Please refer to Forms of Business Organisation Class 11 Business Studies notes and questions with solutions below. These revision notes and important examination questions have been prepared based on the latest Business Studies books for Class 11. You can go through the questions and solutions below which will help you to get better marks in your examinations.

Class 11 Business Studies Forms of Business Organisation Notes and Questions

Forms of Business Organisations (Private Sector Undertakings):

Private business enterprises can broadly divided into two, ie; corporate enterprises and noncorporate enterprises. Joint Stock companies and co-operative organizations form part of corporate organizations. While non-corporate organizations consist of Sole-proprietorship, Joint Hindu Family Business and Partnership firms.

I. Sole Proprietorship

It can be said that a “one man business” as he invests the entire capital, bears all the risks, takes all the advantages and manages the business by himself. It is also called Individual Proprietorship.

Features of Sole Proprietorship Business:

a. Formation and closure is easy – No separate law that governs sole proprietorship.

b. Liability – Unlimited.

c. Sole risk bearer and profit recipient

d. Control – Complete control of business is held with the proprietor himself.

e. No separate entity for the business from the businessman – So that the owner is held liable for all the activities of the business.

f. Lack of business continuity – Since the business and owner are one and the same entity, his death, insanity etc. will affect the existence of the business.

Merits of Sole Proprietorship

a. Quick decision making – No need to consult with others.

b. Confidentiality of information – Secrecy can be maintained.

c. Direct incentive – All the profit goes to the proprietor.

d. Sense of accomplishment – Personal satisfaction by working for himself.

e. Ease of formation and closure – Only minimum legal formalities.

Limitations of Sole Proprietorship

a. Limited resources – Capital is limited and the size of business is small.

b. Limited life – As the business has no separate legal entity.

c. Unlimited liability – even the personal properties are attached.

d. Limited managerial ability.

II. Joint Hindu Family Business (JHF) Hindu Undivided Family Business ( HUF)

A Joint Hindu Family business refers to a business which is owned by the members of a Joint Hindu Family. It is the oldest system of business that can be seen only in India, which is governed by the Hindu Law. The basis of membership in the business is birth in a particular family and three successive generations can be members in the business.

The business is controlled by the head of the family who is the eldest member and is called ‘Karta’.

All members (male and female) have equal ownership right over the property of an ancestor and they are known as ‘co-parceners’.

Features of JHF

a. Formation – Minimum two members from the family and their ancestral property is used. It is governed by Hindu Succession Act, 1956

b. Liability – Limited liability to the members except Karta.

c. Control – Management is vested in the hands of Karta.

d. Continuity – The death of a member or Karta does not affect the business.

e. Minor Members – It is because, membership by birth.

Note: Both male and female members in the family have equal right in the business based on the Hindu Succession (Amendment) Act 2005.

Merits

a. Effective control – No conflict among members as the decisions are taken by Karta.

b. Continued existence – Even the death of Karta does not affect the existence of business, as the next eldest member will take up the position.

c. Limited liability – Liability of members except Karta is limited.

d. Increased loyalty and cooperation – The business is treated as a pride to the family.

Limitations

a. Limited resources – It depends mainly on ancestral properties.

b. Unlimited liability of Karta – His personal properties are also liable to meet the debts of the firm.

c. Dominance of Karta – The leadership of Karta may not be acceptable to all the members in the family, which may results even the breakdown of family.

d. Limited managerial skills – The Karta may not be an expert in all the areas of management.

III. Partnership

In order to overcome the difficulties of sole proprietorship business, a new form of business organization has been emerged and it is called Partnership Business.

Definition – Section 4 of the Indian Partnership Act 1932 defines partnership as “the relation between persons who have agreed to share profit of a business carried on by all or any of

them acting for all.”

Features of Partnership

a. Formation – The formation of partnership is based on the agreement among the partners to run a lawful business and it may be either oral or written. But two people coming together for charitable purpose is not a partnership.

b. Liability – The liability of each partner is unlimited i.e. even their personal properties are held liable for the debts of the partnership firm.

c. Risk bearing – All the risk of loss is shared by the partners as they are sharing profits of the firm.

d. Decision making and control – Decisions are generally taken with mutual consent.

e. Continuity – A partnership is purely a personal organization and it has no separate legal existence apart from its members, hence it lacks continuity.

f. Membership – (2 to 50). Minimum number of members is 2. According to Section 464 of Companies Act 2013 maximum number of partners can be 100, subject the number

prescribed by the government. At present it is limited to 50 by Govt. of India.

g. Mutual agency – Each partner is an agent of the other partners as well as the firm.

Merits of Partnership

1. Easy formation and closure – due to less formality.

2. Balanced decision making – because of the involvement of more than one person.

3. More funds – Large capital can be accumulated.

4. Sharing of risk – reduces the anxiety, burden and stress on individual partners.

5. Secrecy can be maintained – No legal requirements to publish its accounts and reports.

Limitations of Partnership

1. Unlimited liability – attaches even the personal properties.

2. Limited resources – to run large scale business organizations.

3. Conflicts – Disagreement between partners leads to dissolution of firms.

4. Lack of continuity – as it has no separate legal existence.

5. Lack of public confidence – as it is free from government control.

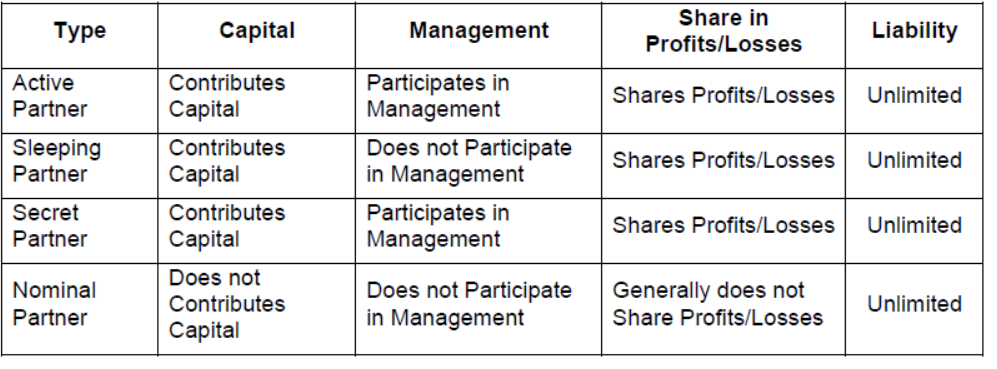

Types of Partners

Depending on the nature of agreement and interest taken in the business, partners are of different types:-

1. Active or Working Partner – A partner who contributes capital and take part in the day to day affairs of the business is called active partner.

2. Sleeping or Dormant Partner – He does not play an active part in the business but simply contributes capital and shares the profit or loss as the case may be.

3. Secret Partner – It is one whose association with the firm is unknown to the public. All other features are just like an active partner.

4. Nominal Partner (Ostensible Partner or Quasi Partner) – Such a partner lends his name and reputation for the benefit of the firm but neither contribute capital nor take part in

management as well as no share in profit of the firm . Although he becomes liable to outsiders for the debts of the firm.

5. Partner by Estoppel – If a person acts as a partner of a firm by his words and conduct, he can be called as partner by estoppel. Even though he is not an actual partner, he is liable for the debts of the firm as he makes himself as a partner in front of the public.

6. Partner by holding out – Sometimes a person may be declared as a partner in a firm by the outsiders and does not deny this even after becoming aware of it. Such a person is known as partner by holding out. He is also liable for the debts of the firm though he is not an actual partner.

Types of Partners – A Comparative Study

Minor as a partner

A minor is a person who has not completed 18 years of age. A minor cannot become a partner as he is not capable to enter into a contract, but he may be admitted as a partner to the benefits of the firm, with the consent of all the partners. He cannot take active part in management and his liability is limited to the extent of his share in the capital and profits of the firm. After becoming major he will be eligible to enjoy all the rights of a partner and his liability becomes unlimited. It should be noted that a partnership cannot be formed with a minor partner.

Rights of a minor partner

1. Right to share the profits and properties of the firm.

2. He can inspect and copy the accounts of the firm. But he has no access to all the books of the firm.

3. He can sue the partners for payment of his share of profits or properties in the firm.

Types of Partnership

Partnership may be broadly divided into two, namely General or Ordinary Partnership and Limited Partnership.

1. General Partnership – In this type of partnership the liability of all the partners is unlimited usually these types of partnership is found in India. On the basis of duration, general

partnership is divided as follows:

b. Particular Partnership – It is formed for a particular purpose or for a particular period. E.g. If a partnership is formed for two years, or for the construction of a house etc. After the

expiry of the time or the completion of construction, it will be dissolved.

c. Partnership at Will – If the duration of a partnership is not specified in the agreement, it is called partnership at will. It will be continued for an indefinite period and it can be dissolved at any time as it is decided by all or any of the partners.

2. Special Partnership (Limited Partnership) – In a limited partnership, there are two classes of partners.

a. General Partners

b. Special Partners

There should be at least one general partner whose liability is unlimited and the liability of special partners is limited to the extent of their capital contribution. It is not allowed in India but prevails in England.

Partnership Deed

It is the document which contains all the terms and conditions of partnership and it can be altered at any time with the consent of all the partners. This agreement may be either oral or written; however it will be better in writing itself to avoid disputes in future. It is also known as the “Articles of

Partnership”.

Contents of Partnership Deed

1. Name of the firm

2. Names and addresses of all partners

3. Nature and place of business

4. Date of Commencement of partnership

5. Duration of partnership, if any

6. Capital contribution by the partners

7. The amount which can be withdrawn by each partner

8. Rules regarding operation of bank accounts

9. Division of profits or losses

10.Interest on capital or drawings, if any

11.Interest on partner’s loan to the firm

12.Salaries, commission, etc. if payable to any partner

13.Details of division of work among the partners

14.The ascertainment of goodwill on admission, retirement and death of a partner.

15.Settlement of accounts in the event of retirement or death of partners.

16.Settlement of accounts on dissolution of the firm

17.Provisions relating to the maintenance and audit of accounts

18.Provisions for arbitration in the event of disputes

19.Provision regarding borrowings of the firm

20.Rights, duties and liabilities of partners

Registration of Partnership

Even though registration of a partnership firm is not compulsory, it can be registered if the partners so desire, according the Partnership Act 1932 with the Registrar of Firms.

Procedure for getting registration:

a. The partners should submit an application in prescribed form contains the following:

i) Name of the firm.

ii) Location of the firm.

iii) Names of other places where the firm carries on business.

iv) The date of joining of each partner.

v) Names and addresses of partners.

vi) Duration of partnership.

vii) This application should be signed by all the partners.

b. Deposit of required fees with the Registrar of Firms.

c. After approval, the Registrar should enter the name of the firm in his register and issues a certificate of registration.

Effects of Non-Registration

1. An unregistered firm cannot sue against a third party for the recovery of claims.

2. An unregistered firm cannot sue against its partners.

3. A partner of an unregistered firm cannot enforce his claims against outsiders or against his co-partners or the firm.

However, non registration does not affect the following:

1. The right of a partner to sue for the dissolution or for settlement of accounts of the dissolved firm.

2. The rights of a third party to sue the firm or the partners for the recovery of claims and debts.

IV. Co-operative Societies

The word co-operation implies joint effort; through joint effort we can attain greater success than individual effort. A co-operative society is a voluntary associations of persons constituted for the purpose of protecting their economic and social interest.

The basic principle of co-operative society is “Self help through mutual help” or in other words, “each for all and all for each”.

Features of Co-operative organizations

1. Voluntary Membership – Anybody can become a member in a co-operative society at his own wish and there is no compulsion at all.

2. Legal Status – As the registration of a cooperative society is compulsory, it gets separate legal entity and continuous existence.

3. Limited Liability – The liability of the members is limited.

4. Control – Control is vested in the hands of board of directors who are elected by the members under the principle of one man one vote.

5. Service Motive – The main objective is to render services to its members rather than profit.

Formation of a Co-operative Society

As per Kerala co-operative societies Act, there should be at least 10 members who are bound together by a common bond belonging to the same locality, class, occupation or having a common economic need. These members called promoters should present a joint application to the Registrar of Co-operative Societies giving the following details.

a. Proposed name of the society.

b. Aim and objective.

c. Area of operation.

d. Nature of members’ liability

e. Particulars of share capital to be raised.

Application should be accompanied by two copies of the byelaws of the society. After scrutiny, the Registrar issues a Certificate of Registration and thereafter the society can admit new members.

Merits of Co-operative Societies

1. Equal voting rights – Each member is having equal voting rights irrespective of their capital contribution, as it follows the principle of ‘one man one vote’.

2. Limited Liability – Liability of members is limited to the extent of their capital contribution.

3. Stable existence – The existence of a society is not affected by the death, insanity, insolvency etc. of members.

4. Economy in operation – To eliminate middlemen, the members offer honorary services to the society, which will in turn reduces cost of operation.

5. Support from government – As it is a democratic organization, government provides various supports such as low taxed, subsidies, grants, low interest rates for loans etc.

6. Easy to form – No complex legal formalities are required to form a co-operative society.

Limitations of Co-operative Societies

1. Limited resources – Low rate of dividend and one man one vote principle reverts the members to invest more capital.

2. Inefficient Management – Office bearers are elected from members and they may not be competent.

3. Lack of business secrecy – The general body openly discusses all facts and figures of the society. Hence secrecy is lost.

4. Excessive Government control – affects the smooth functioning.

5. Difference of opinion – Conflict among the members adversely affect the organization.

Types of Co-operative Societies

1. Consumers’ Co-operative Societies – These are formed by consumers to ensure the supply of consumer goods with a fair price. They purchase the goods directly from

wholesalers and distribute the same to its members and outsiders for a little margin of profit.

2. Producers Co-operative Societies – They are also known as Industrial co-operative societies. It is promoted by small producers, craftsmen etc. which will help them to start

small scale and cottage industries. It supplies raw-materials, tools and equipments to the members and sells the products on behalf of them.

3. Marketing Co-operative Societies – It is formed by farmers, artisans and small producers to market their products. E.g. Rubber Marketing Society, Coir Marketing Society etc. They collect the products of its members and sell it in the market only in favourable conditions. It will help to promote the bargaining capacity of its members.

The important functions of marketing societies are:

a. Pool together the output of individual producers.

b. Grade and process them.

c. Collect marketing information.

d. Provide storage facilities.

e. Provide finance and raw materials.

4. Farmer’s Cooperative Societies – It is an association of small farmers in a village and they join together to reap the benefit of large scale production through Joint Cultivation.

Objectives of co-operative farming societies:

a. Large scale farming.

b. To increase yield per acre of land.

c. To introduce modern method of cultivation.

d. To inculcate the spirit of co-operation among farmers.

5. Credit Co-operative Societies – They extend short term finance at a reasonable rate of interest and thereby the members are protected from the exploitation of money lenders up to

a certain extent.

There are four types of credit societies:

a. Rural banks to supports farmers

b. Urban Banks to help small traders and artisans.

c. Employees’ credit societies formed by the employees in govt. or non-govt organizations.

d. Wage earner’ societies formed by workers to meet their credit needs.

6. Co-operative Housing Societies – They are formed to provide housing facilities to their members, either on ownership or on rental basis. They also help the members to purchase

houses at relatively less cost and on easy installments.

Types of Co-operative Housing Societies:

a. Land Societies – Acquire land and distribute among members as small plots at reasonable price, to be paid in lump sum or instalments.

b. Finance Societies – They are not only selling plots to the members but also advance money for the construction of houses.

c. House Building Societies – They are acquiring land and constructing houses and then allotted to its members on a reasonable price. Since the house building societies

construct a large number of houses, the construction cost is lower.

d. Tenancy Co-operative Societies – These societies own houses and allot them to members on rental basis.

V. Joint Stock Companies

With the rapid growth of commerce and industry, the size of business began to increase and owing to the need for the establishment of large scale enterprises. In these circumstances the sole traders and partnership found themselves unable to supply all the necessary capital and managerial skill, moreover that they were unable to bear all the risks of that much a large scale business. Therefore a new form of business organization came into existence and that is the Joint Stock Companies.

Definition – A company is a voluntary association of persons having separate legal existence, perpetual succession and a common seal.

As per Companies Act 2013, a company means company incorporated under this Act or any other previous company law.

Features of a Company

1. Artificial Person – A company is created by law and exists independent of its members and it can own properties, borrow funds, enter into contracts in its own name, but it is not a natural person.

2. Separate Legal Entity – As the company is a registered body, it is treated as a legal person and its assets and liabilities are separate from those of its owners.

3. Formation – Formation of a company is a time consuming and expensive process as it involves the preparation of several documents and the registration is compulsory under

Companies Act 2013 or any other previous company laws.

4. Perpetual Succession – A company is created by law and hence only the law can bring an end to its existence, i.e. the death, insanity, insolvency or lunacy of members does not affect the life of the company.

5. Control – The owners of a company are the members or shareholders, whereas the management and control is vested in the hands of directors elected by the members.

6. Liability – The liability of members is limited to the extent of their capital contribution only. The members can be asked to contribute to the loss only if any unpaid amount on shares

held by them.

7. Common Seal – A company may or may not have a common seal. As it is an artificial person it cannot sign documents for itself. Therefore a common seal is used for its signature.

8. Risk bearing – The risk of loss in a company is borne by all the shareholders, so that it will not become a heavy burden to them.

Merits of a Company

1. Limited Liability – The public may be encouraged to invest in the shares of a company because of the limited liability.

2. Transfer of Shares – The investors are attracted to purchase the shares o companies as it can be converted into cash at any time.

3. Perpetual existence – A company will continue to exist even if all the members die. It can be liquidated only as per the provisions of Companies Act.

4. Scope for expansion – Through the issue of shares a company can accumulate a large amount of capital. Hence it has greater scope for expansion.

5. Professional Management – Management of a company constitutes the Board of Directors and supported by the salaried managers.

Limitations of a Company

1. Difficulty in formation due to complex formalities.

2. Lack of secrecy – Companies Act requires that each public company should publish their accounts and reports to the Registrar of Companies and to the public time-to-time. Hence

there is no secrecy in the operations of a joint stock company.

3. Impersonal work environment – The large size of a company makes it difficult to maintain personal contact with the employees, customers and creditors.

4. Numerous regulations – The functioning of a company is subject many legal provisions and compulsions such as compulsory audit, filing of reports, statutory meeting, obtaining

certificates from Registrar, SEBI etc.

5. Delay in Decision making due to get consent from the Directors and Share holders.

6. Oligarchic management – Oligarchy means “rule by a few” , therefore, the control is in the hands of a few people who may ignore the interests of the share holders.

7. Conflict of Interest between the management and share holders may adversely affect the progress of the company.

Types of Companies

Companies are classified as:

a. Private Companies.

b. Public Companies

c. One Person Companies.

a. Private Company

A private company is defined as a company by its Articles of Association, restricts the right to transfer the shares, has a minimum of 2 and maximum of 200 members excluding the present and past employees, does not invite public to subscribe to its securities and it is necessary to use the word private limited after its name.

Privileges of a Private Company

1. Easy formation – only two members are required.

2. No need to issue prospectus.

3. Allotment of shares can be down without receiving the minimum subscription.

4. It can start the business as soon as it is incorporated.

5. Need to have only two directors minimum. (Maximum number of directors is 15 in private and public companies).

6. Not required to keep an index of members.

b. Public Company

As per Companies Act, 2013, a Public Company is a company which is not a private company. In other words it has no restriction on the right of members to transfer the shares, has a minimum of 7 members and no limit on maximum members and permits to make any invitation to public to subscribe to its shares and debentures. However, a private company which is the subsidiary of a public company is treated as a public company.

c. One Person Company (OPC) – As per Section 3(1) of Indian Companies Act 2013 enables the formation of a new entity known as One Person Company. An OPC means a company with only one person as its member. It enjoys the privilege of limited liability.

Differences between Private Company and Public Company

Choice of Form of Business Enterprise

Following factors are to be considered while choosing a suitable form of business enterprise:-

1. Cost and ease in setting up the organization – While considering this factor, sole proprietorship and partnership are the most inexpensive form or organization and having less

legal formalities.

2. Liability – From side of investors, company form of organization is more suitable as the risk involved is limited.

3. Continuity – Sole proprietorship and partnership business organizations lacks continuity. If the business is intended for a long period of time, company or cooperative society form of organizations are more suitable.

4. Managerial ability – A sole proprietor may find it difficult to have expertise in all functional areas of management. But it is not a problem in other forms of organizations.

5. Capital consideration – If the business requires huge capital, it should be organized as a company or co-operative society.

6. Degree of control – If direct control over operations and decision making is required, proprietorship is more preferred.

7. Nature of Business – If the business requires personal attention it is better to have a sole proprietorship. Eg: Tailor shop, hair cutting saloons, grocery shop etc. For large business

units, where personal attention is not much required, company form of organization is more suitable.

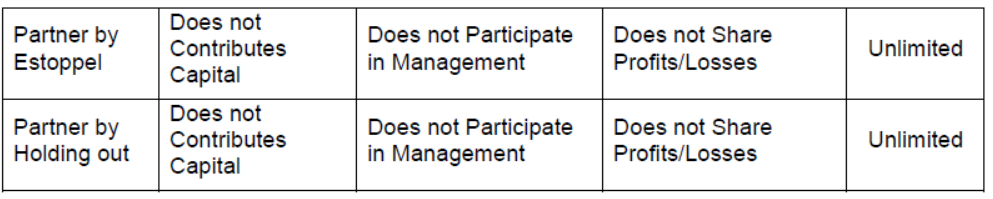

Comparative Evaluation of Forms of Organisation

We hope the above Forms of Business Organisation Class 11 Business Studies are useful for you. If you have any questions then post them in the comments section below. Our teachers will provide you an answer. Also refer to MCQ Questions for Class 11 Business Studies