Students can read the important questions given below for Determination of Income and Employment Class 12 Economics. All Determination of Income and Employment Class 12 Notes and questions with solutions have been prepared based on the latest syllabus and examination guidelines issued by CBSE, NCERT and KVS. You should read all notes provided by us and Class 12 Economics Important Questions provided for all chapters to get better marks in examinations. Economics Question Bank Class 12 is available on our website for free download in PDF.

Important Questions of Determination of Income and Employment Class 12

Question. What is the aggregate demand ?

Ans. The demand for all the final goods and services in economy during year.

Question. What are the components of aggregate demand?

Ans. AD= C + I + G + (X-M)

Question. What is the relation between APC and APS?

Ans. APC+APS=1

Question. What is the relation between MPC and MPS?

Ans. MPS+MPC=1.

Question. If APC is 0.7 then how much will be APS?

Ans. 1-0.7=0.3

Question. If MPC =0.75, what will be MPS?

Ans. MPC+MPS=1

1-0.75=0.25

Question. What is meant by investment?

Ans. Investment means addition to the stock of capital good, in the nature of structures, equipment or inventory.

Question. What is the investment demand function?

Ans. The relationship between investment demand and the rate of interest is called investment demand function.

Question. What is equilibrium income?

Ans. The equilibrium income is the level of income where AD=AS i.e.…AD=AS and planned saving equals planned investment.

Question. Give the formula of investment multiplier in terms of MPC.

Ans. K=1/1-MPC

Question. What can be the minimum value of investment multiplier?

Ans. One.

Question. What is the maximum value of investment multiplier?

Ans. Infinity.

Question. Give the equation of consumption function?.

Ans. C= a + by.

Question. Write down the equation of saving function?

Ans. S= -a + (1-b) y.

Question . “Marginal propensity to consume falls with successive increase in the level of income.” It is always true?

Ans. This may be true if there is equitable distribution of income. A rational consumer always attempts to save more as his income increases, but if bigger part of national income is concentrated in a few hands, the marginal propensity to consume will be high for a poor person as he needs to spends more to fulfill his basic requirements.

Question . Define under-employment equilibrium.

Ans. Under-employment equilibrium refers to a situation when aggregate demand is equal to the aggregate supply at a level where the resources are not fully employed.

Question. Define voluntary & involuntary unemployment.

Ans. Voluntary unemployment refers to the situation when people are willing to remain unemployed in the production activities at the current factor prices. Involuntary unemployment refers to the situation when the willing & able bodied people remain unutilized in the economy due to lack of employment opportunities.

Question. State the causes of excess demand/inflation.

Ans. 1. Excess of Money supply due to excess expenditure by the Government & excess credit creation by the Commercial Banks. 2. Excess of Exports over Imports which leads to scarcity in the domestic supply of essential goods.

2. Tax Evasion by the household & firms.

3. Hoarding & Black marketing of the essential goods by the traders.

4. Due to low market rate of interest.

5. Due to Cyclical fluctuations.

Question. Define the term Aggregate Supply.

Ans. It refers to the total production of commodities in the economy at a given point of time which is measured in terms of value added or the total income generated. It also refers to the disposable income which consist of two components viz, consumption & saving. Since AS = Y, therefore, AS = C + S

Question. Differentiate between Autonomous Investment and Induced Investment.

Ans.

| Autonomous investment | Induced investment |

| 1. It refers to the investment expenditure which is incurred by the Government with the motive to promote the level of growth & development. It is not influenced by the level of profits or income of an economy. | 1. It refers to the investment expenditure which is incurred by the enterprises with the motive to make greater investments & receive higher returns. It is positively related to level of income. |

| 2. It is influenced by the change in population structure, natural calamities, change in technology & institution, war etc. | 2. It is influenced by the level of income of an economy. Higher the income, greater is the induced investments, & vice versa. |

Question. Explain the distinction between voluntary and involuntary unemployment.

Ans. Voluntary unemployment refers to the situation when people are willing to remain unemployed in the production activities at the current factor prices. Involuntary unemployment refers to the situation when the willing & able bodied people remain unutilized in the economy due to lack of employment opportunities.

Question. What is equilibrium income?

Ans. The equilibrium income is defined as the level of income where AD = AS that means Aggregate Demand is = to the Aggregate supply. Planned savings is always = to the planned investment.

Question. Explain the relationship between investment multiplier and MPC?

Ans. K=1/1-MPC, It shows direct relationship between MPC and the value of Multiplier. Higher the proportion of increased income spend on consumption, higher will be value of investment multiplier. Higher the proportion of increased income spend on consumption, higher will be value of investment multiplier.

Question. Define the meaning of Deflationary gap? And measure to correct it.

Ans. It is the economic situation when Aggregate demand is less than Aggregate supply corresponding to the full employment level of output. Measures to correct it:

a- Fiscal tools:

1-Increase govt. expenditures.

2- Decrease the taxes

b- Monetary tools:

1-Decrease in –CRR, SLR, REPO, REVERSE REPO.

2- Purchase of bonds and securities in open market operation

3- Decrease in debt margin.

Question. What is Inflationary gap or excess demand? State measures to correct it.

Ans. It is the economic situation when Aggregate demand is more than Aggregate supply corresponding to the full employment level of output.

Measures to correct it:

a- Fiscal tools:

1-decrease govt. expenditures.

2- Increase the taxes

b- Monetary tools:

1-Increase in –CRR, SLR, REPO, REVERSE REPO.

2- sell of bonds and securities in open market operation

3- increase in debt margin.

Question. Explain the role of the following in correcting ’Excess demand in an Economy’

1. Bank Rate

2. Open market

Ans. 1. To Correct excess demand central bank can rise the bank rate. This forces commercial bank to increase lending rates. This reduces demand for borrowing by the public for investment and consumption. Aggregate demand falls.

2. When there is excess demand Central Bank sells securities. This leads to flow of money out of the commercial banks to the central bank when people make payment by cheques. This reduces deposits with the banks leading to decline in their lending capacity. Borrowing decline. AD declines.

Question. Explain the meaning of investment multiplier? What can be its minimum value and maximum value why?

Ans. Defined as the ratio of change in the income to the change in the investment.

K=ΔY/ΔI.

The value of the multiplier is determined by the MPC. It is directly related to MPC.

K=1/1-mpc = 1/1-0 =1

K=1

Minimum value of K is when minimum value of MPC=0, the minimum value of K will be unit one.

Maximum value of K is when Value of MPC=1 , the value of K will be infinitive .

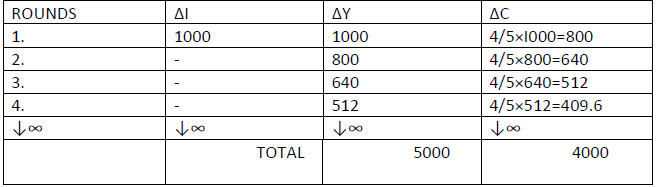

Question. Explain the working of a multiplier with an example.

Ans. Multiplier tells us what will be the final change in the income, as a result of change in investment. Change in investment results in the change in income. Symbolically:

ΔI→ΔY→ΔC→ΔY

The working of a multiplier can be explained with the help of the following table which is based on the consumption that is, ΔI=1000 and MPC=4/5.

Process of Income Generation

As per the table the initial increase in the investment of Rs 1000 there is a total increase in the income by Rs 5000 given MPC=4/5 . Out of this total increase in the income Rs 4000 will be consumed and Rs 5000 be saved.

Question. Differentiate between ex ante and ex post investment.

Ans. Ex ante is the planned investment which the planner intends to invest at different level of income and employment in the economy. Ex post investment may differ from ex ante investment when the actual sales differ from the planned sales and the firms thus face unplanned addition or reduction of inventories.

Question. What is meant by determination of income & output?

Ans.Determination of income, output & employment is one of the core issues of the Macro Economics. The level of income, output and employment is determined by the Aggregate demand & Aggregate supply.

Question. Define the term Aggregate Demand (AD)/ Aggregate Expenditure.

Ans.It refers to the sum total of demand made by all the economic units in the economy at a given point of time. It can be also defined as the total expenditure incurred by the household, government, & enterprises of the economy at a given point of time.

Q. What are Ex-ante savings?

Ans. Ex-ante savings refers to the amount of savings which savers plan to save at different levels of income in an economy.

Q. Define Ex-ante investments.

Ans. Ex-ante investments refers to the amount of investments which investors plan to invest at different levels of income in an economy.

Question. Explain the components of AD.

Ans.There are four components of AD viz. Household Consumption demand, Private Investment demand, Govt. demand, & Net Exports.

1. Household Consumption demand/Consumption expenditure refers to the amount spent on durable & non-durable commodities by the consumer households at a given point of time. The consumption expenditure is influenced by the level of income of the households.

Question. Define the term dissaving.

Ans. The saving curve SS intersect X-axis at OY level of income. Before this level the saving is negative, called as dissavings. It is the situation when the consumption is greater than income. The savings are positive when the consumption is less than income.

Question. Explain the two types of consumption function or propensity to consume.

Ans. i) Marginal Propensity to Consume (MPC): It refers to the ratio of change in consumption by change in disposable income. The value of MPC always lies between 0 and 1 i.e. 0<MPC<1. It is obtained by ΔC/ ΔY

ii) Average Propensity to consume: It refers to the ratio of total consumption by total disposable income. APC = C/Y

Question. Define the term Saving Function or propensity to save.

Ans. It refers to the functional relationship between saving & level of income, S = f (Y). In other words, it is the tendency of the households to save at a given level of income.

Question. Briefly explain the two types of Saving function or propensity to consume.

Ans. I) Marginal propensity to save (MPS):

It refers to the ratio of change in savings by the change in level of income, i.e. MPS =

ΔS/ΔY. The MPS lies between 0 & 1 i.e. 0 ≤ MPS ≤ 1

AI) Average propensity to save (APS):

It refers to the ratio of total savings by total income, i.e. APS = S/Y.

Question. State the relationship between MPC & MPS.

Ans. MPC + MPS = 1; So, MPC = 1-MPS; &, MPS = 1-MPC

Similarly, the relationship between APC & APS is that, APC + APS = 1

Q. What is meant by effective demand?

Ans. The level of aggregate demand required to achieve full employment equilibrium is called effective demand.

Q. What is the impact of excess demand?

Ans. Excess demand leads to inflation without any increase in output and employment as economy is already operating at the full employment level.

Question. Define the term Private Investment Demand.

Ans. It refers to the expenditure incurred by the enterprises on the creation of new capital assets viz plants, machineries, transport equipments, implements & tools, building etc.

Question. Explain the determinants of Investment. There are three important determinants of Investment viz.

Ans. i) Revenue from Investment (ROI): Revenue from investment or expected returns implies the prospective yield of the capital invested. The enterprises would undertake an investment project to increase the production capacity only when that generates the additional revenue.

ii) Cost of Investment: Cost of investment implies supply price of capital asset, and the rate of interest on the loan money borrowed for the purchase of the asset. Higher the cost, lower will be the investment.

iii) Business expectations: which implies the enterprises to speculate in the future gains which are uncertain, and is prompted by bullish expectations i.e. the expectation of prices to go up.

Question. Define the term investment/income multiplier & explain its working.

Ans. This concept has been developed by J. M. Keynes in 1936. This concept explains the resultant change in the level of income in an economy due to change in the investment. In other words, when an economy raises a certain amount of investment, the level of income rises by a certain amount i.e. the investment generates greater amount of income in the economy. The multiplier indicates by what times the level of income rises due to rise in the investment at a given point of time.

For example, if the investment increases by Rs. 100 crores, & the income rises by Rs. 200 crores, the multiplier will be 200/100 =2.

According to Keynes, “Investment multiplier tells us that when there is an increment of aggregate investment; income will increase by an amount which is K times the increment of investment.”

ΔY = KΔI; thus, K = ΔY/ΔI, where K is the investment multiplier.

The multiplier can be defined as the ratio of change in income to the change in investment.

Working of the Multiplier: Multiplier process can be explained as the change in investment leads to change in income which further leads to change in consumption expenditure. This again results into further change in income. This process continues till consumption expenditure becomes zero. The resultant increase in income depends upon the existing MPC which determines the value of K. K = 1/1-MPC or K = 1/MPS.

Question. Define the term Aggregate Supply.

Ans. It refers to the total production of commodities in the economy at a given point of time which is measured in terms of value added or the total income generated. It also refers to the disposable income which consist of two components viz, consumption & saving.

Since AS = Y, therefore, AS = C + S

Question. Define the term Ex-ante savings & investment, & explain how they are different to ex-post savings & investment.

Ans. Ex-ante savings refers to the savings planned by the household for the given year, while ex-ante investment refers to the amount of investment planned by the producers towards the production of commodities in the given year. Ex-post savings refers to the realized or actual savings made by the households in a year, while ex-post investment refers to the actual amount of investment made by the producers towards the production of commodities in a year.

Question. State the causes of deficient demand/deflation.

Ans. 1. Lack of Money supply due to curtailed expenditure by the Government & less credit creation by the Commercial Banks.

2. Excess of imports over exports which leads to excess of availability of essential goods.

3. Excess of production by the enterprises due to improper planning and wrong estimation.

4. Due to high market rate of interest. 5. Due to depression prevailing in the economy.

Question. Explain the Measures to correct excess (inflationary gap) & deficient demand (deflationary gap).

Ans. The measures can be classified into two measures viz.

1. Fiscal measures/policy;

2. Monetary measures/policy

1. Fiscal measures: These measures are formulated & implemented by the Government to control inflationary or deflationary situation. The following tools are used to control & combat the inflationary & deflationary situation.

b) Public Expenditure: The govt. expenditure has a large impact on the creation of money supply & further on the rise/fall in AD. During the inflationary situation, the Govt. may curtail the unproductive expenditure to check expansion of money supply which may tend to reduce the AD. This will prevent in the inflow of excess money in the economy. During the deflationary situation, the govt. should raise the expenditure on the economy by funding various developmental projects. This will lead to induce the money supply in the economy & the AD too will rise.

2. Monetary Measures: These measures are adopted by the Central Bank of a country in order to control inflation or combat deflation. There are two methods or instruments of monetary policy viz.

Question Quantitative Methods or General methods, which refer to the control of quantity of money supply through credit control. The following instruments are used in quantitative method:

Ans.A) Bank Rate Policy: It refers to the rate of interest charged by the Central Bank on the loans & advances given to the Commercial Banks. The Bank Rate is determined by the Central Bank itself. The rise in BR leads to rise in rate of interest which affects the savings & demand for loans. During the excess demand situation, the CB raises the BR which leads to rise in rate of interest. This leads to raise the savings & reduce the demand for loans. Consequently, there is a fall in purchasing power & further fall in AD.

B) Open Market Operations: It refers to the process to sale & purchase of securities by the CB in the economy. During the excess demand situation, the CB sells the bonds & securities in the market which is purchased by the banks, individuals and other financial institutions of the economy. This helps in wiping out the excess of money supply from the society & further there is a fall in purchasing power of the people.

Consequently, the AD falls, this helps in reducing the price level. During the deficient demand situation, the CB purchases the securities of different institutions which induce the inflow of money sully in the economy. This further leads to rise in money supply & thus there is rise in AD.

C) Cash Reserve Ratio: The CRR is an important tool which is used to correct the inflationary & deflationary situation, as the rise in CRR leads to fall in the lending capacity of the banks. During the excess demand situation, the CB raises the CRR which leads to fall in the lending capacity of the banks. This results in fall in money supply & further fall in AD. The fall in AD leads to fall in price level. During the deflationary situation, the CB reduces the CRR which raises the lending capacity of the banks. The rise in lending capacity leads to rise in money supply & further rise in AD.

D) Repo & Reverse repo rate: During inflation, the RBI increases the repo rate to make the credit dearer in order to restrict its supply. Similarly, RBI increases the RRR to encourage the commercial banks to park more funds with RBI. This helps in restricting money supply in the economy.

Qualitative Measures:

1. Regulation of Margin Requirements: The margin requirements refers to the difference between current value of the security offered for loans and the value of loans granted. In case of inflationary tendencies in an industry, the CB will raise the margin requirement so as to restrict the flow of credit, & vice versa in case of deflationary situation in an industry.

2. Rationing of Credit: The fixation of credit quota for different industries is called as rationing of credit. In order to restrict the flow of credit for speculative activities in a sector, the CB will introduce rationing credit. The quota limits fixed in granting loans by the CB cannot be exceeded by the Commercial Banks.

3. Moral Suasion & Direct Action: In case of inflationary or deflationary situations, the CB may issue directives with a view to control the flow of credit. The advices of the CB are generally accepted by the Commercial Banks for expanding or contracting credit. In case the commercial banks do not comply with the directives, the CB may initiate direct action against the member banks.

Q. Define investment.

Ans. Investment refers to the expenditure incurred on creation of capital assets.

Q. Define involuntary unemployment.

Ans. Involuntary unemployment refers to a situation in which all those people, who are willing

and able to work at the existing wage rate, do not get work.

Q. What is full employment?

Ans. Full employment refers to a situation in which all those people, who are willing and able

to work at the existing wage rate, get work.