Please refer to the Chapter 8 Bill of Exchange Important Questions with answers provided below. We have provided Important Questions for Class 11 Accountancy for all chapters as per CBSE, NCERT and KVS examination guidelines. These case based questions are expected to come in your exams this year. Please practise these Important based Class 11 Accountancy Questions and answers to get more marks in examinations.

Important Questions Chapter 8 Bill of Exchange

Short Answer Type Questions :

Question. Bills of exchange must contain ‘an unconditional promise to pay’. Do you agree with the statement?

Ans. No, I do not agree with this statement. According to Section 5 of the Negotiable Instrument Act, 1881, “Bills of exchange is an instrument in writing containing an unconditional order, signed by the maker directing a certain person to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument”. Therefore, bills of exchange is an order by the drawer (creditor) to the drawee (debtor) without any condition. Hence, the bills of exchange does not contain an unconditional promise to pay rather it contains an unconditional order to pay.

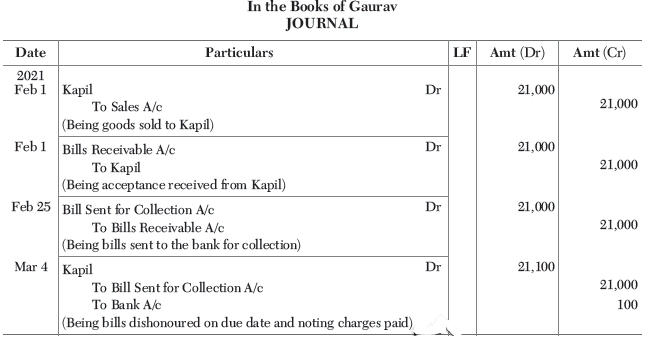

Question. Kapil purchased goods for ₹ 21,000 from Gaurav on 1st February, 2021 and accepted the bills of exchange drawn by Gaurav for the same amount. The bill was payable after a month. On 25th February, 2021, Gaurav sent the bill to his bank for collection. The bill was duly presented by the bank. Kapil dishonoured the bill and the bank paid ₹ 100 as noting charges. Record the necessary journal entries for the above transactions in the books of Gaurav.

Ans.

Question. Define bills of exchange and briefly explain parties to a bills of exchange.

Ans. According to Indian Negotiable Instrument Act, 1881, “A bills of exchange is an instrument in writing, an unconditional order signed by the maker directing to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument”. Parties to bills of exchange are as follows

(i) Drawer He is a person who sold goods on credit to someone. He writes or draws the bill.

(ii) Drawee He is the debtor who purchases the goods on credit and accepts bill. He is liable to pay the amount mentioned in the bill.

(iii) Payee The person to whom the payment is to be made is called payee. The drawee himself or any other person may be the payee of the bill.

Question. On 1st January, 2021, Khushi drew a bill on Sarthak for ₹ 1,00,000 payable after 3 months. Sarthak accepted the bill and returned it to Khushi. After 10 days, Khushi endorsed the bill to her creditor, Smita. On the due date, the bill was dishonoured and Smita paid ₹ 2,000 as noting charges.

Record the transactions in the journal of Sarthak and Smita.

Ans.

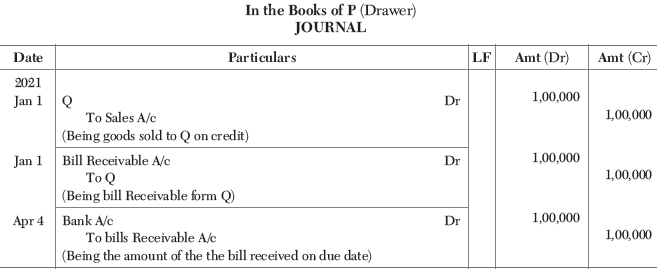

Question. On 1st January, 2021, P sold goods to Q for ₹ 1,00,000. On the same date P draws a bill on Q for ₹ 1,00,000 due after three months. Q accepted the bill and returned it to P. P retained the bill till the due date and Q meets the bill on due date. Pass journal entries in the books of both the parties.

Ans.

Question. State any four essential features of bills of exchange.

Ans. The essential features of bills of exchange are (any four)

(i) It must be in writing.

(ii) It is an order to make payment.

(iii) The order to make payment is unconditional.

(iv) The maker of the bills of exchange must sign it.

(v) The payment to be made must be certain.

(vi) The date on which payment is to be made must also be certain.

(vii) It must be payable to a certain person.

(viii) It must be stamped as per the requirement of law.

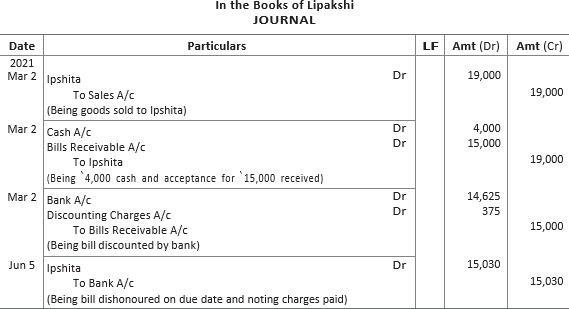

Question. Lipakshi sold goods worth ₹ 19,000 to Ipshita on 2nd March, 2021. ₹ 4,000 were paid by Ipshita immediately and for the balance, she accepted a bills of exchange drawn upon her by Lipakshi payable after 3 months. Lipakshi discounted the bill immediately with her bank @10% p.a. On the due date, Ipshita dishonoured the bill and the bank paid ₹ 30 as noting charges.

Record the necessary journal entries in the books of Lipakshi.

Ans.

Question. On 1st January, 2020, Rao sold goods worth ₹ 20,000 to Reddy. Half of the payment was made immediately and for the remaining half, Rao drew a bill of exchange upon Reddy payable after 30 days. Reddy accepted the bill and returned it to Rao. On the due date, Rao presented the bill to Reddy and received the payment. Journalise the above transactions in the books of Rao and prepare Rao’s account in the books of Reddy.

Ans.

Long Answer Type Questions :

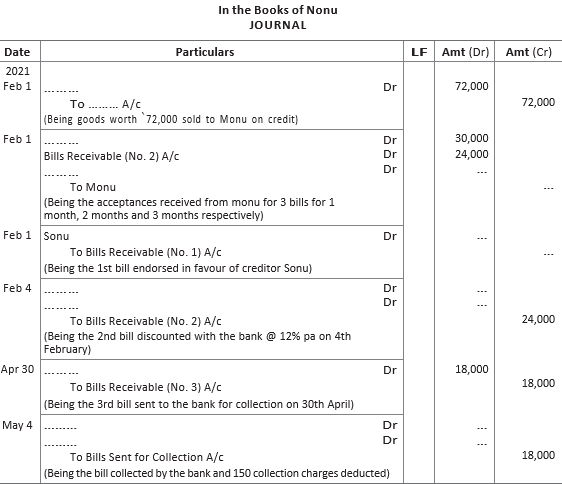

Question. From the following information, complete the following journal entries.

Ans.

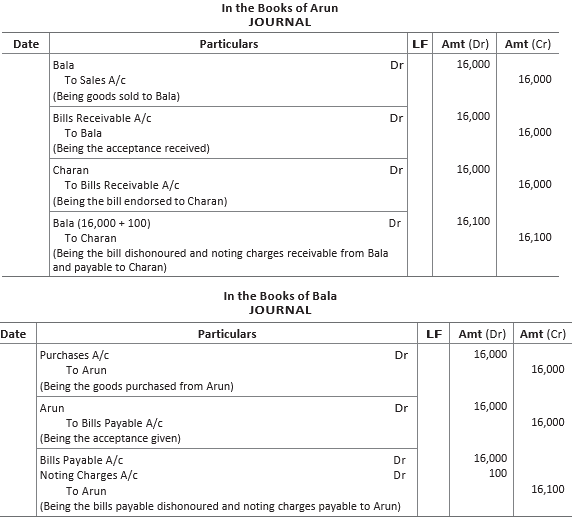

Question. Arun sold goods to Bala for ₹ 16,000 and drew a bill on Bala for three months who duly accepted the same. Arun endorsed the bill to Charan. Charan endorsed it to his creditor Dharam. Dharam discounted the bill at 15% per annum. On the date of maturity, the bill was dishonoured and bank paid noting charges amounting ₹ 100.

Show the necessary journal entries in the books of all the parties.

Ans.

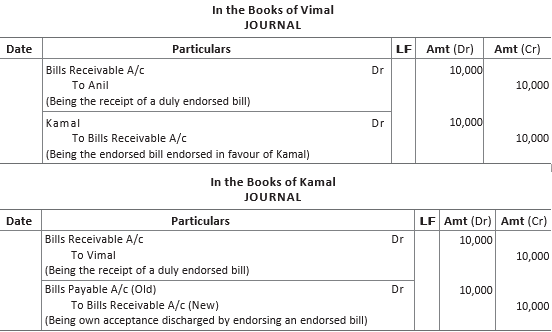

Question. Anil drew a 3 months bill for ₹ 10,000 upon Sunil. The bill was endorsed in favour of Vimal who endorsed it in favour of Kamal who in turn endorsed it in favour of Anil to discharge his own acceptance. Prepare journal in the books of Anil, Sunil, Vimal and Kamal.

Ans.

Note Since the question is silent with regard to payment of bill on maturity, therefore no journal entries are passed to that effect.

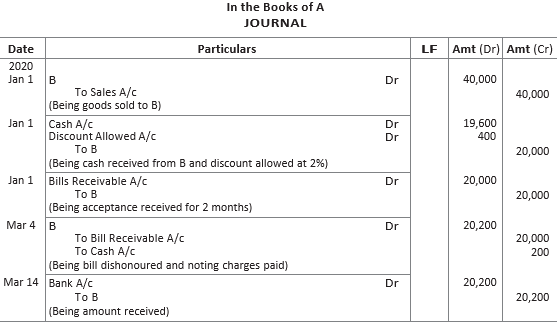

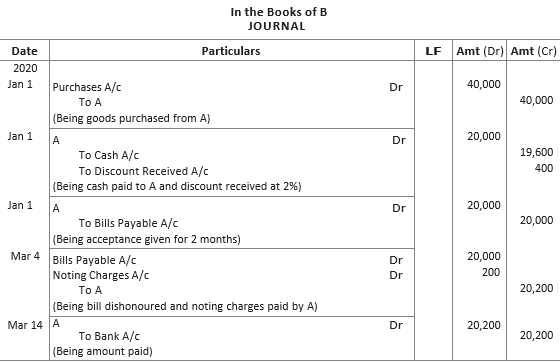

Question. On 1st January, 2020, A sold goods to B for ₹ 40,000 less 2% cash discount. B paid 50% price immediately and A drew a bill on B for two months for the balance. This bill is duly accepted by B.

The bill was dishonoured on the due date and A paid ₹ 200 as noting charges. B paid the amount due to A by cheque after ten days. Pass entries in the books of both the parties.

Ans.

Question. On 1st July, 2021, Ashu draws on Vishu who owed him ₹ 25,000, two bills, one for ₹ 15,000 for three months and another for ₹ 10,000 for two months. Vishu accepts these bills. Ashu endorses on 3rd July the first bill to his creditor Krish in full settlement of his account of ₹ 15,500 and discounts the second bill on 4th July with his banker @ 12% per annum. The first bill is duly paid at maturity but the second bill is dishonoured and ₹ 150 are paid as noting charges. On 15th September, Vishu paid due amount to Ashu.

Give journal entries to record these transactions in the books of Ashu and Vishu.

Ans.

Question. Distinguish between bills of exchange and a promissory note.

Ans. The differences between bills of exchange and promissory note are as follows

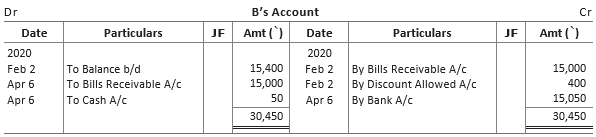

Question. On 2nd February, 2020, A purchased from B goods for ₹ 17,500. A paid ₹ 2,500 immediately and for the balance gave a promissory note to B, payable after 60 days. B endorsed the promissory note in favour of his creditor C for the full settlement of a debt of ₹ 15,400. On the due date of the bill, C presented the bill to A, which the latter dishonoured and C paid ₹ 50 as noting charges. On the same date, C informed B about the dishonour of the bill and B immediately settled his debt to C by cheque for ₹ 15,050

which includes noting charges. A settled B’s claim by cheque for the same amount. Record the necessary journal entries in the books of B, C and A for the above transactions and prepare A’s and C’s accounts, in the books of B, B’s account in the books of A and also B’s account in the books of C.

Ans.

Question. On 1st February, 2020, John purchased goods for ₹ 25,000 from Jimmi. He immediately made a payment of ₹ 5,000 by cheque and for the balance accepted the bill of exchange drawn upon him by Jimmi. The bill of exchange was payable after 40 days.

Five days before the maturity of the bill, Jimmi sent the same to his bank for collection. The bank duly presented the bill to John on the due date who met the bill. The bank informed the same to Jimmi.

Pass necessary journal entries in the books of John and Jimmi and prepare John’s account in the books of Jimmi and Jimmi’s account in the books of John.

Ans.

Question. Explain briefly the procedure of calculating the date of maturity of bills of exchange. Give example.

Ans. In arriving at the maturity date (i.e. the date on which bills of exchange or promissory note becomes due for payment) 3 days, known as days of grace must be added to the date on which the period of credit expires. However, when the date of maturity is a public holiday, the maturity date will be the preceding business day. Also when an emergency holiday is declared under the Negotiable Instruments Act, 1881, which happens to be the date of maturity of bills of exchange, then the date of maturity will be the next working day immediately after the holiday.

For example,

Date of the Bill Period

(i) 1st January, 2021 2 months

(ii) 23rd November, 2021 2 months

(iii) 23rd May, 2021 60 days

Emergency Holiday – 25th July, 2021

(i) The due date will be — 1st March, 2021 + 3 days of grace = 4th March, 2021

(ii) The due date will be — 23rd January + 3 days of grace = 26th January.

Since, due date is falling on 26th January, 2021 which is a public holiday, the due date will be the preceding day, i.e. 25th January, 2021.

(iii) The due date will be — 8 days of May + 30 days of June + 22 days of July + 3 days of grace = 25th July Since, due date is falling on 25th July which is declared as an emergency holiday, the due date will be 26th July, 2021.

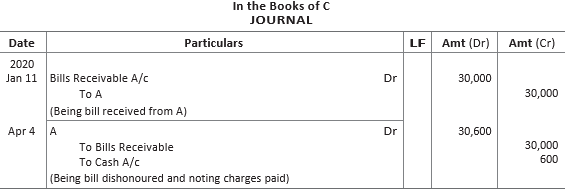

Question. On 1st January, 2020, A drew a bill on B for ₹ 30,000 payable after 3 months. B accepted the bill and returned it to A. After 10 days, A endorsed the bill to his creditor C. On the due date, the bill was dishonoured and C paid ₹ 600 as noting charges. Record the transactions in the books of A, B and C.

Ans.

Question. On 1st January, 2020, A sold goods for ₹ 60,000 to S. 50% of the payment was made immediately by S on which A allowed a cash discount of 2%. For the balance, S drew a promissory note in favour of A payable after 22 days. Since, the date of maturity of bill was a public holiday, A presented the bill on a day, as per the provisions of Negotiable Instrument Act which was met by S. State the date on which the bill was presented by A for payment and journalise the above transactions in the books of A and S.

Ans.

Note Since the due date of the promissory note i.e., 26th January, falls on a public holiday, due date will be one day earlier i.e., 25th January.

Question. A bill for ₹ 13,500 is drawn by Vishal on Rakesh and accepted by the latter payable at Union Bank of India. Show what journal entries would be recorded in the books of both the parties under each of the following circumstances, if the bill is met on maturity

(i) The bill is retained till the due date.

(ii) The bill is discounted with SBI, for ₹ 13,140.

(iii) The bill is endorsed by Vishal in favour of his creditors Harshit & Co in full settlement of their debt of ₹ 13,560.

(iv) The bill is sent to bank for collection.

Ans.