Please refer to the Chapter 6 Trial Balance and Rectification of Errorsg Important Questions with answers provided below. We have provided Important Questions for Class 11 Accountancy for all chapters as per CBSE, NCERT and KVS examination guidelines. These case based questions are expected to come in your exams this year. Please practise these Important based Class 11 Accountancy Questions and answers to get more marks in examinations.

Important Questions Chapter 6 Trial Balance and Rectification of Errors

Short Answer Type Questions :

Question. What will be the effect of the following on trial balance?

(i) Rent received ₹ 2,000 entered in cash book but not posted to rent account.

(ii) Purchase return of ₹ 20,000 has been wrongly posted to the debit side of sales return account but correctly entered in the customers account.

(iii) Discount received ₹ 1,000 entered in cash book but not posted to discount received account.

Ans. (i) Debit side of trial balance will exceed by ₹ 2,000.

(ii) Debit side of trial balance will increase by ₹ 20,000.

(iii) Debit column of trial balance will increase by ₹ 1,000.

Question. Mention the rules that are taken into consideration while preparing trial balance.

Ans. Following rules should be taken into care

(i) The balances of all assets accounts, expenses and losses accounts, drawings, cash and bank balances, purchases and sales return are placed in debit column of the trial balance.

(ii) The balances of all liabilities accounts, income and profit accounts, capital, sales, purchases return are shown in credit column of trial balance.

(iii) Normally, closing stock does not appear in the trial balance. It is usually given outside the trial balance as an adjustment. In case, it appears in the trial balance, it means that it has already been adjusted through purchases.

(iv) The amount due from all debtors is shown collectively under the head ‘Sundry Debtors’.

(v) The amount due to all creditors is shown collectively under the head ‘Sundry Creditors’.

Question. State any four functions of a trial balance.

Or

Describe the purpose for the preparation of a trial balance.

Or

What are the objectives or functions or importance of a trial balance?

Ans. The objectives, functions or purpose of a trial balance are

(i) Ascertain the Arithmetical Accuracy of the Ledger Accounts The trial balance ensures the arithmetical accuracy of the ledger accounts.

When the debit and credit balances in the trial balance are equal, it is assumed that the posting to the ledger accounts is arithmetically correct i.e., all debits and corresponding credits have been properly recorded in the ledger.

(ii) Helps in Locating Errors A trial balance helps in the detection or location of errors. However, all the errors are not disclosed, but only arithmetical errors are disclosed.

(iii) Summary of the Ledger Accounts Trial balance offers a summary of the ledger. It enables us to know the assets, liabilities, expenses, incomes, etc.

(iv) Helps in the Preparation of Final Accounts Trial balance is considered as the connecting link between accounting records and the preparation of financial statements. As trial balance is a list of summary of all ledger accounts, it provides a basis for preparation of final accounts (trading and profit and loss account and balance sheet).

Question. From the ledger balances, prepare trial balance.

Ans.

Question. Ramesh’s CA extracted the following trial balance as on 31st March, 2020

State the errors committed in the above trial balance along with reasons.

Ans. (i) Furniture and machinery are assets, therefore their balances should appear in debit columns.

(ii) Goodwill is also an asset. Thus, it’s balance should be shown in debit column.

(iii) Creditors are liability for the firm. Thus, they should be shown under credit column.

Question. Give journal entries to rectify the following.

(i) A purchase of goods from Varun amounting to ₹ 300 has been wrongly entered through the sales book.

(ii) On 31st December, goods of the value of ₹ 600 were returned by X and were taken into stock on the same date but no entry was passed in the books.

(iii) An amount of ₹ 400 due from Y which had been written-off as a bad debt in a previous year, was unexpectedly recovered and had been posted to the personal account of Y.

(iv) A cheque for ₹ 200 received from Z was dishonoured and had been posted to the debit of sales return account.

Ans.

Question. Rectify the following errors.

(i) Credit sales to Mohan ₹ 7,000 were recorded as ₹ 700.

(ii) Credit purchases from Rohan ₹ 9,000 were recorded as ₹ 900.

(iii) Goods returned to Rakesh ₹ 4,000 were recorded as ₹ 400.

Ans.

Question. Rectify the following errors.

(i) Credit purchases from Rohan ₹ 9,000 were recorded in sales book.

(ii) Goods returned to Rakesh ₹ 4,000 were recorded in the sales return book.

(iii) Good returned from Mahesh ₹1,000 were recorded in purchases return book.

(iv) Goods returned from Mahesh ₹ 2,000 were recorded in purchases book.

Ans.

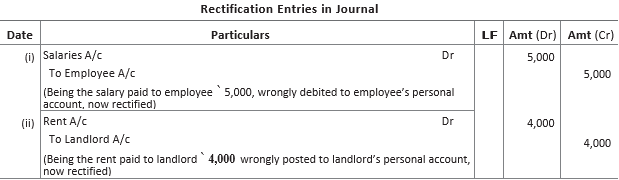

Question. Rectify the following errors.

(i) Salary paid ₹ 5,000 was debited to employee’s personal account.

(ii) Rent paid ₹ 4,000 was posted to landlord’s personal account.

(iii) Goods withdrawn by proprietor for personal use ₹1,000 were debited to sundry expenses account.

(iv) Cash received from Kohli ₹ 2,000 was posted to Kapur’s account.

Ans.

Question. State whether the balance of the following accounts should be placed in the debit or the credit columns of the trial balance.

(i) Plant and machinery

(ii) Discount allowed

(iii) Bank overdraft

(iv) Sales

(v) Interest paid

(vi) Bad debts

Ans. (i) Debit Plant and machinery is an asset which has a debit balance. Therefore, it will be shown in debit column of trial balance.

(ii) Debit Discount allowed is an expense which has a debit balance. Therefore, it will be shown in debit column of trial balance.

(iii) Credit Bank overdraft is a liability which has a credit balance. Therefore, it will be shown in credit column of trial balance.

(iv) Credit Sales account always has a credit balance which is shown in the credit column of trial balance.

(v) Debit Interest paid always has a debit balance which is shown in the debit column of trial balance.

(vi) Debit Bad debts is a loss which has a debit balance. Therefore, it will be shown in debit column of trial balance.

Question. Prepare the trial balance with following information.

Ans.

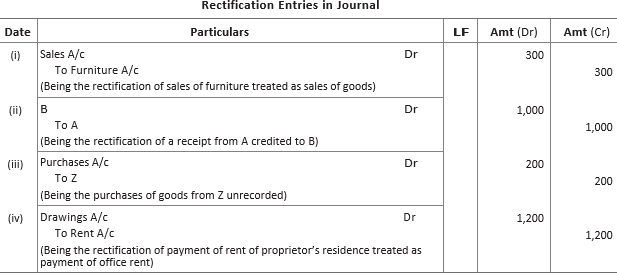

Question. The following errors, affecting the account for the year 2020 were detected in the books of Raj Brothers, Meerut.

(i) Sale of old furniture ₹ 300 treated as sale of goods.

(ii) Receipt of ₹1,000 from A credited to B.

(iii) Goods worth ₹ 200 bought from Z have remained unrecorded so far.

(iv) Rent of proprietor, ₹ 1,200 debited to rent account.

Ans.

Question. Rectify the following errors.

(i) Cash received from Karim ₹ 6,000 posted to Nadeem.

(ii) Cash sales to Radhika ₹ 15,000 was shown as receipt of commission in the cash book.

(iii) Furniture purchased from M/s Rao, for ₹ 8,000 was entered into the purchases book.

Ans.

Question. The following trial balance has been prepared by an unexperienced accountant. Redraft it in a correct form.

Ans.

Question. State whether the balances of the following accounts should be placed in debit or credit column of trial balance and also state the reasons

Bank overdraft Commission received

Motor cycle Rates, taxes and insurance

Salaries Repairing charges

Ans. Bank overdraft and commission received will be shown under credit column of trial balance as they are liability and income respectively.

Motor cycle, rates, taxes and insurance, salaries and repairing charges will be shown under debit column of trial balance as motor cycle is an asset and rest of them are expenses.

Question. Prepare a correct trial balance from the following trial balance in which there are certain mistakes.

Ans. Errors in trial balance which are identified above are as follows

(i) Closing stock will appear in debit column of trial balance.

(ii) Since, cost of goods sold is given, opening stock will not be taken as it is already included in cost of goods sold.

(iii) Debtors and expenses will come in debit column of trial balance.

(iv) Capital will appear in credit column of trial balance as it is a liability for business.

Note Cost of Goods Sold = Opening Stock + Purchase + Direct Expenses − Closing Stock

Question. Rectify the following errors.

(i) A credit purchases of ₹ 3,120 from Vihan was passed in the books as ₹ 4,200.

(ii) Goods (cost ₹ 2,500 sales price ₹ 3,000) distributed as free samples among prospective customers were not recorded.

(iii) Wages paid to the firm’s workmen for making additions to machinery amounting to ₹1,050 were debited to the wages account.

Ans.

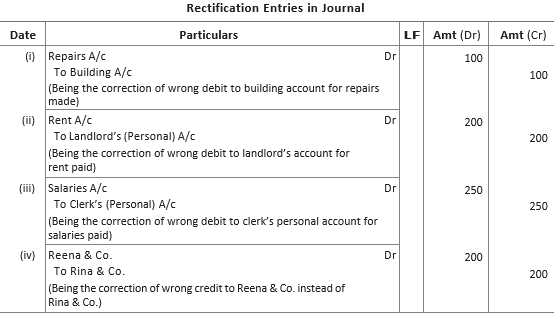

Question. The following errors were found in the books of Rajan & Sons. Give the necessary entries to correct them.

(i) Repairs made were debited to building account ₹ 100.

(ii) ₹ 200 paid for rent, debited to landlord’s account.

(iii) Salary ₹ 250 paid to a clerk due to him has been debited to his personal account.

(iv) ₹ 200 received from Rina & Co. has been wrongly entered as from Reena & Co.

Ans.

Question. Write a short note on error of omission.

Ans. Errors of Omission This kind of error arises when a transaction is partially or completely omitted (left out) to be recorded in the books of accounts. These can be of two types

(i) Error of Complete Omission When a transaction is completely omitted from being recorded in the books of original record, it is an error of complete omission. This error does not affect the trial balance.

(ii) Error of Partial Omission When a transaction is partially omitted from being recorded in the books, it is an error of partial omission. This error affects the trial balance.

Question. Write a note on balance method for preparing trial balance.

Ans. Balance method is the most commonly used method for preparing trial balance. Under this method, the balance of all the accounts (including cash and bank accounts) are incorporated in the trial balance. The debit and credit columns of the trial balance are totalled and they must be equal.

This method can be used to prepare trial balance only when all the ledger accounts have been balanced. The account balances are used because the balance summarises the net effect of all transactions relating to an account and helps in the preparation of financial statements.

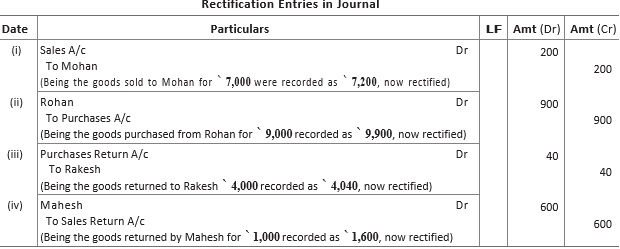

Question. Rectify the following errors.

(i) Credit sales to Mohan ₹ 7,000 were recorded as ₹ 7,200.

(ii) Credit purchase from Rohan ₹ 9,000 were recorded as ₹ 9,900.

(iii) Goods returned to Rakesh ₹ 4,000 were recorded as ₹ 4,040.

(iv) Goods returned from Mahesh ₹ 1,000 were recorded as ₹ 1,600.

Ans.

Question. State the limitations of trial balance.

Ans. (i) Trial balance only confirm that the total of all debit balances matches the total of all credit balances.

(ii) A trial balance gives only condensed information of each account.

(iii) Trial balance total may agree inspite of errors. There are certain errors which are not disclosed by a trial balance.

Question. Rectify the following errors.

(i) Depreciation provided on machinery ₹ 4,000 was not recorded.

(ii) Bad debts written-off ₹ 5,000 were not recorded.

(iii) Discount allowed to a debtor ₹100 on receiving cash from him was not recorded.

(iv) Bills receivable for ₹ 2,000 received from a debtor was not recorded.

Ans.

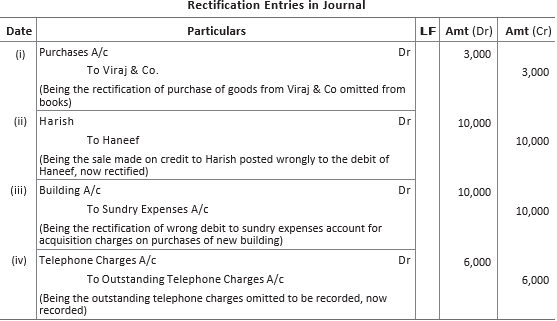

Question. Pass journal entries to rectify the following errors.

(i) Credit purchase of goods of ₹ 3,000 from Viraj & Co. was not recorded in the books although the goods were taken into stock.

(ii) Credit sale of goods to Harish amounting to ₹ 10,000 was posted to the account of Haneef.

(iii) Acquisition charges on the purchase of a new building amounting to ₹10,000 were debited to the sundry expenses account.

(iv) Outstanding telephone charges of ₹ 6,000 had been completely omitted.

Ans.

Question. What is a suspense account? Is it necessary that a suspense account will balance off after rectification of the errors detected by the accountant? If not, then what happens to the balance still remaining in suspense account?

Ans. Suspense account is an account which is opened on a temporary basis to balance the trial balance. No, it is not necessary that a suspense account will balance after rectification of errors detected by the accountant. Suspense account can remain unbalanced if all the errors are not detected. Balance remaining in the suspense account is transferred to the balance sheet on the assets side, if there is a debit balance or to the liabilities side if there is a credit balance.

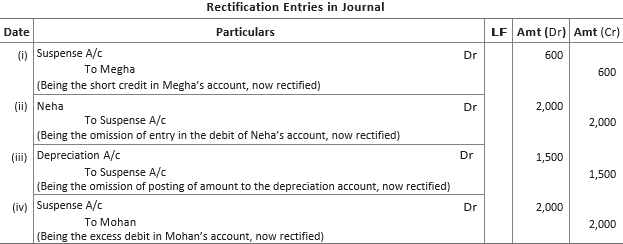

Question. Rectify the following errors.

(i) Sales return from Megha ₹ 1,600 was posted to her account as ₹ 1,000.

(ii) Cash paid to Neha ₹ 2,000 was not posted to her account.

(iii) Depreciation written-off on furniture ₹ 1,500 was not posted to depreciation account.

(iv) Credit sales to Mohan ₹ 10,000 were posted to his account as ₹ 12,000.

Ans.

Question. Describe in brief about errors of commission.

Ans. When a transaction is recorded wrongly in the books of accounts, it is called error of commission. Errors of commission can be classified into the following

(i) Error of Recording This error arises when any transaction is incorrectly recorded in the books of original entry. This error will not affect the trial balance.

(ii) Error of Casting This error arises when a mistake is committed in totalling. This error affects the trial balance.

(iii) Error of Carrying Forward It is an error which arises when a mistake is committed in carrying forward a total of one page to the next page. This error affects the trial balance.

(iv) Error of Posting When the information recorded in the books of original entry are incorrectly entered in the ledger, it is an error of posting.

Question. Rectify the following errors and use suspense account where necessary.

(i) ₹ 2,500 paid for office furniture was debited to office expenses account.

(ii) A cash sale of ₹ 7,500 to Saksham was correctly entered in the cash book but was posted to the credit of Saksham’s account.

(iii) Goods amounting to ₹ 1,800, returned by Aryan, were entered in the sales book and posted therefrom to the credit of Aryan’s account.

(iv) Bills receivable received from Sangeet for ₹ 5,000 was posted to the credit of bills payable account and credited to Sangeet’s account.

Ans.

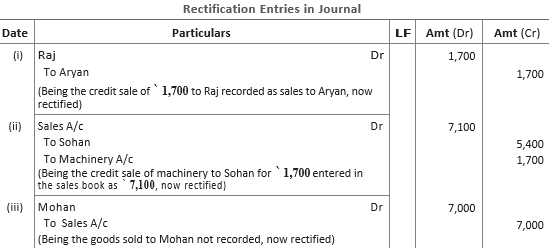

Question. Pass the necessary journal entries to rectify the following errors.

(i) Credit sale of ₹ 1,700 to Raj was recorded as sales to Aryan.

(ii) Credit sale of old machinery to Sohan for ₹ 1,700 was entered in the sales book for ₹ 7,100.

(iii) Credit sales to Mohan ₹ 7,000 were not recorded.

Ans.

Long Answer Type Questions :

Question. Rectify the following errors assuming that suspense account was opened to ascertain the difference in trial balance.

(i) Depreciation provided on machinery ₹ 6,250 was not posted to depreciation account.

(ii) Bad debts written-off ₹ 5,890 were not posted to debtor’s account.

(iii) Discount allowed to a debtor ₹ 175 on receiving cash from him was not posted to discount allowed account.

(iv) Goods withdrawn by proprietor for personal use ₹ 2,520 were not posted to drawings account.

(v) Bills receivable for ₹ 10,000 received from a debtor was not posted to bills receivable account.

Ans.

Question. What kinds of errors would cause difference in the trial balance? Also give an example that would not be revealed by a trial balance.

Ans. The errors that lead to the differences in the trial balance are termed as one sided errors. These are those errors that affect only one account. Below are given the errors that cause differences in the trial balance

(i) Wrong casting of any account, this is termed as the error of casting.

(ii) Wrong carrying forward of the balances from previous year’s books or from one end of page to another. These types of errors are termed as the errors in carrying forward.

(iii) If entries are posted in the wrong side of accounts.

(iv) Posting of a wrong amount in account, this is termed as the error of posting.

(v) If entries are recorded partially, i.e., the entries are not recorded completely, then due to the error of partial omission, trial balance does not agree.

Example of error that would not be revealed in a trial balance

Sales to Mr X, omitted to be recorded in the sales day book.

Question. Following is the trial balance of Anuj Jindal as on 31st March, 2020.

Having prepared trial balance, it was discovered that following transactions remained unrecorded.

(i) Goods were sold on credit amounting to ₹ 80,000 (ii) Paid to creditors ₹ 44,000 by cheque

(iii) Goods worth ₹ 14,000 were returned to the supplier (iv) Paid salary ₹ 30,000 by cheque You are required to pass journal entries for the above mentioned transactions. Also, redraft the trial balance.

Ans.

Working Notes

1. Debtors = 4,80,000 + 80,000 = ₹ 5,60,000

2. Creditors = 3,60,000 − 44,000 − 14,000 = ₹ 3,02,000

3. Sales = 21,00,000 + 80,000 = ₹ 21,80,000

4. Bank balance = 90,000 − 44,000 − 30,000 = ₹ 16,000

5. Salaries = 3,30,000 + 30,000 = ₹ 3,60,000

Question. Rectify the following errors assuming that suspense account was opened.

(i) Purchase of ₹ 4,000 from Bheem was entered in sales book. Although Bheem’s personal account was rightly credited.

(ii) Sales to Nakul of ₹ 4,300 credited to his account as ₹ 3,400.

(iii) Sale of old furniture of ₹ 5,400 was credited to sales account as ₹ 4,500.

(iv) Goods worth ₹ 1,000 taken by proprietor for personal use was omitted from being recorded.

(v) Sale to Arjun worth ₹ 2,960 was entered in sales book as ₹ 2,690.

(vi) Sales return book balance of ₹ 2,100 was not included in books.

Ans.

Question. You are presented with a trial balance showing a difference which has been carried to suspense account and the following errors are revealed.

(i) ₹ 17,000 paid in cash for a typewriter was charged to office expenses account.

(ii) A cash sale of ₹ 50,000 to Pluto, correctly entered in the cash book, was posted to the credit of Pluto’s account in the sales ledger.

(iii) Goods amounting to ₹ 8,000, returned by Sky, were entered in the sales book and posted therefrom to the credit of Sky’s account.

(iv) Bills receivable fromStar for ₹ 30,000 posted to the credit of bills payable account and credited to Star’s account.

(v) Goods amounting to ₹ 1,00,000 sold to Sun were correctly entered in sales book but posted to Sun’s account for ₹ 1,80,000.

(vi) Sales returns book was overcast by ₹ 1,000.

Journalise the necessary corrections.

Ans.

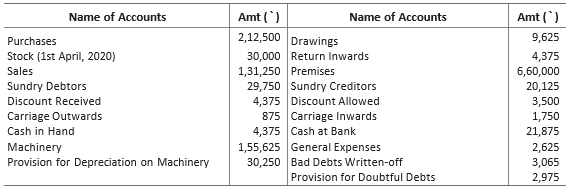

Question. Following balances were extracted from the books of Shri A Jadeja on 31st March, 2021. You are required to prepare a trial balance. The amount required to balance the trial balance should be entered as capital.

Ans.

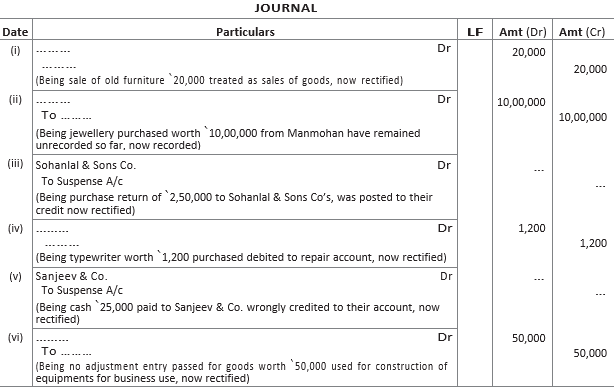

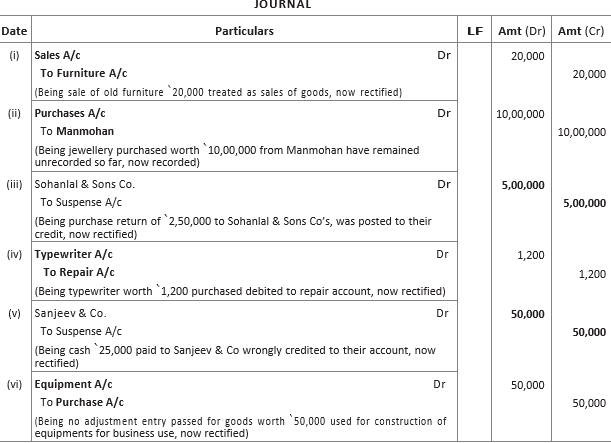

Question. From the following information, complete the missing rectification entries.

Ans.

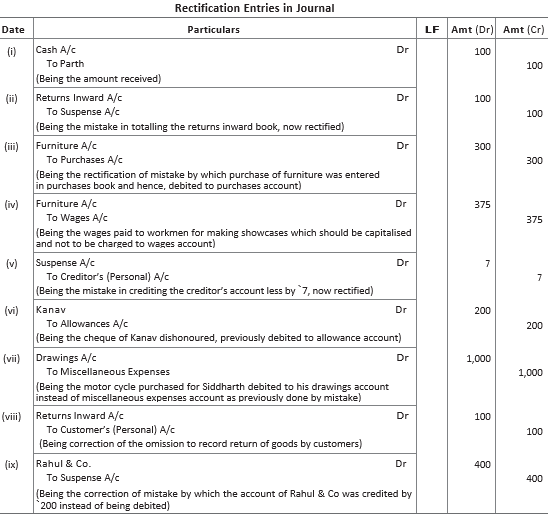

Question. Correct the following errors found in the books of Siddharth. The trial balance was out by ₹ 493 excess credit. The difference thus, has been posted to a suspense account.

(i) An amount of ₹ 100 was received from Parth on 31st December, 2020 but has been omitted to enter in the cash book.

(ii) The total of returns inward book for December has been cast ₹ 100 short.

(iii) The purchase of an office table costing ₹ 300 has been passed through the purchases day book.

(iv) ₹ 375 paid for wages to workmen for making show-cases had been charged to wages account.

(v) A purchase of ₹ 67 had been posted to the creditors account as ₹ 60.

(vi) A cheque for ₹ 200 received from Kanav had been dishonoured and was passed to the debit of ‘allowances account’.

(vii) ₹ 1,000 paid for the purchase of a motor cycle for Siddharth had been charged to ‘miscellaneous expenses account’.

(viii) Goods amounting to ₹ 100 had been returned by customer and were taken into stock, but no entry in respect there of, was made into the books.

(ix) A sale of ₹ 200 to Rahul & Co. was wrongly credited to their account.

Ans.

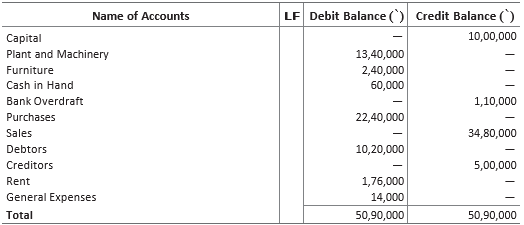

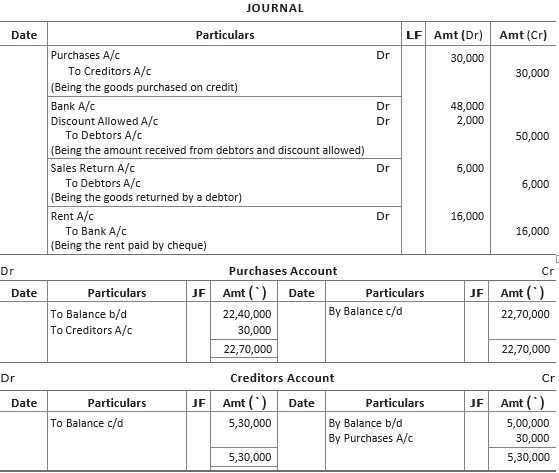

Question. Following is the trial balance of Sudhir Chaudhary as on 31st March, 2021.

Following transactions were entered into but were not recorded in the books of accounts

(i) Goods worth ₹ 30,000 were purchased on credit.

(ii) Received a cheque of ₹ 48,000 from a debtor in full settlement of his account of ₹ 50,000.

(iii) Goods amounting to ₹ 6,000 were returned by a customer.

(iv) Paid rent for the month ₹ 16,000 by cheque.

You are required to pass journal entries for the above mentioned transactions and post them into the ledger. Also, redraft the trial balance.

Ans.

Question. In taking out a trial balance, a book-keeper finds that debit total exceeds the credit total by ₹ 7,040. The amount is placed to the credit of a newly opened suspense account. Subsequently, the following mistakes were discovered. You are required to pass the necessary entries for rectifying the mistakes and show the suspense account.

(i) Sales day book was overcast by ₹ 2,000.

(ii) A sale of ₹ 1,000 to Gokul Prasad was wrongly debited to Kanti Prasad.

(iii) General expenses ₹ 360 was posted as ₹ 1,600.

(iv) Cash received from Shanti Prasad was debited to his account ₹ 3,000.

(v) While carrying forward the total of one page of the purchase book to the next, the amount of ₹ 24,700 was entered as ₹ 26,500.

Ans.