Students can read the Case Study questions given below for Accounting For Not For Profit Organisation Class 12 Accountancy. All Accounting For Not For Profit Organisation Class 12 Notes and questions with solutions have been prepared based on the latest syllabus and examination guidelines issued by CBSE, NCERT and KVS. You should read all Case Study Questions provided by us and the Class 12 Accountancy Case Study Questions provided for all chapters to get better marks in examinations.

Case Study Questions of Accounting For Not For Profit Organisation Class 12

There are certain organisations which are set up for providing services to its members and the public in general. Such organisations are called Not for Profit Organisation. Eg: Clubs, charitable institutions, schools, welfare societies etc.

ACCOUNTING RECORDS OF NOT-FOR-PROFIT ORGANISATION

1. Receipt & Payment Account 2. Income & Expenditure Account 3. Balance sheet

Receipt and Payment Account: The Receipt and Payment account is a real A/c which is prepared at the end of an accounting year giving a summary of all cash receipts and payments {either Capital or Revenues/ Previous, Current or Next Year}.

Income and Expenditure Account: It is the summary of income and expenditure for the accounting year. It is just like a profit and loss account {Nominal A/c} prepared on accrual basis in case of the business organisations. It includes only revenue items of current year only and the balance at the end represents surplus or deficit.

Treatment of some peculiar items:

1. Subscription – Current year subscription is to be calculated and it is shown on the credit side of Income and Expenditure Account. Whereas, subscription received for some specific purpose like subscription for tournament fund, subscription for construction of a building etc. should be capitalized and hence shown on the liability side of the Balance Sheet.

2. Donation a. Specific donation – Donation for building, donation for library etc. must be treated as capital receipt and shown on the liability side of balance sheet. b. General donation can be shown on the credit side of Income and Expenditure A/c.

3. Grant received from central govt., state govt. or local bodies for day to day expense are treated as income. But grant for specific purpose like construction of a building is to be capitalized.

4. Legacies: It is the amount received as per the will of a deceased person who may or may not specify the use of the amount. Legacies, use of which is specified are specific legacy and is shown in the balance sheet as liability. If the use is not specified it is considered as revenue nature and credited to income and expenditure account.

5. Honorarium — It is the amount paid to the person who is not a regular employee of the institution. This is shown on the expenditure side of the income and expenditure account.

5. Endowment fund – Fund meant for providing permanent means of support. It is a capital receipt.

6. Entrance Fee/Admission Fee – It is the amount of fees collected on the admission of members. In the absence of specific information, it is preferably be revenue item.

7.Life membership fee – It is a lump sum amount received from certain members towards life membership instead of annual subscription. It should be capitalised as it is a capital receipt.

8.Special purpose fund – E.g. Tournament fund, Charity fund, Prize fund, Endowment fund etc. If there is any expense orincome relating to that fund it will be added back or will be deducted from that fund only in the Liabilities side of Balance sheet

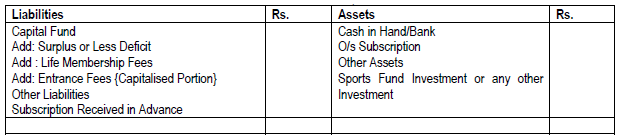

Balance Sheet

as at 31st March, 2020

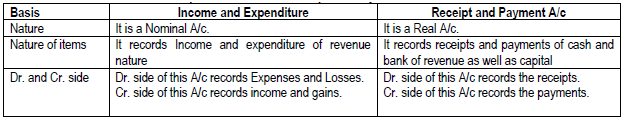

Difference between Income and Expenditure A/c and Receipt and Payment A/c

Calculation of Expense (Eg. Stationery Consumed) during the year:

*Amount of Stationery to be debited to Income and Expenditure A/c

Note: Stock of stationery is an asset, closing stock of stationery is shown on the asset side of the closing Balance Sheet.

Calculation of Subscription to be shown in Income and Expenditure A/c

1. If Sub. O/s at the end as on is given it means it includes current year as well as previous year pending amount.

2. If Subscription O/s at the end for the year ending it means it is only current year’s pending amount.

Format of Receipts and Payments A/c

Format of Income and Expenditure A/c

Format of Balance Sheet

as at 31st March, 2020