Please refer to Class 12 Accountancy Sample Paper With Solutions Set A provided below. The Sample Papers for Class 12 Accountancy have been prepared based on the latest pattern issued by CBSE. Students should practice these guess papers for class 12 Accountancy to gain more practice and get better marks in examinations. The Sample Papers for Accountancy Standard 12 will help you to understand the type of questions which can be asked in upcoming examinations.

Sample Paper for Class 12 Accountancy With Solutions Set A

PART A

(Accounting for Partnership Firms and Companies)

Question. Any change in the relationship of existing partners which results in an end of the existing agree ment and enforces making of new· agreement is called:

(a) Revaluation of partnership

(b) Reconstitution of partnership

(c) Realisation of partnership

(d) None of the above

Answer

B

Question. Assertion(A): XYZ are partners with Fixit capitals of Rs.9,00,000 each the partnership deed allowed for salary of Rs.1,00,000 per annum tonX and interest on capital @5% per annum. Net profit for the year is Rs.5,00,000. Amounts of appropriation will be credited to their respective capital accounts

Reason (R): When capital accounts are fixed, all appropriations are credited or debited in the partners current accounts

Reason (R): When capital accounts are fixed, all appropriations are credited or debited in the partners current accounts

a. Assertion(A) and Reason(R) are correct and Reason(R) is the correct expla-nation of Assertion(A)

b. Assertion(A) and Reason(R) are correct and Reason(R) is not the correct explanation of Assertion(A)

c. Assertion(A) is correct but Reason(R)is not correct

d. Assertion(A) is not correct but Reason(R)is correct

Answer

D

Question. X Ltd. purchased Sundry Assets of Rs.600000 and Liabilities of 50000 from Y Ltd.9% Deben-tures of Rs 100 each were issued as purchase consideration of Rs.475000. Amount of capital Reserve will be:

(a) 50,000

(b) 65,000

(c) 15,000

(d) 75000

Answer

D

Or

Question.A company issued 6,000 shares of Rs. 10 each money to be called up:- On application Rs. 3 on allotment Rs. 3 on first call Rs. 2 and remaining on second call. On allotment one shareholders having 100 shares paid full amount The amount collected on allotment……….

(a) 18,000

(b) 12,000

(c) 18,400

(d) 18,600

Answer

C

Question. A and B are partners sharing profit and losses in the ratio of 3 : 2. A’s capital is Rs. 1,20,000 and B’s capital is Rs. 60,000. They admit C for 1/5thshare of profits. C should bring as his capi-tal

(a) Rs. 36,000

(b) Rs. 48,000

(c) Rs. 58,000

(d) Rs. 45,000

Answer

D

Or

Question.The Goodwill of firm Rs 1,80,000 valued at three year’s purchase of super profit . If capital employed is Rs 2,00,000 and Normal rate of return is 10% per annum .The amount of average profit will be _____

(a) 80,000

(b) 60,000

(c) 20,000

(d) 18,000

Answer

A

Question. Siddharth and Nitish were partners in a firm sharing profits and losses in the ratio of 3:2. Their capitals were Rs.3,00,000 and Rs.4,00,000 respectively. They were entitled to interest on capital @ 10 %. The firm earned profit of Rs.21,000 during the year .The interest on Sidharth capital will be

(a) ₹12,000

(b) ₹9,000

(c) ₹30,000

(d) ₹40,000

Answer

B

Question. A company issued 1000 7% Debentures of Rs 100 at 5% Discount and Repayable at 10 % Pre-mium .What will be the amount of Loss on issue of Debentures.:

(a) Rs 10,000

(b) Rs 20,000

(c) Rs 15,000

(d) Rs 30,000

Answer

C

Or

Question.Discount or loss of issue of debenture to be written off after 12 months from the date of bal-ance sheet or after the period of operating cycle in shown as :

(a) Other current asset

(b) Other non current assets

(c) Other long term liability

(d) Other current liabilities

Answer

C

Question. A company Forfeited 1,000 shares of Rs 10 each , Rs 7 called up. For the non payment of Rs 2 First call . All these shares were reissued at Rs 5 per share, ₹7 paid up. What will the amount transferred to capital Reserve account :

(a) 2,000

(b) 3,000

(c) 4,000

(d) 5,000

Answer

B

Question. Manu,Binu and Sini are partners sharing profits in the ratio 5:4:1. Sini is given guarantee that her share in the year will not be less than Rs.5000. Profit for the year ended 31 March 2023 is Rs.40,000. Deficiency in the guaranteed profit of Sini is to be borne by Binu. Deficiency to be borne by Binu is

(a) ₹1,500

(b) ₹4,000

(c) ₹5,000

(d) ₹1,000

Answer

D

Or

Question. Nisha, Nimi &Nikesh are partners sharing profits in the ratio 2:2:1. Nimi retires from the firm The capital account of Nisha, Nimi &Nikesh are Rs 60,000 Rs70,000 and Rs 50,000 re-spectively after adjustment of goodwill , reserves and Revaluation profit . Nimi was to paid in cash brought in by Nisha &Nikesh in such a way that their capital are in proportion of new ra-tio . How much amount Nisha &Nikesh must bring to pay Nimi :

(a) Rs 50,000 by Nisha & Rs 20,000 by Nikesh

(b) Rs 60,000 by Nisha & Rs 10,000 by Nikesh

(c) Rs35,000 by Nisha and Rs 35,000 by Nikesh

(d) Rs 40,000 by Nisha and Rs 30,000 by Nikesh

Answer

B

Read the hypothetical text and Based on this case, answer questions Vineet & Dhanya were partners in firm sharing profits in the ratio 2:1. As per partnership deed interest is allowed on capital @10% p.a. On 31/3/2022 their fixed capital account bal-ances were₹3,00,000 and ₹2,00,000 respectively. On 30/6/2021 Vineet had withdrawn ₹50,000 out of capital and Dhanya introduced ₹50,000 as additional capital. The firm earned a profit of ₹1,50,000 for the year ended 31/3/2022

Question. Capital of Vineet on 1/4/2021 were ₹———-

Answer.₹350,000

Answer

Question. Net divisible profit of the firm for the year ended 31/3/2022 will be————

Answer.₹1,00,000

Answer

Question. In which of the following case, revaluation account is debited?

(a) Increase in value of asset

(b) Decrease in value of asset

(c) Decrease in value of liability

(d) No change in value of assets

Answer

B

Question. Silver spoon Ltd had allotted 20,000 shares to the applicants of 28,000 shares on pro rata basis. The amount payable on application was Rs.2 per share Mukesh had applied for 420 shares .The number of shares allotted and the amount carried forward for adjustment against allotment money due from Mukesh are

(a) 300 shares, Rs.240

(b) 340 shares, Rs.200

(c) 320 shares ,Rs 100

(d) 60 shares Rs.120

Answer

A

Question. As per sec. of the companies Act amount. received as premium on securities cannot be utilized for :-

(a) Issuing fully paid bonus shares to the members

(b) Purchase of fixed assets

(c) Writing off preliminary expenses

(d) Buy back of its own shares

Answer

B

Question. Ravi,Sachin and Kapil are equal partners. Virat is admitted as a partner in the firm for 1/4th share. Virat brings Rs.20,000 as capital and Rs.5000 being half of the premium for Goodwill. The value of goodwill of the firm is

(a) ₹10,000

(b) ₹20,000

(c) ₹40,000

(d) None of these

Answer

C

Question. A,B&C are partners sharing profits in the ratio 5:3 :2. They decided to share future profits in the ratio of 2:3:5. Workmen compensation reserve in balance sheet is Rs.50,000. No information as to workmen compensation claim is given. Workmen compensation reserve will be

(a) distributed among A,B,C in the ratio 5:3:2

(b) distributed among A,B,C in the ratio 2:3:5

(c) distributed among A,B,C in the ratio 1:1:1

(d) Will be carried forward to new balance sheet

Answer

A

Or

Question.P,Q &R are partners sharing profits equally. P drew regularly ₹ 4,000 in the beginning of every month for six months ended 30th September, 2020. Calculate interest of P’s drawing @ 5% p.a.

(a) ₹350

(b) ₹200

(c) ₹1,200

(d) ₹700

Answer

A

Question. On Dissolution of firm X,a partner has taken over furniture at Rs. 7,200 ( being 10% less than book value). Its book value is :-

(a) Rs. 7,920

(b) Rs. 8,000

(c) Rs. 7,200

(d) Rs. 7,000

Answer

B

Question. Partiv, Mili and Reena are partners in a firm sharing profits in the ratio of 3: 2 : 1. Reena dies and the balance in her capital account after making necessary adjustments on account of re-serves, revaluation of assets and liabilities workout to be ₹60,000. Partiv and Mili agreed to pay to her executor’s ₹75,000 in full settlement of her claim. Calculate goodwill of the firm and record Journal Entry for treatment of goodwill on Reena’s death

Answer.

Partiv’s Capital A/c. Dr. 9,000

Mili’s Capital A/c. Dr. 6,000

To Reena’s Capital A/c. 15,000

(Reena’s share of goodwill adjusted in Partiv’s and Mili’s capital accounts in their gaining ratio of 3:2)

Question. Amita and Babu are partners sharing profits in the ratio of 3:2, with capitals of ₹50,000 and ₹30,000 respectively. Interest on capital is agreed @ 6% p.a. Babu is to be allowed an annual salary of ₹2,500. During the year 2021-22, the profits prior to the calculation of interest on capital but after charging Babu’s salary amounted to ₹12,500. A provision of 5% of the profit is to be made in respect of commission to the manager.Prepare Profit and Loss Appropriation account .

Or

Pass necessary rectifying journal entries for the omissions committed while preparing Profit and Loss Appropriation Account. You are also required to show your workings clearly. Madhu and Sagar are partners in a firm sharing profits in the ratio of 3:2. Their fixed capitals are: Madhu ₹2,00,000, and Sagar ₹3,00,000. After the accounts for the year are prepared it is discovered that interest on capital @10% p.a. as provided in the partnership agreement, has not been credited in the capital accounts of partners before distribution of profits.

Answer.

Profit after charging Babu salary 12,500

add Babu salary. 2,500

15,000

Less provision for managers commission 5% of Rs.15,000 (750)

Net profit as per P&L account 14,250

Share of profit transferred to Amita’s capital account Rs.4 ,170 Babu’s capital account Rs.2 ,780

Or

Madhu’s Current A/c. Dr. 10,000

To Sagar’s Current A/c. 10,000

(Adjustment for omission of interest on capitals)

Question. A company issued 1,00,000, 9% debentures of ₹100 each at discount of 5%, but redeemable at premium of 5%. Give journal entries for issue of debentures

Or

Dye&dye Ltd., purchased building worth ₹1,50,000, Machinery worth 1,40,000 and furniture worth 10,000 from Colours ltd, and took over its liabilities of ₹20,000 for a purchase consider-ation of 3,15,000. Dye&dye Ltd. paid the purchase consideration by issuing 12% debentures of 100 each at a premium of 5%. Record necessary journal ent ries.

Answer.

Question. X and Y are partners in a firm sharing profit/loss in the ratio of 2:1. They agree to admit Z as a new partner for 1/4th share. Z brought in ₹ 3,00,000 for share of capital and necessary amount of cash for share of goodwill. Goodwill valued at ₹ 1,20,000. X and Y withdraw 40% of premium for goodwill from the firm. Pass necessary Journal entries for the above in books of the firm

Answer.

Question. Beauty Unlimit Ltd. has an authorised capital of ₹10,00,000 divided into equity shares of ₹10 each. The company invited applications for 50,000 shares. Applications for 45,000 shares were received. Final call of ₹3 per share was not made. All money were duly received except on first call of₹ 2 per share on 1,000 shares. 600 of these shares were forfeited. Present the ‘Share Capital’ in the Balance Sheet of the company.

Also prepare ‘Notes to Accounts.

Answer.

Question. Abhishek &Navin were partners in a firm sharing profits and losses in the ratio of 3:7. On 31st March,2022, their firm was dissolved. On that date the Balance Sheet showed a stock of ₹90,000 and creditors of ₹1,00,000. After transferring the assets and liabilities to the realisa-tion account, the following transactions took place:

i. Abhishek took over 50% of the total stock at 10% discount.

ii. 20% of the total Stock was taken over by creditors of ₹20,000 and balance was paid by cheque.

iii. Remaining stock was sold at 10% loss.

iv. 40% of the remaining creditors were paid by cheque at a discount of 5% and the balance were taken by Navin.

Journalise in the books of the firm.

Answer.

Question. Good bricks Limited issued for public subscription of 1, 20,000 equity shares of ₹ 10 each at a premium of ₹2 per share payable as under:

With Application ₹3 per

share On allotment (including premium)₹ 5 per share

On First call. ₹ 2 per share

On Second and Final call. ₹ 2 per share

Applications were received for 1, 60,000 shares. Allotment was made on pro-rata basis.Ex-cess money on application was adjusted against the amount due on allotment. Manohar, whom 4,800 shares were allotted, failed to pay for the two calls. These shares were subsequently forfeited after the second call was made. All the shares forfeited were reissued to Sudha as fully paid at ₹7 per share. Record journal entries in the books of the company to record these transactions relating to share capital.

Or

Question.Pass journal entries for forfeiture and re-issue in both of the following cases (a) 200 shares of 100 each issued at a premium of 10 were forfeited for the non-payment of allotment money of 760 per share. The first and final call of 20 per share on these shares were not made. The forfeited shares were reissued at 70 per share as fully paid-up. (b)150 shares of 10 each issued at a premium of 4 per share payable with allotment were for-feited for non payment of allotment money of ₹8 per share including premium. The first and final call of ₹4 per share was not made. The forfeited shares were reissued at 15 per share fully paid-up.

Answer.

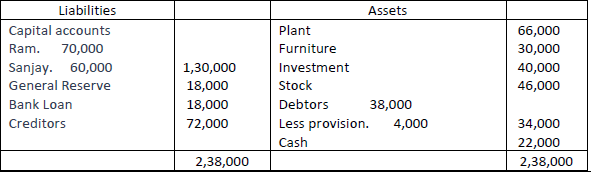

Question. Ram and Sanjay were partners sharing profits in the ratio of 2:1. On 1st April 2022.They ad-mitted Bharat, as a new partner for 1/4 share in profits. Bharat will bring ₹ 60,000 for Good-will and ₹1,50,000 as capital, At the time of admission the Balance Sheet Ram and Lakshman was as under

It was decided to

(i) Reduce the value of stock by .10, 000.

(ii) Plant to be valued at 80,000.

(iii) An amount of .3,000 included in creditors was not payable.

(iv) Half of the investment were taken over by Ram and remaining were valued at ₹.25,000. Prepare revaluation account, partners ‘capital account and Balance sheet of the reconstituted firm

Or

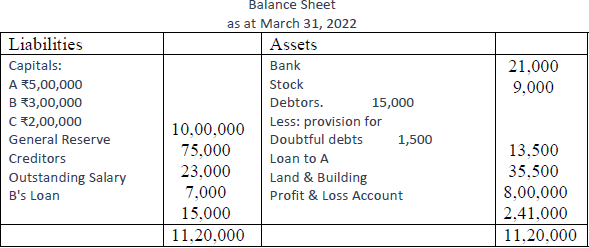

A, B and C were partners in a firm sharing profits & losses in proportion to their capitals. Their Balance Sheet as at March 31, 2022 was as follows:

On the date of above Balance Sheet, C retired from the firm on the following terms:

1. Goodwill of the firm will be valued at ₹ 3,00,000.

2. Provision for Bad Debts would be maintained at 5% of the Debtors.

3. Land & Building would be appreciated by 90,000.

4. A agreed to repay his Loan.

5. The loan repaid by A was to be utilized to pay C. The balance of the amount payable to C was transferred to his Loan Account bearing interest @ 12% per annum. Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of the reconstituted firm.

Answer.Revaluation profit Ram 8000 Sanjay Rs.4000(3 marks); Partners capital account:Ram Rs.1,10,000 Sanjay Rs.90,000 Bharat Rs.50,000(3 marks), balance sheet Rs.3,37,000(2 marks)

Or

6 Revaluation profit A ₹45,375, B ₹27 ,225 ,C ₹18,150 C loan account Rs.209,450. Closing balance of Capital A -Rs.4,24,875, B-Rs2,54,925 Balance sheet Rs.9,34,250

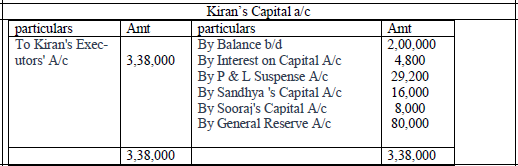

Question. Sandhya, Kiran and Sooraj were partners in a firm sharing profits and losses in the ratio of 2:2:1. On 31st March, 2022 their Balance Sheet was as follows:

Kiran died on 12.6.2022. According to the partnership deed, the legal representatives of the deceased partner were entitled to the following:

(i) Balance in his Capital Account.

(ii) Interest on Capital 12% p.a.

(iii) Share of goodwill. Goodwill of the firm on Kiran’s death was valued at 60,000.

(iv) Share in the profits of the firm till the date of his death, calculated on the basis of last year’s profit. The profit of the firm for the year ended 31.3.2022 was 3,65,000. Prepare Karan’s Capital Acount to be presented to his representatives.

Answer.

Question. (I)”Alpha Ltd.” purchased Machinery from Mukta Machine Ltd. for ₹ 6,90,000. Mukta Ma-chine ltd. was paid by accepting a draft of ₹90,000 payable after three months and the bal-ance by issue of 6% debentures of 100 each at a discount of 20%. Pass necessary journal en-tries for the above transactions in the books of “Alpha Ltd.” (ii)Savio Ltd. issued 2,500, 8% Debentures of 100 each at a discount of 10% on 1st April, 2019 redeemable at par after five years. The company has a balance of 15,000 in Securities Pre-mium Reserve. The company decided to use the Securities Premium Reserve for writing off the loss on issue of debentures and also decided to write off the remaining discount in the first year itself. Pass the Journal Entries for Issue of Debentures and writing off the Discount on Issue of Debentures.

Answer.

Part B :- Analysis of Financial Statements (Option – I)

Question. Under the sub head of short – term provision which one is shown from the following :

(a) Interest accrued and due on borrowing

(b) Proposed dividend

(c) unpaid dividend

(d) calls in advance

Answer

B

Or

Question. Current ratio 4:1, Current assets Rs. 60,000 quick assets are 2:5:1. Calculate inventory

(a) 22,500

(b) 37,500

(c) 15,000

(d) 25,000

Answer

A

Question. If Revenue from operations is Rs 12,00,000 and cash revenue from operations is 20% if credit revenue from operations . What will be credit revenue from operations :

(a) Rs2,00,000

(b) Rs 8,00,000

(c) Rs 10,00,000

(d) Rs 12,00,000.

Answer

C

Question. Investment costing Rs. 10,000 sold for Rs. 12,000. The amount shown in investing activity is

(a) Rs. 2,000

(b) Rs. 10,000

(c) Rs. 12,000

(d) Rs. 2,200

Answer

C

Or

Question.Interest received on investment by a financing company is shown under:

(a) Operating Activity

(b) Investing Activity

(c) Financing Activity

(d) Cash and Cash Equivalents

Answer

A

Question. Plant and Machinery of Book Value of Rs. 5,00,000 at a loss of 5%. Inflow under Investing Ac-tivities will be

(a) Rs. 4,75,000

(b) Rs. 5,00,000

(c) Rs. 3,80,000

(d) Rs. 3,60,000

Answer

A

Question. Under which sub-heads will the following items be placed in the Balance Sheet of the com-pany as per Schedule III of Companies Act,2013?

i. Cheques in hand ii. Loose tools

iii. Securities Premium Reserve

iv. Long-term Investments with maturity period less than six months

v. Building under Construction

vi. Livestock

Answer.

Question. The proprietary ratio of M. Ltd. is 0.80:

1. State with reasons whether the following transac-tions will increase, decrease or not change the proprietary ratio: 1.Obtained a loan from bank 2,00,000 payable after five years..

2. Purchased machinery for cash 75,000.

3. Redeemed 5% redeemable preference shares 1,00,000

Answer.1. Decrease 2. No change 3. Decrease

Question. From the following details, calculate Return on Investment and Total Assets to Debt ratio: Fixed Assets ₹ 75,00,000; Current Assets ₹ 40,00,000; Current Liabilities ₹ 27,00,000; 12% Debentures ₹ 80,00,000; Net Profit after tax ₹ 2,94,000; Tax rate 40%.

Or

From the following information, compute ‘Debt-Equity Ratio’ and Current Ratio

Long-Term Borrowings. ₹ 2,00,000

Long-Term Provisions. ₹1,00,000

Current Liabilities. ₹50,000

Non-Current Assets ₹3,60,000

Current Assets. ₹90,000

Answer.Return on Investment = {14,50,000/88,00,000} x100=16.48%

Total Assets to Debt Ratio = 1,15,00,000/80,00,000 = 1.44 : 1

Or

Debt-Equity Ratio = Debt / Equity (Shareholders’ Funds) = 3,00,000 / 1,00,000

= 3 :1, Current ratio=9:5

Question. Read the following hypothetical text and answer the given question on the basis of the same.

Nimisha an MBA graduate had started a business in the year 2021 and follow-ing are the results of the business for the year ended 31st March 2023

1. Calculate cash flow from operating activities

2. Calculate cash flow from investing activities

3. Calculate cash flow from financing activities

Answer.

1. Cash flow from operating activities Rs.3,08,000

2. Cash used in investing activities Rs.5,15,000

3. Cash flow from financing activities Rs.2,00,00