Please refer to the Chapter 9 Financial Statements – I Important Questions with answers provided below. We have provided Important Questions for Class 11 Accountancy for all chapters as per CBSE, NCERT and KVS examination guidelines. These case based questions are expected to come in your exams this year. Please practise these Important based Class 11 Accountancy Questions and answers to get more marks in examinations.

Important Questions Chapter 9 Financial Statements – I

Short Answer Type Questions :

Question. Discuss the need of preparing a balance sheet.

Ans. The need and importance of preparing a balance sheet is stated in the following points

(i) It helps to ascertain the true financial position of the business at a particular point of time.

(ii) It helps in ascertaining the nature and cost of various assets of the business such as the amount of closing stock, amount owing from debtors, amount of fictitious assets, etc.

(iii) It helps in determining the nature and amount of various liabilities of the business.

(iv) It gives information about the exact amount of capital at the end of the year and the addition or deduction made into it in the current year.

(v) It helps in finding out whether the firm is solvent or not. The firm is solvent if the assets exceed the external liabilities. It would be insolvent if opposite is the case.

(vi) It helps in preparing the opening entries at the beginning of the next year.

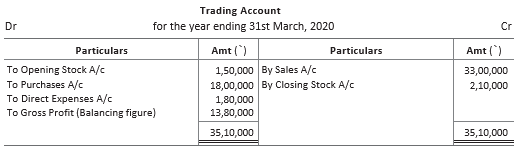

Question. Calculate the amount of gross profit and operating profit on the basis of the following balances extracted from the books of M/s Rajiv and Sons for the year ended 31st March, 2020.

Ans.

Operating Profit = Gross Profit − (Operating Expenses* + Operating Income)

=13,80,000 − (3,30,000 + 0) = ₹ 10,50,000

Note (i) Loss due to fire is a non-operating expense.

(ii) *Operating Expenses = Administration Expenses + Selling and Distribution Expenses = 1,35,000 + 1,95,000 = ₹ 3,30,000

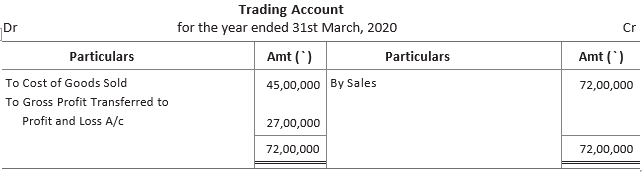

Question. From the following information, prepare trading account for the year ended 31st March, 2020.

Ans.

Note Wages has not been shown on the debit side and closing stock has not been shown on the credit side of the trading account because it has already been adjusted while calculating the cost of goods sold.

Question. What are the objectives of preparing financial statements?

Ans. The basic objectives of preparing financial statements are

(i) To present a true and fair view of the working of the business.

(ii) To help to judge the effectiveness of the management.

(iii) To provide sufficient and reliable information to various users interested in financial statements.

(iv) To facilitate efficient allocation of resources.

(v) To disclose various accounting policies.

(vi) To provide information about the cash flows.

(vii) To provide information about the earning capacity.

(viii) To provide financial data on assets (economic resources) and liabilities (obligations) of an enterprise.

Question. From the following information, find cost of goods sold and net sales.

The percentage of gross profit on sales is 20%.

Ans.

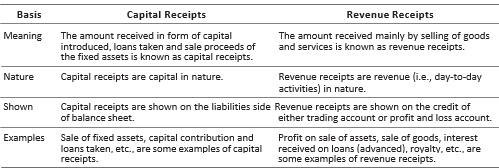

Question. Distinguish between capital receipts and revenue receipts.

Ans. The differences between capital receipts and revenue receipts are

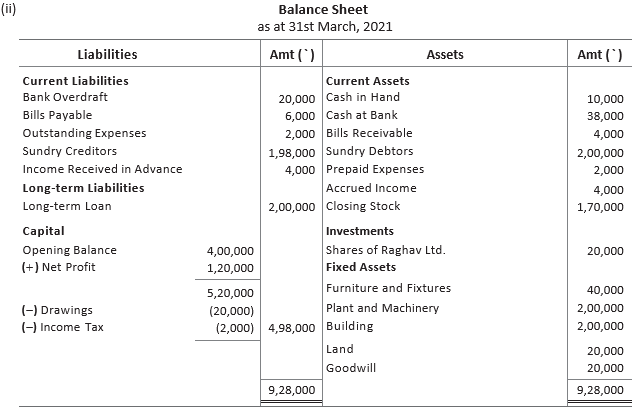

Question. From the following information, prepare a balance sheet of Mr Raghav as at 31st March, 2021. (i) in order of permanence (ii) in order of liquidity.

Ans.

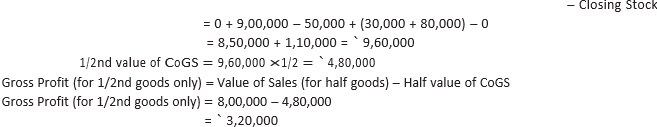

Question. Calculate the gross profit from the following for 50% goods sold. Total purchases during the current year are ₹ 9,00,000, Return outward ₹ 50,000, Lighting ₹ 30,000, Wages ₹ 80,000 and Electricity ₹ 8,000 and 1/2nd goods are sold for ₹ 8,00,000.

Ans. Cost of Goods Sold (CoGS) = Opening Stock + Total Purchases − Return Outward + Direct Expenses

Question. State whether the following statements are items of capital or revenue expenditure, with reason.

(i) Expenditure incurred on repairs and white washing at the time of purchase of an old building in order to make it usable.

(ii) Registration fees paid at the time of purchase of a building.

(iii) Depreciation on plant and machinery.

Ans. (i) Capital Expenditure Any expenditure on purchase of an asset to make it usable is capital expenditure.

(ii) Capital Expenditure Registration fee is part of cost of an asset.

(iii) Revenue Expenditure Depreciation is charged on yearly basis throughout the life of an asset.

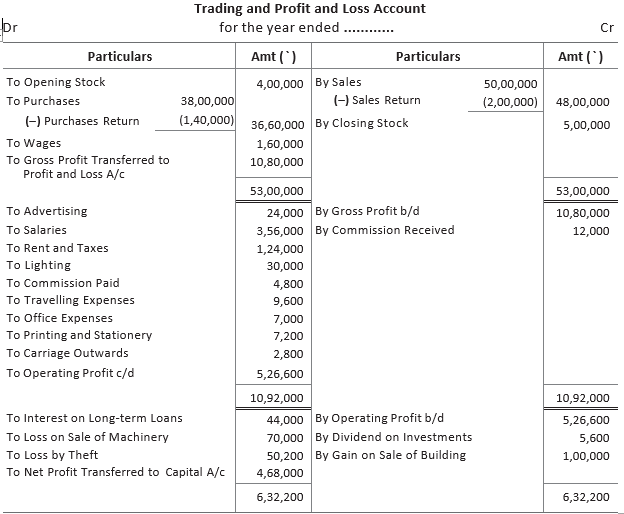

Question. Calculate gross profit, operating profit and net profit from the following.

Closing stock was valued at ₹ 5,00,000.

Ans.

Question. Calculate gross profit from the following.

Ans. Cost of Goods Sold (CoGS) = Opening Stock + Purchases − Purchase Return + Direct Expenses − Closing Stock

= 20,000 + 3,50,000 + 3,000 − 90,000 = 3,73,000 − 90,000 = ₹ 2,83,000

Where, carriage on purchases is direct expense.

Gross Profit = Net Sales − CoGS = Sales − Sales Return − CoGS

= 6,50,000 − 10,000 − 2,83,000 = ₹ 3,57,000

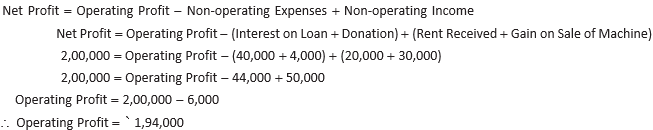

Question. From the following details, calculate operating profit.

Ans.

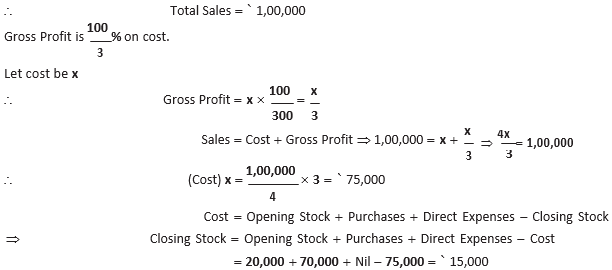

Question. Calculate closing stock from the following details.

Rate of gross profit on cost 33 1/3 %.

Ans. Total Sales = Cash Sales + Credit Sales = 60,000 + 40,000

Question. What are financial statements and what information is provided by them?

Ans. Financial statements are the final/end products of an accounting process, which begins with the identification of accounting information and recording it in the books of primary entry.

Financial statements are prepared following the accounting concepts and conventions. These statements are prepared at the end of accounting period and give information about the financial position and performance of an enterprise.

Trading and profit and loss account present a true and fair view of the financial performance of the business in the form of profit and loss during the year. Balance sheet presents a true and fair view of the financial position of the business.

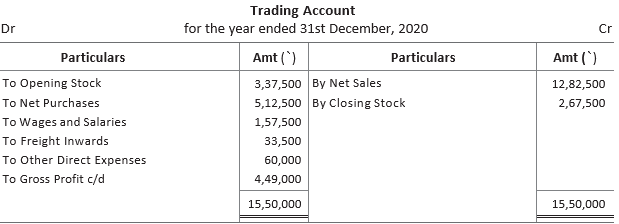

Question. Trading account of M/s Volvoline Technologies is given below

Pass closing journal entries on the basis of the above trading account. Also, transfer the gross profit to profit and loss account.

Ans.

Question. What are the features of a trading account?

Ans. Features of trading account are

(i) Trading account is the first stage in the preparation of final accounts.

(ii) It provides information about gross profit and gross loss.

(iii) Balance of trading account is transferred to profit and loss account.

(iv) Trading account is a nominal account.

(v) Trading account relates to a particular accounting period and is prepared at the end of that period.

(vi) Trading account records only revenue items and not capital items.

Question. Calculate opening stock from the following details

Rate of gross profit on cost 33 1/3 %.

Ans. Net Sales = Cost of Goods Sold (CoGS) + Gross Profit (GP)

Cash Sales + Net Credit Sales = CoGS + GP

Long Answer Type Questions :

Question. From the following balances of M/s Nilu Sarees as on 31st March, 2021. Prepare trading and profit and loss account and balance sheet as on that date.

Closing stock as on 31st March, 2021 ₹ 22,000.

Ans.

Note (i) Total of debit side of trial balance is ₹ 3,64,700 and total of credit side of trial balance is ₹ 3,43,370. The difference in credit side is ₹ 21,330.

(ii) Difference in credit side of trial balance ₹ 21,330 will be treated as liabilities and posted in liabilities side of balance sheet.

Question. Distinguish between capital expenditure and revenue expenditure and state whether the following statements are items of capital or revenue expenditure.

(i) Expenditure incurred on repairs and white washing at the time of purchase of an old building in order to make it usable.

(ii) Expenditure incurred to provide one more exit in a cinema hall in compliance with a government order.

(iii) Registration fees paid at the time of purchase of a building.

(iv) Expenditure incurred in the maintenance of a tea garden which will produce tea after 4 years.

(v) Depreciation charged on a plant.

(vi) The expenditure incurred in erecting a platform on which a machine will be fixed.

(vii) Advertising expenditure, the benefits of which will last for 4 years.

Ans. The differences between capital expenditure and revenue expenditure are

(i) Expenditure incurred on repairs and white washing at the time of purchase of an old building in order to make it usable — Capital Expenditure

(ii) Expenditure incurred to provide one more exit in a cinema hall in compliance with a government order — Capital Expenditure

(iii) Registration fees paid at the time of purchase of a building — Capital Expenditure

(iv) Expenditure incurred in the maintenance of a tea garden which will produce tea after 4 years — Revenue Expenditure

(v) Depreciation charged on a plant — Revenue Expenditure

(vi) The expenditure incurred in erecting a platform on which a machine will be fixed — Capital Expenditure

(vii) Advertising expenditure, the benefits of which will last for 4 years—Deferred Revenue Expenditure.

Question. What is a balance sheet? What are its characteristics?

Ans. The balance sheet is a statement prepared for showing the financial position of the business summarising its assets and liabilities at a given date. It is prepared at the end of the accounting period after the trading and profit and loss account have been prepared. The assets reflect debit balances and liabilities (including capital) reflect credit balances.

It is called a balance sheet because it is a statement of balances of ledger accounts which have not been closed till the preparation of the trading and profit and loss account.

Features/Characteristics of balance sheet are as follows

(i) Balance sheet is prepared at a particular point of time and not for a particular period.

(ii) It is only a statement and not an account.

(iii) It is prepared after the preparation of trading and profit and loss account.

(iv) It shows the financial position of the business.

(v) It is a summary of balances of those ledger accounts which have not been closed by transferring to the trading and profit and loss account.

(vi) It shows the nature and value of assets.

(vii) It shows the nature and amount of liabilities.

(viii) The total of assets side must be equal to the liabilities side.

Question. The following is the trial balance of Manju Chawla on 31st March, 2021. You are required to prepare trading and profit and loss account and a balance sheet as on that date.

Closing Stock ₹ 2,000

Ans.

Note There is a difference of ₹ 700 in debit side of trial balance, so it will be shown in the assets side of the balance sheet.

Question. Distinguish between profit and loss account and balance sheet.

Ans. The differences between profit and loss account and balance sheet are

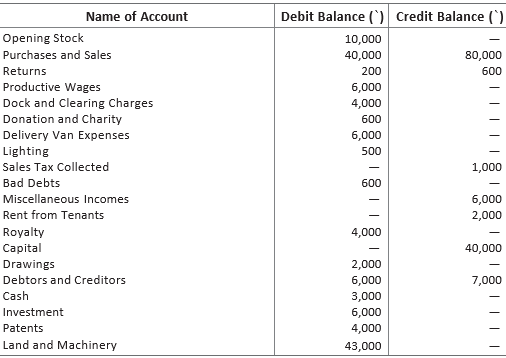

Question. The following trial balance is extracted from the books of M/s Ram on 31st March, 2020. You are required to prepare trading and profit and loss account and the balance sheet as on that date.

Ans.