Please refer to Formation of a Company Class 11 Business Studies notes and questions with solutions below. These revision notes and important examination questions have been prepared based on the latest Business Studies books for Class 11. You can go through the questions and solutions below which will help you to get better marks in your examinations.

Class 11 Business Studies Formation of a Company Notes and Questions

Formation of a Company

Formation of a company involves the following stages:

1. Promotion

2. Incorporation

3. Subscription of Capital

A private company has to complete only the first two stages, while a public company must undergo all the three stages.

I. Promotion

It refers to the sum total of activities by which a business enterprise is brought into existence, or in other words the business operations by which a company is established. Promotion is the discovery of business opportunities and the subsequent organization of funds, property and management ability into business concern for the purpose of making profit there from.

Promoter

The persons who perform the work of promotion and bring an enterprise into existence are known as promoters. A promoter is an entrepreneur or businessman who gives birth to a business concern and a promoter may be an individual, a firm or a company.

Functions of Promoters

1. Identification of business opportunity – Here the promoters have to discover a business idea. It may be about a new line of business or the expansion of an existing business.

2. Feasibility studies – It involves the evaluation and analysis of the potential of the proposed project. Promoters may conduct the following types of feasibility studies:

a. Technical feasibility – Here the promoters have to ensure the project is technically possible such as availability of raw materials, infrastructure, adequate technology etc.

b. Financial feasibility – If the project requires large funds which cannot be raised within the available means, it is better to stop that project.

c. Economic feasibility – Even if the project is technically and financially viable, it may have poor profitability, so that the promoters have to take expert advice.

Only when the above feasibility studies give positive results, the promoters can launch the new project.

3. Name approval – They have to select a name for the company and it should not be identical or same to an existing company. If it is satisfied by the Registrar of Companies, it will approved.

4. Fixing up of signatories to the Memorandum of Association – Here the promoters have to fix the members who are willing to sign the MoA and obtain their written consent to act as directors and to take the qualification shares.

5. Appointment of professionals – The promoters are entitled to appoint professionals like mercantile bankers, auditors etc. to assist them in the formalities of registration of the company.

6. Preparing necessary documents – The promoters are bound to prepare necessary documents for registration such as Memorandum of Association, Articles of Association, Prospectus or Statement in lieu of prospectus, list of directors etc.

Documents Required to be Submitted for Registration of Companies

1. Memorandum of Association (MoA)

2. Articles of Association (AoA)

3. Consent of Proposed Directors

4. Agreements if any

5. Statutory Declaration

6. Payment of Fees

1. Memorandum of Association –

It is the most important document of a company. It defines the objects and powers of a company and the company’s relationship with the outside world. While preparing the Memorandum of Association, great care should be taken, because the company cannot go beyond the limits laid down in it as it is the charter or magna carta of the company.

Contents of Memorandum (Clauses of MoA)

1) Name Clause – It contains the name of the company. A company can have any name subject to the following conditions: –

a. The name must not be identical to the name of an existing company.

b. The name should not give an impression that the company has a connection with the government or national heroes.

c. The name should end with the word “Limited” or “ Pvt. Limited” as the case may be.

2) Domicile Clause or Situation Clause – It contains the place or State where in the company’s registered office is situated. Exact address is not required at the time of registration but it should be informed to the Registrar within 30 days.

3) Objects Clause – It defines the purpose for which the company is formed. i.e. the aim of the company be disclosed in the object clause.

4) Liability Clause – This clause limits the liability of members to the amount unpaid on the shares owned by them. Eg: Face value of a share is Rs.10, on which Rs.6 paid, the liability of the shareholder is limited to the balance amount of Rs.4 only.

5) Capital Clause – This clause states the maximum capital (authorized capital) with which the company is to be incorporated along with its division, ie: 1 lakh shares of Rs.10 each comprises a total capital of Rs.10 lakhs.

6) Association Clause – It is in the form of a declaration stating the willingness of the members to associate in order to form a company and to take shares in the company. It must be signed by at least 7 persons in case of a public company and by at least 2 in case of a private company.

2. Articles of Association – It is the byelaw of a company. It contains the rules and regulations for the internal management of the company. It is subsidiary to MoA and hence it should not contradict with anything stated in MoA.

A public company may have its own AoA or may adopt Table F,G,H,I or J. These Tables are model AoA given in Companies Act 2013 for different types of companies such as Company Limited by shares (Table F), Company Limited by Guarantee (Table G) etc. which contains the rules and regulations regarding internal management of a company.

3. Consent of Proposed Directors – A written consent of proposed directors is also required

to confirm that they agree to act as directors and to undertake qualification shares.

4. Agreement – Agreement with any individual for appointing him as Managing Director or whole time director or manager is another document to be submitted to the Registrar.

5. Statutory Declaration – It should be submitted to the Registrar stating that all legal formalities have been complied with. It must be signed by any one of the following: an advocate of high court or supreme court, a chartered accountant, a director of the company, manager or secretary of the company.

6. Payment of Fee – Along with all the above documents, necessary fee has to be paid for registration based on the authorized capital of the company.

Position of promoters – The promoter is deemed to act as a trustee of the company under promotion (actually he is not an agent or trustee). The contracts entered by the promoter with the various parties are ratified (approved) by the company on incorporation. He should not make any secret profits. He has the right to get remuneration for the services rendered and be reimbursed for the expenses incurred by him.

The promoter is personally liable for all the preliminary contracts even after incorporation and he is also liable to the shareholders and debenture holders for any mis-statement in the

prospectus at the time of issue of company securities.

II. Incorporation

Incorporation means the registration of the company under the Indian Companies Act 1956. It is the second stage in formation of a company. In order to get registered, the promoters have to submit the above mentioned documents to the Registrar of Companies which are listed below in brief.

1. Memorandum of Association

2. Articles of Association

3. Written consent of proposed directors to act as directors

4. Agreement if any, with the proposed managing director or manager

5. A copy of the approval of name from the Registrar

6. Statutory declaration

7. Notice of exact address of the registered office of the company (30 days exemption)

8. Documentary evidence of payment of registration fee

Certificate of Incorporation

After scrutiny of the above documents, the Registrar issues a certificate of registration which is called the Certificate of Incorporation. It is also called the birth certificate of the company.

Effect of Certificate of Incorporation

a. A company becomes a legal entity with perpetual succession.

b. It can enter into valid contracts.

On the issue of certificate of incorporation, a private company can commence its business. But a public company has to go through two more stages in the formation.

III. Capital Subscription

A public company can raise funds from the public by issuing shares and debentures. Following are the steps required for raising funds from the public.

1. SEBI Approval – Approval from Securities and Exchange Board of India (SEBI) is the regulatory authority in India is to be obtained for raising funds from the public.

2. Filing of Prospectus – A copy of prospectus or statement in lieu of prospectus must be filed with the Registrar of Companies.

3. Appointment of Bankers, Brokers and Underwriters – Bankers collect the application money from the public, brokers distribute the application form and encourage the public to apply for shares and underwriters give guarantee to the issue of shares by giving an undertaking to buy the shares for a commission if not subscribed by the public.

4. Minimum Subscription – The minimum amount of capital which must be subscribed by the public before a public company can allot shares is known as minimum subscription (90% of the issued amount as per the SEBI guidelines) and is decided by the directors and stated in the prospectus.

Minimum subscription is used to purchase property, to meet all preliminary expense and as working capital. If minimum subscription is not received within 120 days from the date

of issue, amount collected must be returned to the applicants. If not, the directors are liable to repay the money with 6% interest from 130th day onwards.

5. Application to stock exchange – Company must give an application to at least one stock exchange for permission to deal in its shares or debentures.

6. Allotment of shares – Once the permission is obtained from the stock exchange, the company can allot shares to the applicants.

Prospectus

It is a document, notice, circular or advertisement inviting offers for subscription or purchase of any shares or debentures of a company from the public. A public limited company limited by shares must issue a prospectus if it intends to issue the shares to the public and a copy of the same should be filed with the Registrar.

Statement in lieu of Prospectus

In case a public company is confident of raising the required capital privately, they need not issue a prospectus to the public. But they have to prepare a Statement in Lieu of Prospectus and it must be filed with the Registrar for registration.

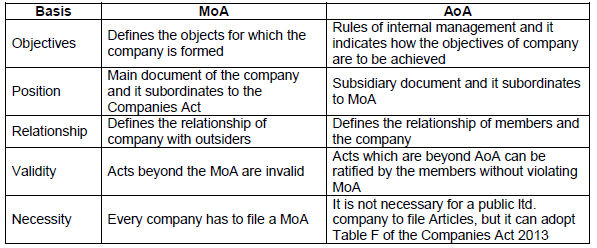

Differences between Memorandum and Articles of Association

We hope the above Formation of a Company Class 11 Business Studies are useful for you. If you have any questions then post them in the comments section below. Our teachers will provide you an answer. Also refer to MCQ Questions for Class 11 Business Studies