) Depositing cash in banks is a wonderful way of keeping the money secure. Bank guarantee the security of your money from being robbed or looted.

(2) The surplus cash leftover after every month expenditure can be deposited in a bank to earn interest over the same. Hence, surplus cash when deposited brings home extra money off interest.

(3) Banks also provide the facility of depositing or withdrawing money at one’s own convenience. It is a good way of saving some money which would otherwise be spent in unnecessary things.

Question. How is money transferred from one bank account to another bank account? Explain with an example.

Ans. Money can be transferred from one bank account to another in many ways like cheque payments, net banking, etc.

For example – A shoe manufacturer, M. Salim, has to make a payment to the leather supplier and writes a cheque for a specific amount. This means that the shoe manufacturer instructs his bank to pay this amount to the leather supplier.

The leather supplier takes this cheque, and deposits it in his own account in the bank. The money is transferred from one bank account to another bank account in a couple of days. The transaction is complete without any payment of cash.

Question. Why do banks and cooperative societies need to lend more? Explain.

Ans. Banks and cooperative societies need to lend more.

(1) This would lead to higher incomes

(2) People could borrow cheaply for a variety of needs.

(3) They could grow cropsand set up smallscale industries etc.

(4) Cheap and affordable credit is crucial for the country’s development

(5) To save and reduce the dependence on informal sources of credit

(6) It is important that the formal credit is distributed more equally so that the poor can benefit from the cheaper loans.

Question. Explain any three functions of the Reserve Bank of India.

Ans. Functions of the Reserve Bank of India are:

(1) The RBI is the only authorized body that can issue currency in the country.

(2) They print, distribute and regulate the flow of currency in the economy.

(3.) The RBI provides central and state governments with banking facilities.

(4) The Reserve Bank of India also supervises all other commercial banks in the country. It provides financial assistance to these banks, like short-term loans and advances.

(5) To maintain the value of the rupee in the global economy, the RBI acts as the custodian of foreign exchange reserves in the country.

(6) The primary function of the Reserve Bank of India is the control of credit and money in the market.

Question. Describe the utility of Cheque.

Ans. The utility of cheque is as follows:

(1) Cheques have the same features as money.

(2) They settle payments without the use of cash.

(3) They are widely accepted as a means of payment.

(4) There pose the least risk in transactions.

(5) In a fair dealing, it is the most appropriate means of money transactions.

Question. How is the concept of self help groups important for poor people ? Give your view point.

Ans. Self help groups for poor people:

(1) Help borrowers overcome the problem of lack of collateral.

(2) Get timely loans for a variety of purposes (releasing mortgaged land, buying seeds, fertilizers, cattle, etc.) and at a reasonable interest rate.

(3) Help women to become financially selfreliant.

(4) The regular meetings of the group provide a platform to its members to discuss and act on a variety of social issues such as health, nutrition, domestic violence, etc.

Question. Why are service conditions of formal sector loans better than those of the informal sector? Explain.

Ans. The formal sector works under the supervision of the Reserve Bank of India. The rate of interest is very low. Commercial banks and cooperative societies are the main sources of the formal source of credit. They provide ensured services and also have a set protocol for deliverance of loan activities. In the formal sector, the interest rate, collateral and documentation requirement, and the mode of repayment together comprise what we call the terms of credit. The terms of credit vary substantially from one credit arrangement to another. They may also vary depending on the nature of the lender and the borrower.

Question. Why is it diffcult for poor people to get loan from banks?

Ans. Limited availability of banks makes it diffcult for poor people in rural areas to get loans from banks. Poor people don’t have sufficient collateral and required documents to present to banks while borrowing.

Question. “Credit activities of the informal sector should be discouraged.” Support the statement with arguments.

Ans. Credit activities of the informal sector should be discouraged because

(1) This sector includes activities between money lenders, traders, employers, neighbours, relatives, etc. which are outside the control of the government.

(2) There is no organisation to supervise the lending activities of the informal sector.

(3) There are no fixed rules and regulations for this sector to follow.

(4) Informal lenders charge higher interest on the money they give to the borrowers as loan. Sometimes a substantial part of their hard-earned income is repaid as interest and the principal amount remains the same. Due to this, the borrowers always run with the risk of falling into a debt-trap.

(5) Sometimes these lenders impose very tough and unreasonable conditions on the borrowers, and they find no other option than to comply.

Question. Why is modern currency accepted as a medium of exchange without any use of its own ? Find out the reason.

Ans. Modern currency is accepted as a medium of exchange without any use of its own because:

(1) Modern currency is authorized by the government of a country.

(2) In India, the Reserve Bank of India issues all currency notes on behalf of central Government.

(3) No other individual or organization is allowed to issue currency.

(4) The law legalises the use of rupee as a medium of payment that cannot be refused in settling transactions in India.

(5) No individual in India can legally refuse a payment made in Rupees.

Question. Which organisation supervises the functioning of the banks in India and how? Explain.

Ans. The Reserve Bank of India supervises the functioning of the banks in India in the following ways:

(1) The banks maintain a minimum cash balance out of the deposits they receive. The RBI monitors the banks in actually maintaining cash balance.

(2) The RBI sees that the banks give loans not just to profit-making businesses and traders but also to small cultivators, small scale industries, to small borrowers etc.

(3) Banks have to submit information to the RBI periodically on how much they are lending, to whom, at what interest rate etc.

Question. Why are formal sources of credit preferred over the infomal source of credit? Give three reasons.

Ans. Formal sources of credit preferred over Informal sources of credit because:

(1) Formal sources have low cost of borrowing

(2) Higher Income through cheap borrowing

(3) No exploitation and debt trap.

Question. Why is credit a crucial element in the economic development?

Ans. Credit is a crucial element in economic development of a country because:

(i) It helps to meet the ongoing expenses of production

(ii) It helps in increasing earnings

(iii) It helps in completing production in time.

Long Answer Type Questions

Question. “Bank plays an important role in the economic development of the country.” Support the statement with examples.

Answer : Bank plays an important role in the economic development of the country in many ways:

(i) Bank provides loan in rural area for crop production ultimately resulting in the development of many places.

(ii) Bank provides loan to create fixed assets that will create employment opportunities.

(iii) It acts as a link between savers and investors i.e. people who have surplus money and those who are in need of money.

(iv) Banks accepts the deposit and pay an amount as interest on the deposit which mobilizes savings.

(v) Bank uses major portion of these deposits to extend loan for the industrial and agricultural sector. They also provide funds to different organisations.

Question. What are demand deposits? Explain any three features of it.

OR Which type of deposits with the banks are called demand deposits? State some important features of demand deposits.

Answer : People save their money in banks by opening an account. The deposits in the bank accounts can be withdrawn on demand, so these deposits are called demand deposits.

(i) Banks accept the deposits and also pay an interest rate on the deposits. In this way, people’s money is safe with the banks and it also earns interest. (ii) The facility of cheques against demand deposits makes it possible to directly settle payments without the use of cash. Since, demand deposits are accepted widely as a means of payment, along with currency, they constitute money in the modern economy.

(iii) It is authorised by the government of the country.

Question. ‘‘The rupee is widely accepted as a medium of exchange.’’ Explain.

Answer : The rupee is widely accepted as a medium of exchange because:

(i) The currency is authorised by the government of the country.

(ii) In India, the Reserve Bank of India issues currency notes on behalf of the central government.

(iii) The law legalises the use of rupee as a medium of payment that cannot be refused in settling transactions in India.

(iv) No individual in India can legally refuse a payment made in rupees. Hence, the rupee is widely accepted as a medium of exchange.

Question. Why is money transaction system better than barter system? Explain with examples.

Answer : (i) Transaction system is better than a barter system because the double coincidence of wants creates a problem.

(ii) For example, a shoe manufacturer wants to sell shoes in the market and wants to buy wheat. For this, he would look for a wheat growing farmer who would exchange his wheat with the shoes.

(iii) In a barter system, goods are exchanged without the use of money.

(iv) In contrast, in an economy where money is in use; money provides the crucial intermediate step.

Question. “Credit sometimes pushes the borrower into a situation from which recovery is very painful.” Support the statement with examples.

Answer : It is true that credit sometimes pushes the borrower into a situation from which recovery is very painful. It happens in cases like:

(i) In case of rural area if crop fails due to natural factors, it will be difficult to repay.

(ii) In case of failure of a business it will be difficult to repay interest.

(iii) In situations with high risks, credit might create further problems for the borrower.

(iv) In the situation when borrower is unable to pay previous loan and he takes new loan.

(v) Loans taken by poor people from informal lenders sometimes, lead them to debt trap because of high interest rate.

Question. Why is cheap and affordable credit important for the country’s development? Explain any three reasons.

OR Why is credit a crucial element in the economic development?

OR

“Cheap and affordable credit is crucial for the country’s development.’’ Explain the statement with five points.

Answer : Importance of cheap and affordable credit for the country’s development:

(i) Cheap and affordable credit would lead to higher income.

(ii) Many people could borrow for a variety of needs

(iii) It encourages people to invest in agriculture, do business and set up small scale industries etc.

(iv) It enables more investment which will lead to the acceleration of economic activities.

(v) Affordable credit would also end the cycle of the debt trap.

(vi) Any other relevant point.

Question. Describe the vital and positive role of credit with examples.

OR What is credit? How does credit play a vital and positive role? Explain with an example.

Answer : ‘Credit’ refers to an agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment.

Credit plays a vital and positive role as:

(i) Credit helps people from all walks of life in setting up their business, increase their income and support their families.

(ii) To some people, loan helps a lot in constructing their houses and get relief from monthly rent.

(iii) To others, it helps a lot in raising their standards of living.

(iv) Example of Salim, credit helps him and he is able to increase his earnings.

Question. How can the formal sector loans be made beneficial for poor farmers and workers? Suggest any five measures.

Answer : Formal sector loans can be made beneficial for poor farmers and workers in the following ways:

(i) Create awareness to farmers about formal sector loAnswer :

(ii) Process of providing loans should be made easier. It should be simple, fast and timely.

(iii) More number of Nationalized Banks/Cooperative Banks should be opened in the rural sector.

(iv) Banks and cooperatives should increase facility of providing loans so that dependence on informal sources of credit reduces.

(v) The benefits of loans should be extended to poor farmers and small scale industries.

(vi) While formal sector loans need to expand, it is also necessary that everyone receives these loAnswer :

Question. How are deposits with the bank beneficial for individual as well as for the nation? Explain with examples.

Answer : The deposits with banks are beneficial for the individual as well as for the nation:

(i) Banks accept deposit and also pay an amount as interest and in this way people earn money.

(ii) People’s money is safe with banks.

(iii) It is easy for individuals to get credit who have savings and current account in the banks.

(iv) Poor people who are engaged in production need credit.

(v) Credit provided by the banks for government projects helps in the development of the nation.

(vi) Banks provide loans for the promotion of International trade.

(vii) Development of infrastructure is undertaken with the loans provided by the banks.

Question. Why is it necessary for banks and cooperatives to increase their lending in rural areas? Explain.

Answer : Necessity for the banks and cooperative societies to increase their lending facilities in rural areas:

(i) Dependence on informal sources of credit reduces.

(ii) To provide more loan facilities to rural households.

(iii) To save rural people from exploitation.

(iv) It is important that the formal credit is distributed more equally so that the poor can benefit from the cheaper loAnswer :

(v) The bank and the cooperative societies have to increase the lending facilities to improve the livelihood of the people in the rural areas.

Question. How do banks play an important role in the economy of India? Explain.

Answer : Banks play an important role in developing the economy of India:

(i) They keep the money of the people in their safe custody.

(ii) They give interest on the deposited money to the people.

(iii) They mediate between those who have surplus money and those who are in need of money.

(iv) They provide loan to a large number of people at the low interest rate.

(v) They promote agricultural and industrial sector by providing loAnswer :

(vi) They also provide funds to different organisations.

Question. How do banks mediate between those who have surplus money and those who need money?

Answer : (i) Banks keep a small proportion of their deposits as cash with themselves.

(ii) Major portion of deposits is used for extending loAnswer :

(iii) The banks mediate between depositors and borrowers in this way.

(iv) They charge high rate of interest on loans than what they offer on deposits.

Question. Which are the two major sources of formal sectors in India? Why do we need to expand the formal sources of credit?

Answer : The two major sources of formal sources of credit are:

(i) Banks and

(ii) Cooperatives. Need to expand formal sources of credit are:

(i) To save the poor farmers and workers from the exploitation by the informal sector credit.

(ii) Informal sector charges a higher interest on loans which means that a large part of the earnings is used to repay the loan.

(iii) Formal credit can fulfil various needs of the people by providing cheap and affordable credit.

Question. Explain any two features each of formal sector loans and informal sector loAnswer :

Answer : Formal Sector

Loans: Include loans from banks and cooperatives. Features of formal sector loans are:

(i) Formal sectors provide cheap and affordable loans and their rate of interest is monitored by Reserve Bank of India.

(ii) Formal sector strictly follows the terms of credit, which include interest rate, collateral, documentation and the mode of repayment. Informal Sector Loans: Include loans from moneylenders, traders, employers, relatives, friends, etc. Features of informal sector loans are:

(i) Their credit activities are not governed by any organisation, therefore they charge a higher rate of interest.

(ii) Informal sector loan providers know the borrowers personally, and hence they provide loans on easy terms without collateral and documentation.

Question. Self help groups help borrowers overcome the problem of the lack of collateral.” Examine the statement.

Ans. Following are the ways through with self help groups (SHGs) help borrowers overcome the problem of the lack of collateral:

(1) Self-help group is able to solve collateral problem. Members can take small loans from the group itself to meet their needs without any collateral.

(2) The Group charges interest on their loans but this is less than what the money lenders charge.

(3) Most of the decisions regarding savings and loan activities are taken by the group members. The group decides as regards the loans to be granted the purpose amount, interest to be charged, repayment schedule, etc. The group is responsible for the repayment of the loan. Any case of non-repayment of loan by any one member is followed up seriously by other members in the group.

(5) Because of these mentioned features, banks are willing to lend to poor women when organised in SHGs, keep as conclusion even though they have no collateral as such. Groups meet regularly and provide a platform to discuss and act on variety of social issues.

Question. “Credit sometimes pushes the borrower into a ‘situation from which recovery is very painful.” Support the statement with examples.

Ans. Yes, it is true that credit sometimes pushes the borrower into a situation from which recovery is very painful. It can be further understood through the following points :

(1) Sudden calamities cannot be predicted. In rural areas, if crops fail due to any natural factors, then it becomes dificult for the borrower to repay the loan. For example, thunderstorms, hailstorms, etc. destroy crops and farmer’s source of income. Loan repayment becomes impossible for the farmer.

(2) In informal sectors, the rate of interest is not fixed and is usually very high. In case the credit is not repaid then the interest rates further mounts leading the borrower in a debt trap.

(3) There are cases when people have to sell their land and fixed assets to repay loan.

(4) The borrower is often pushed into painful situation in case of high risk activities failure and specially when there is no support.

(5) Some borrowers also commit suicide if they fail to repay the loan.

Question. ‘‘Bank plays an important role in the economic development of a country.” Support the state-ment with examples.

Ans. ‘‘Banks plays an important role in the economic development of the country’’. This statement can be supported by:

(1) Loan is provided by banks to workers of the agriculture sector for all stages of crop production which results in the development of many households.

(2) Employment opportunities are created when banks provide loan to create fixed assets like buildings, industries and factories.

(3) Banks acts as a link between savers and investors. They mediate between those who have surplus money and those who are in need of it.

(4) One can easily rely and trust banks when it comes to keeping money safe. Banks provide a percentage of interest on the deposited money to the people which boosts their demands as well.

(5) Banks encourage entrepreneurs, native craftsmen and industrialists to work, produce and develop without worrying about capital or credit which in turn helps to make country economically sound. Banks help to distribute money allotted by various government schemes to beneficiaries in the remotest areas of the country.

Question. Review any three merits and any two demerits of ‘formal sector of credit’ in India.

Ans. Merits :

(1) Formal sector of credit helps to meet the working capital needs of production.

(2) It also helps in completing production on time.

(3) It offers loans at low rates of interest.

(4) It helps in increasing earnings by making more investment.

(5) It helps in meeting on going expenses of production activities.

Demerits:

(1) The formal sector of credit lacks credibility in rural areas.

(2) People face difficulty in obtaining loans.

(3) People don’t always have collateral or required documents.

Question. What are the differences between formal and informal sources of credit? Mention five points.

Ans. The difference between formal and informal sources of credit is as follows:

Question. Describe the vital and positive role of credit with examples.

Ans. Credit plays a crucial role in a country’s development. By sanctioning loans to developing industries and trade, banks provide them with the necessary aid for improvement. This leads to increase in the production, profits and employment. However, caution must be exercised in the case of loans from the informal sector, which includes high interest rates that may be more harmful than good. For this reason, it is important that the formal sector gives out more loans so that borrowers are not duped by moneylenders, and can ultimately contribute to national development. For example: A loan given to a fresh post-graduate for setting up a business might contribute to employment generation and infrastructure development in the near future.

Question. ‘Poor households are still dependent on informal sources of credit.’ Why is it so? Give reasons.

Ans. Poor households are still dependent on informal sources of credit due to the following reasons:

(1) Banks are not present everywhere in rural India. Even when they are present, getting a loan from a bank is much more difficult than taking a loan from informal sources.

(2) Bank loans require proper documents and collateral which poor people in rural India cannot produce to the bank.

(3) Informal lenders such as moneylenders know the borrowers personally and hence are often willing to give a loan without collateral.

(4) The borrowers can approach the moneylenders even without repaying their previous loans.

(5) Banks do not sanction any loan to the borrowers if they have not cleared the previous loans.

Question. Describe any five informal sources of loans in India.

Ans. The informal sources of loan in India are:

(1) Moneylenders – They charge a high rate of interest, because of which many borrowers fall into a debt trap.

(2) Employers – Many people prefer taking loans from their boss or employer who cuts a fixed amount from their salary on monthly basis as repayment.

(3) Informal institutions – They give loans easily but are not authorised by the government. They charge a high rate of interest.

(4) Family and friends – They give loans easily but if a person is unable to repay then it causes distress in the relation.

(5) Big landlords – They charge a high rate of interest and also force small farmers who take loans from them to sell their produce at low prices to them, as they gave money to them when they needed.

Question. Why is it necessary that banks and cooperatives increase their lending in rural areas? Explain.

Ans. Banks and cooperatives should increase their lending in rural areas because:

(1) India largely depends on agriculture for export revenues. Farmers and agricultural workers in rural areas deserve special attention as they lack capital and resources to invest in their work.

(2) Most of the people in rural areas are illiterate and informal money lenders exploit and cheat them for their benefit. People need a reliable source for credit.

(3) Most loans from informal lenders carry a very high interest rate and do little to increase the income of the borrowers.

(4) Banks and co-operative societies provide loans to the rural households at cheap rates and are backed by the government, which helps them boost their income. Incentives are also given to farmers for quick repayment.

(5) Most of the people in urban areas depend upon the rural people for their food and raw material requirements. For better production and to boost their income sources, easy credit is required.

(6) High rate of interest and repayment of such high amount to informal sources, make farmers fall in a debt trap. Formal sources are monitored and backed by the government. Help is given to them readily in dire times.